How many Fortune 500 companies are there where every CEO in its history has at one point or another stood behind a counter and been yelled at by a customer?

The above is a quote from a member of O’Reilly Automotive’s management team, which sums up the company’s pride in its culture and ‘promote from within’ philosophy. The second largest speciality retailer of automotive aftermarket parts, tools and equipment in the US, it has more than 220 senior managers with an average of 20 years of service and more than 280 corporate managers with an average of 16 years. With such a well-established workforce, O’Reilly has successfully navigated numerous external challenges from natural disasters to the global financial crash and the Covid-19 pandemic.

Founded in 1957 by Charles F. O’Reilly and his son, it initially operated one single store with 13 “team members” in Springfield, Missouri. As of December 2022, it has more than 5,900 stores in 47 US states and 42 stores in Mexico, with almost 84,000 team members. Throughout its history, O’Reilly’s focus on its culture has meant that individuals move up the ranks and perpetuate the values that have served it well for more than 65 years. Many companies talk about culture but here is one that really does what it says it does – and has the numbers (above) to prove it.

Of course, it’s not simply about culture. For a company to succeed, ultimately, it must deliver the products and services that customers need – and O’Reilly has an impressive infrastructure. Through a sophisticated inventory system, it keeps track of customer preferences and sales trends to get the right products where there is demand. The distribution centre network provides stores with same-day or overnight access to around 158,000 stock-keeping units (SKUs), many not stocked by other auto part retailers. Beyond these centres, the company also operates more than 375 Hub stores that provide a delivery service and same-day access to an average of 80,000-90,000 SKUs from a Super Hub or 42,000 from a Hub to other stores nearby. More than 95% of O’Reilly stores receive multiple same-day and weekend deliveries of parts that are particularly difficult to source.

In the highly fragmented auto parts market, O’Reilly’s dual market strategy of selling to both auto repair professionals and do-it-yourself (DIY) customers is a core advantage, which has been well honed since the company’s entry into the DIY market. This approach allows the company to target a larger base of consumers. It does so by a) capitalising on its existing retail and distribution infrastructure, operating profitably in both large markets and less densely populated areas that typically attract fewer competitors, and b) enhancing its services for DIY customers in such a technical market, offering a broad on-hand inventory and technical knowledge which is otherwise the preserve of professional mechanics.

Indeed, the technical proficiency of its staff comes back to O’Reilly’s stated culture. The company’s in-store team, or “Professional Parts People” as they’re known, undergo extensive training to serve its professional customers at dedicated counters in store, as well as advising DIY shoppers. They also must take O’Reilly’s own certified parts professional test, which helps them to become certified by the National Institute for Automotive Service Excellence.

This in-store expertise is one reason O’Reilly is less threatened by e-commerce than retailers in many other sectors. The auto aftermarket industry is technical in nature and there is an immediacy to demand if a vehicle breaks down, so that professional knowledge combined with on-hand inventory is a key competitive advantage. Additionally, based on the specificity and bulkiness of components, customers are unlikely to be using Amazon for these types of orders, even if they’d like that ease of experience. And O’Reilly has adapted accordingly, providing an excellent omnichannel experience, which really paid off during the pandemic. The online offering features a large online catalogue, 360° spin images and numerous “How To” videos and step-by-step guides on maintenance, diagnostics and product selection. The How To topics are wide ranging, from “what’s leaking from my car, truck or SUV?” to “which battery is right for my vehicle?” and “how to calculate gas mileage”. Similar to the in-store experience, there’s a live chat function with parts professionals to provide the same quality of customer support online. For its professional customers, O’Reilly’s business-to-business website firstcallonline.com allows them to order parts easily and quickly.

In the same way that O’Reilly has successfully transitioned to this omnichannel business from a very traditional bricks-and-mortar network of stores so it has positively adapted to operating in a world where environmental considerations matter. Despite the nature of the industry that it serves, O’Reilly’s products help consumers to run their vehicles as efficiently as possible whilst extending the lifespan of those vehicles (as opposed to them being replaced with a newer model).

