Long in the shadow of neighbouring China, India is projected to be the world’s fastest growing economy this year and next. Investment manager Alan Lander and investment analyst Connor Graham recently spent two weeks in the country, speaking to management teams and taking the pulse of Asia’s “other superpower”.

We have been regular visitors to India for more than thirty years, witnessing in that time an economic transformation on an epic scale. Often overshadowed by China’s dazzling metamorphosis from Communist backwater to global powerhouse, India’s own journey from socialism to capitalism has been one of the great economic tectonic shifts of recent decades.

Yet for all its impressive accomplishments – hundreds of millions lifted out of poverty, a rapidly expanding middle class and highly educated workforce – an air of promise unfulfilled has often clung to the Indian economy, no more so than when comparing its progress to that of neighbouring China.

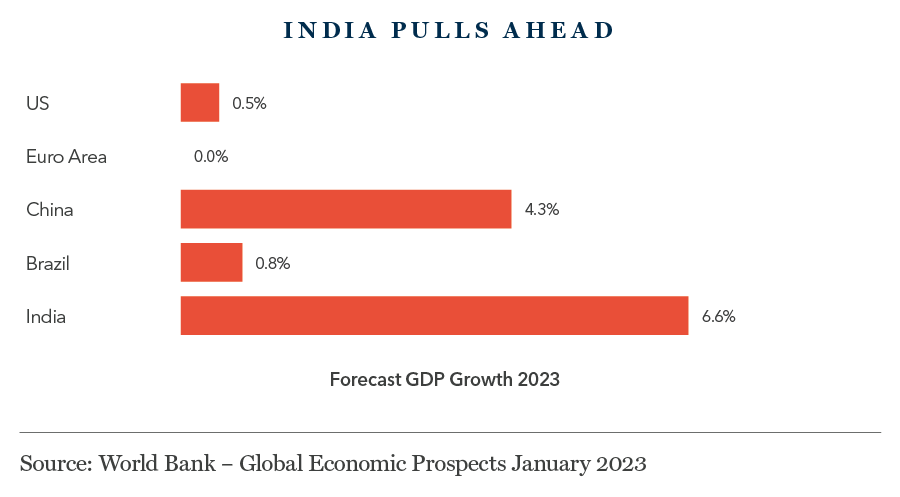

That perception may be about to change, however. At a time of great economic uncertainty for much of the world, India is projected to be the fastest-growing major economy this year and next.1 On track to surpass China later this year as the world’s most populous nation, there is a growing sense that India stands on the cusp of an exciting new stage in its development.

A new age of prosperity?

Nowhere is the conviction in India’s future prospects held more strongly than in Delhi’s corridors of power. In her speech to India’s parliament in February, finance minister Nirmala Sitharaman declared 2023’s Union Budget to be “the first budget of Amrit Kaal”. In Vedic astrology, Amrit Kaal refers to a pivotal moment when the gates of pleasure become accessible to human beings, angels, and monsters. Traditionally, it is also the most auspicious period to start a new project or business. For Prime Minister Narendra Modi, such a moment has arrived for the Indian economy and the years ahead will see the country “ascend to new heights of prosperity.”

India is projected to be the fastest-growing major economy this year and next

Mr Modi’s ambition may be as bold as some of his policies and rhetoric are divisive, but there is no denying that he is deploying considerable resource in its service. India’s once-creaking infrastructure, for example, is undergoing a massive upgrade. In February’s budget, capital expenditure as a share of total expenditure was the highest in fifteen years. Evidence of this investment was abundantly clear in Mumbai, the first stop on our two-week trip. Whether it is a new eight-lane coastal road set to halve the north-south travel time across the city or the ongoing expansion of the metro rail network, building work is happening everywhere you look.

Another area of government focus is manufacturing. Long in the shadow of India’s service sector, manufacturers across a range of industries are benefiting from initiatives aimed at facilitating investment, easing barriers, fostering innovation and encouraging onshore capacity expansion. The hope is that these measures will not only support import substitution but also help grow exports too.

These aspirations have received an unexpected but potentially game-changing boost from the emergence of the ‘China Plus One’ strategy. Scarred by geopolitical uncertainties and the legacy of Covid-19 disruption, companies around the world are seeking to diversify their supply chains away from a sole reliance on China. And as a geopolitically ‘neutral’ player, India stands to benefit.

India’s once-creaking infrastructure…is undergoing a massive upgrade

One company leveraging all of this to its advantage is speciality chemicals business Aarti Industries. A trusted partner to large international players such as Bayer, BASF and DuPont, Aarti has built a reputation for reliably and flexibly producing a diverse range of chemical compounds. In many ways, this is a familiar tale of an Indian manufacturer innovating at the process rather than the product level. Rarer is the ability to do it quite as well as Aarti does, however. Focusing on products where it can command a significant share of the global market, the business has built a 25-35% share in most product categories and is typically a top three supplier globally.

