Your investment team.

Rather than choosing individual fund managers to run our portfolios, we think that being collaborative gets better results for our clients. We believe that many minds are better than one. Our approach to stock ratification is built on consensus. We believe that robust, collaborative debate leads to better outcomes — and we always reach a decision as one team.

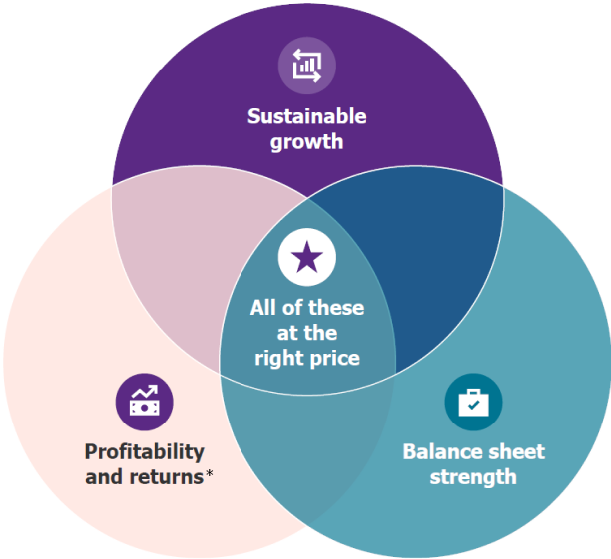

*Returns in this sense refers to metrics such as cash return on capital employed

Finding a Walter Scott investment. Firstly, we look back.

The fundamental characteristics of a company provide the clues to its future. Why do we focus on finding these three key characteristics, and importantly, finding them at the right price? Thorough analysis and valuation lie at the heart of our research approach. Overpaying for growth – or from our perspective, buying value without the prospect of growth – are not recipes for achieving good long-term returns.

Alan Lander, Head of Research, discusses the three key dynamics that underpin our investment approach:

Then we look forward.

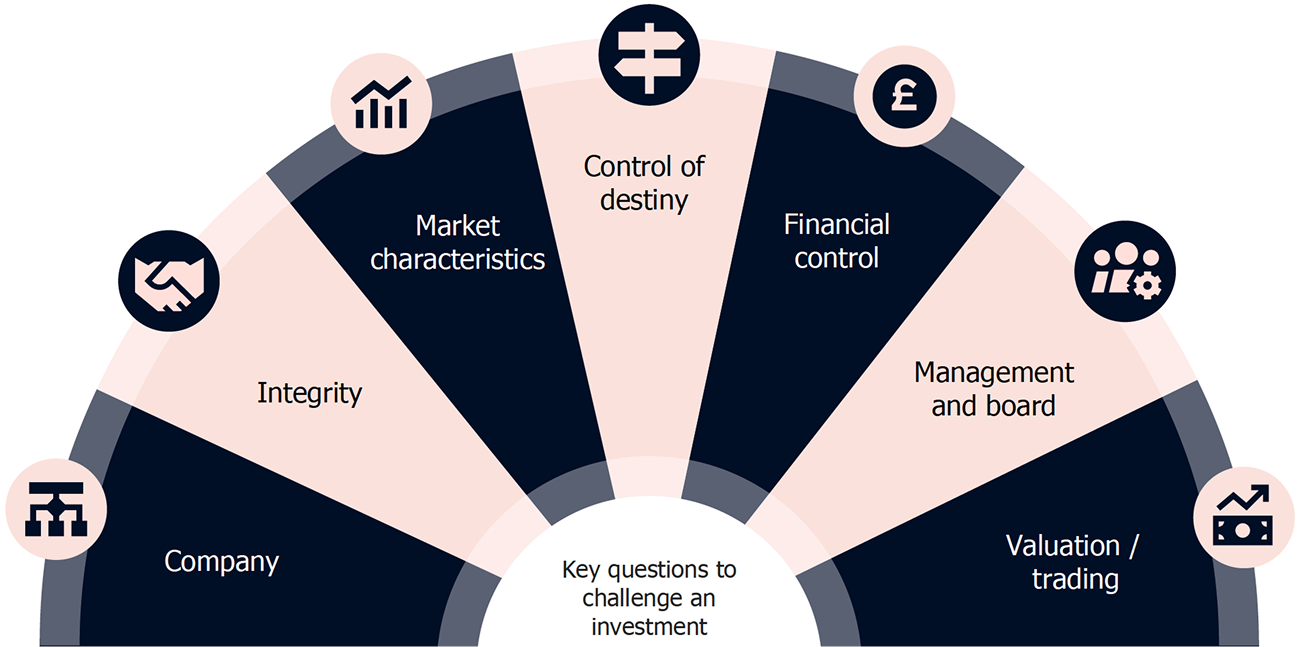

If a company does make it through to the qualitative stage of our research, the ‘Seven Sisters’ questions form the next stage of our in-depth analysis. This analysis acts as a pre-flight safety check before a stock enters the portfolio. And in case you were wondering why we call them the Seven Sisters, this is after the seven hills that surround our home city of Edinburgh.

Our ‘Seven Sisters’ assess:

Company: Business model, structure, geography and operations.

Integrity: Audit and accounting practices, and material ESG factors.

Market: Size, growth, cyclicality, structure and regulation.

Control of destiny: Ability to influence outcomes versus external dependence.

Financial profile: Returns, cash flow and balance-sheet strength.

Management and board: Experience, tenure, diversity and remuneration.

Valuation and trading: Valuation, liquidity and share-class considerations.

Team decision making in action.

Buying a stock is a team decision. It starts with the stock champion, then the regional team, then the full research team and finally the Investment Executive. When we decide to sell a stock, we have the single dissenting voice principle, whereby if one person on the team puts forward a convincing, researched argument as to why the team should sell a company, we will sell it. Unanimity in action.

Stock champion

Screening

Reading

Research trips

Industry events

Sector projects

Regional teams

EMEA

Americas

Asia

Emerging markets

Research team

Full proposals

Peer review

Rigorous debate

Investment Executive

Ratification

Position sizing

Cash flow management

Portfolio management

Ways to invest with us, wherever you are in the world.

You can invest with us either directly or through our distribution partners in the US, Canada, Europe, the UK, Asia, and Australia who have appointed us as sub-advisers to their funds. To learn more about investing with us, please get in touch.