The AI-driven surge of recent times has resulted in market concentration levels not seen for decades. Whilst not commonplace, these episodes do occur.

From the established blue-chip giants of the 1970s to the mobile telecommunications and internet companies of the early 2000s, stock markets have experienced periods where a select few companies have held significant dominance.

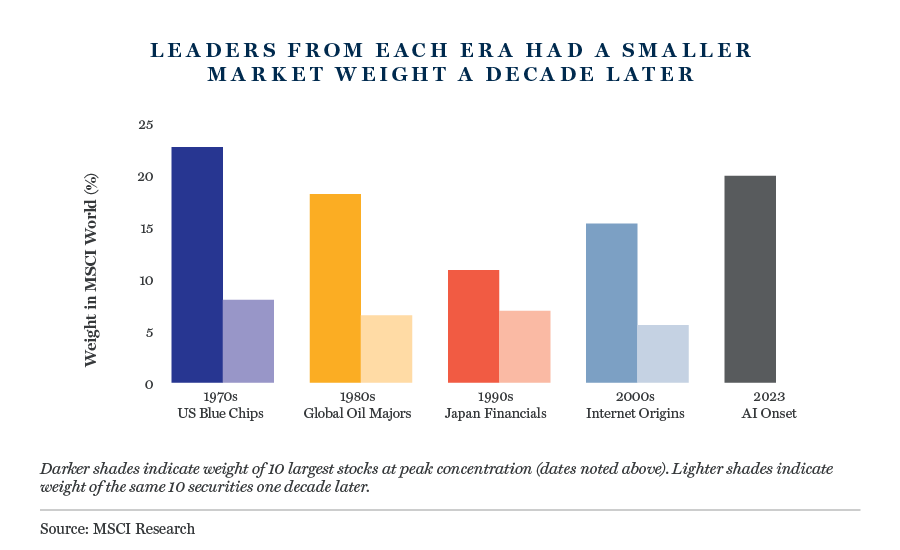

One interesting point is what happens next. As the chart above shows, these eras of market concentration rarely last.

What happens to so many of these large stocks in the subsequent decade? Dropping out of the top 10 could be due to any number of factors, from industry consolidation to regulation or a failure to innovate and adapt. Whatever the reason, it suggests that investors should be cautious about extrapolating today’s market trends too far into the future.

Long-term leaders

Some companies do feature in the top 10 from one decade to another (and another). Until recently, companies such as Exxon, General Electric, and IBM were prominent members of the group regardless of the market trends.

Today, Microsoft is one of those staying the distance, having been there in the early 2000s and now very much part of the AI story today. This speaks to the software company’s continued ability to innovate and adapt from a leader in software to being at the forefront of AI, having first invested in OpenAI in 2019. More recently, it has incorporated Copilot, an AI-powered digital assistant, into Word to PowerPoint, Outlook and Excel. Looking to 2030 and beyond, we believe Microsoft will continue to rank highly.

Another is Alphabet, a business which has built up a dominant position in online advertising and search, through Google. Like Microsoft, it has also been in the AI game for years, having bought the UK-based AI research laboratory DeepMind back in 2014. Alphabet has a strong competitive position over the long term, thanks to its ownership of multiple platforms with billion-plus users, strong data-gathering capabilities, proprietary hardware and mobile operating systems (Android).

Beyond Sentiment

As investors, we evaluate companies on an individual basis, irrespective of the prevailing market momentum. It is still very early days for AI and progress is rarely linear. While we believe many of today’s market leaders will continue to play a critical role in the AI ecosystem for decades to come, history at least suggests that recent concentration levels are unlikely to persist.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.