For Aarti’s CFO, this is an exciting time for the business as well as India. Not only is the company picking up significant business from companies relocating manufacturing capacity, but there is a positive impact too from the government’s range of production-linked incentives. Investment in the domestic pharmaceutical industry will also prove beneficial in time. Referring to “a golden era for opportunities in India”, the CFO explained that Aarti was identifying many more opportunities than it had the capacity to exploit.

The same upbeat tone was echoed by representatives of Vinati Organics, another Mumbai-based producer of speciality chemicals, which is making use of tax incentives to support capacity expansion. Interestingly, Vinati believes that the government’s infrastructure plans will not only position India to take capacity from China but from Europe too, albeit on a smaller scale.

Rising incomes, growing opportunities

As well as an important manufacturing hub, Mumbai is also India’s financial centre and home to the country’s insurance industry. Life insurance in India remains a nascent market – penetration stood at only 3.2% of the population in 2021 – but the long-term opportunity is enormous.2 As the country’s 1.4 billion population grows more affluent, demand for wealth protection products will also grow. Whilst this same narrative is playing out across the developing world, few markets hold the potential of India.

Despite the very large and very obvious opportunity, however, progress to date has perhaps underwhelmed. In our conversations with some of India’s leading insurance companies, we got the sense that the industry had somewhat lost its way in recent years. For some time, sales efforts were aimed at the very affluent end of the market, with less emphasis placed on increasing penetration across India’s social spectrum. That dynamic is now changing, however, and companies are starting to address the real long-term opportunity – selling products to the swelling ranks of the Indian middle class.

Life insurance in India remains a nascent market… but the long-term opportunity is enormous

The benefits of this shift in focus were clear when we spoke with ICICI Prudential Life (IPLIC). Four years ago, IPLIC set out to double its Value of New Business (an important measure of profitability for life insurance companies) by 2023. At the time that ambitious target was put in place, management was seeking to address several issues, among them an overreliance on the high-net-worth segment of the market and a lack of lower premium, more-affordable protection products. Fifteen quarters into the sixteen-quarter plan and the business is on course to hit its target, despite the disruption wrought by Covid-19 in the intervening years. Importantly, this push for greater penetration also aligns with Indian government policy, which bodes well for future growth.

From Mumbai, via stops in Hyderabad and Ahmedabad, we travelled to Bengaluru, where the standout meeting was with United Spirits, a drinks company majority owned by Diageo. We last met with United Spirits during our previous trip to India in the pre-Covid days of 2019. Back then the business was nearing the end of a complete overhaul of its processes and corporate culture that had begun with Diageo’s initial involvement in 2013. Prior to this, United Spirits was a volume-led business with a reputation for failing to operate in a clean and compliant manner. Under Diageo’s guidance, it has evolved into a value-led operation with a focus on efficiency, margin expansion and doing business the ‘right way’.

With the ‘Diageo-ification’ of United Spirits now complete (the company prefers to be known now as Diageo India), management is fully focused on harnessing the considerable long-term opportunity in India’s drinks market. Positive demographics, rising incomes amongst Indian consumers, and a less-regulated approach to alcohol sales – a slow but seemingly inevitable process – will enable United Spirits to not only sell more of Diageo’s global brands in India, but to also take greater share of the higher-margin premium end of the market.

Reflections

Ending our trip in Delhi, we could reflect on two weeks of constructive and insightful meetings. Our discussions with the Indian subsidiaries of overseas companies provided informative updates on the ongoing opportunity in the country for global players, whilst conversations with domestic businesses allowed us to dig deeper into some new and potentially interesting investment candidates. Many of these businesses have strong product or service offerings in parts of the Indian economy that are currently enjoying macro and geopolitical tailwinds, whether that be the country’s fast-growing middle class, alignment with government policy, or the diversification of global supply chains. Even if they don’t translate directly into portfolio investments, the insights afforded by these meetings will prove valuable inputs and into our ongoing research and analysis back in Edinburgh.

Ending our trip in Delhi, we could reflect on two weeks of constructive and insightful meetings

One of the enduring benefits of trips such as these is the chance to take the pulse of a country and of those involved in the ‘day-to-day’ of its economic life. From our meetings in India, a picture emerged of a nation confident in itself and its future, both in the near and in the long term. And whilst it would be unwise to underestimate the scale of the challenge that lies ahead for the country as it aims for developed nation status by 2047 – India remains beset by high levels of corruption, poverty and inequality – it would be equally misguided to downplay the considerable efforts now underway to accelerate the country’s development. Progress may not prove linear but these are undoubtedly exciting times for India Inc.

Sources:

1World Bank – Global, Economic Prospects January 2023

2Invest India

Stock Examples

The information provided in this article and video relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.

Important Information

This article and video are provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This article and video may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.