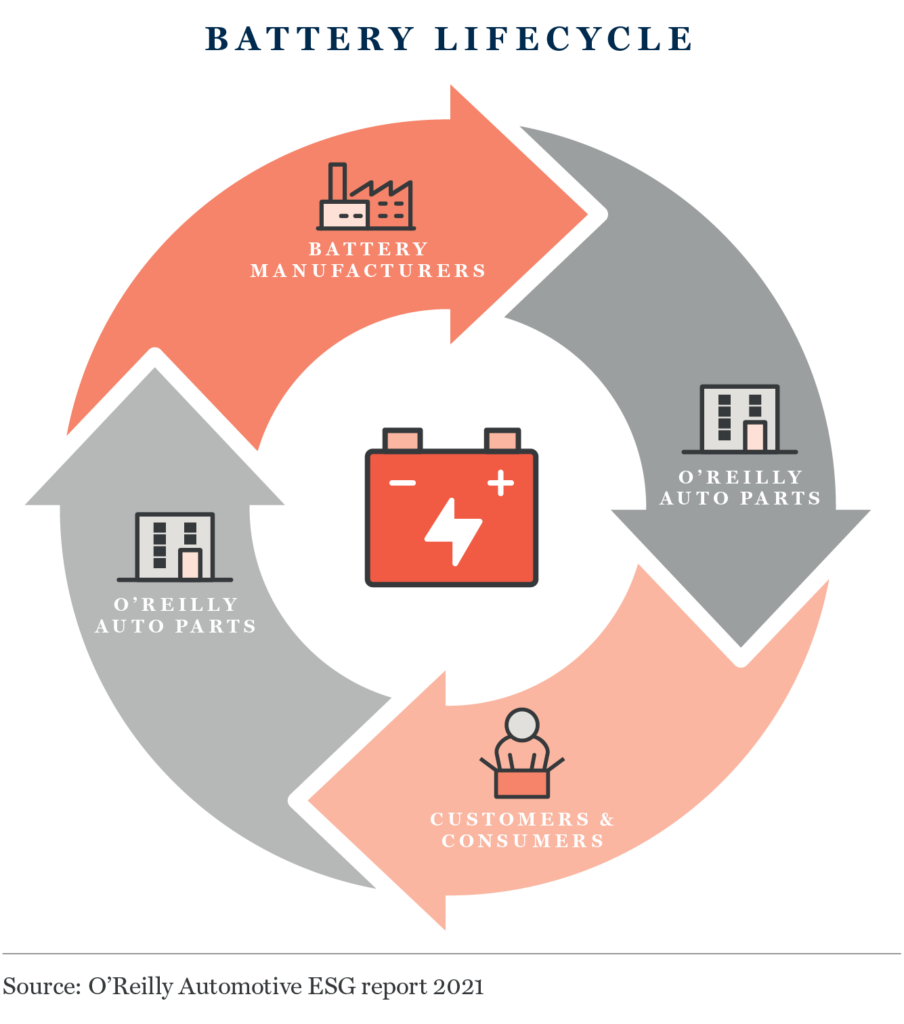

The company also provides recycling facilities for oil, used oil and batteries as well as remanufacturing parts. In 2021 alone, O’Reilly recycled more than nine million lead batteries, more than nine million gallons of used motor oil and almost 900,000 used oil filters. In terms of remanufacturing, it returned more than seven million used parts to its suppliers to be remade into new parts. One of O’Reilly’s largest suppliers estimated that this practice saved it from generating 44,468 metric tonnes of CO2 in 2021. O’Reilly sells millions of remanufactured parts a year.

Related to this, the next great challenge for the auto parts industry comes in the form of electric vehicles. Hybrid vehicles all have the same internal combustion engine (ICE) components of a regular ICE vehicle. Of course, pure electric cars don’t have many of these parts but of those that they do, they can be very high value eg. generators and battery packs. It is currently very difficult for O’Reilly, or anyone, to know what the impact on the market will be as and when electric vehicles take over. According to S&P Global Mobility, the current US light vehicle fleet is 283 million1. Based on the current trajectory of take up, that would suggest that, given that only 1% of vehicles are electric, it is going to take almost 20 years for these to make up even 40% of the market. That means that there will still be hundreds of millions of ICE vehicles continue to require maintenance and repair for decades. In addition, given that we still don’t really know what the mass adoption price point will be, nor the charging infrastructure situation, it’s hard to work out the specific effect today.

What is certain is that, as it has done throughout its 65-year history, O’Reilly will continue to look ahead, preparing itself for changes in technology and vehicle fleets, ready to educate consumers and mechanics, and respond to product demand, long before those vehicles start needing parts.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.