Key takeaways

- Bjørn Gulden has transformed the fortunes of Adidas since taking the helm in 2023

- The pivot to heritage classics like Samba and Gazelle has paid off handsomely

- Can the iconic Three Stripes maintain its impressive momentum in a world of tariffs?

Kanye West’s Yeezy collaboration with Adidas was celebrated as “one of the great retail stories of the century” by Forbes magazine in 2020. At the time, it wasn’t hard to see why. The tie-up between the self-styled ‘Lord of Rap’ and the iconic German sportswear giant was estimated to be generating north of $1bn in annual revenues. Not bad for a collaboration that had launched its first sneaker only five years previously.

Just two years later, however, Adidas would pull the plug on Yeezy after a string of antisemitic outbursts by West. The timing of the incident was unfortunate. On its own, the loss of an asset responsible for an estimated 40% of profits would present a challenge for any company. But Yeezy’s demise came at a time when Adidas was already under pressure from Covid-19, Russia’s invasion of Ukraine and slowing sales in China.

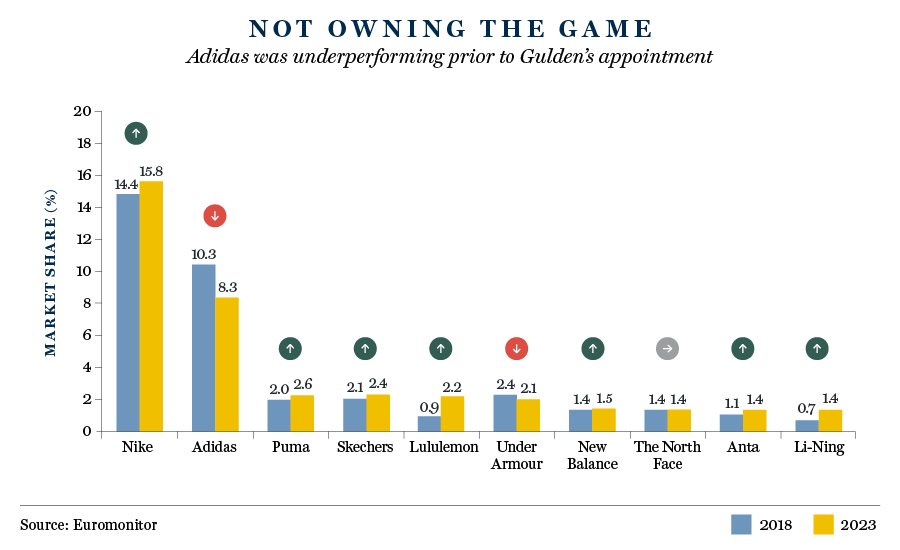

Compounding these woes were a troubled strategic pivot to a direct-to-consumer business model and a huge inventory overhang that necessitated heavy discounting. Fighting fires on a number of fronts, Adidas was struggling to keep pace with the competition, losing market share to both established rivals and a slew of up-and-coming challengers.

Fingers of blame were pointed at CEO Kasper Rørsted, whose ‘Own the Game’ strategy was thought to place too much emphasis on technology and digital, and not enough on the core competencies of product design and innovation. Before 2022 was out, Adidas would announce Rørsted’s departure and task Puma CEO Bjørn Gulden with reviving the brand’s fortunes.

Gulden, a former professional footballer in Germany and his native Norway, came with impeccable credentials. At Puma, he had orchestrated an impressive turnaround in the company’s fortunes, reinvigorating a tired brand and establishing it as the third largest footwear player globally. He was also no stranger to the Three Stripes, having worked at Adidas for several years in the 1990s. The appointment was warmly received by investors, with the share price sharply higher on the news.

The ‘Gulden Opportunity’

Soon after Gulden took the reins at Adidas, I visited the company’s HQ in the small Bavarian town of Herzogenaurach to learn more about his plans. True to his straight-talking reputation, the new CEO was nothing if not forthright.

Adidas, Gulden told me, had lost its way under his predecessor. Product and marketing people had been sidelined, usurped by an army of spreadsheet-wielding strategists and consultants intent on turning the company into a tech business. In the rush to embrace a direct-to-consumer model, management had forgotten the importance of the wholesale market – retailers, frustrated by a lack of access to Adidas stock, often turned their attention to other brands.

Bureaucracy and centralised decision making, meanwhile, had suffocated innovation. To emphasise his point, Gulden recalled being greeted by a presentation deck with no fewer than 341 KPIs on his first day in the job.

Gulden’s remedy was as simple as his diagnosis was brutal. On his watch, product would once again be king and the business would rebuild its relationship with retailers. Decision making would be devolved, replacing top-down directives with a more agile, bottom-up approach that prioritised local product development.

On this final point, he was adamant. For Adidas to thrive, it would need to offer more local products for local markets. To do so successfully, the company’s creative impulse could no longer just come from Germany; China, India, Japan and the US would have to become design hubs. This decentralisation would come with a cost, but it would be much less costly than designing products that people didn’t want.

If he had doubts about his ability to engineer the change Adidas required, Gulden didn’t show them. There were two key factors in his favour, he argued. First, the business had the talent to be successful. When he took the job, he didn’t bring a team with him; he knew there were good people already at Adidas. His job was to empower the right people and to remove the obstacles and bureaucracy that were stopping them from doing their best work.

The other lever he could pull on was a world-famous roster of heritage franchises. Scaling up production of the iconic Samba, Gazelle, Campus and Spezial lines would maximise exposure to the global trend for retro, lifestyle trainers and build some much-needed early momentum as Adidas embarked on its turnaround journey.

I left Herzogenaurach under no illusions about the scale of the challenge facing Gulden. Even putting to one side the long-term job of reinvigorating an ailing giant, there were onerous near-term hurdles to overcome, perhaps most immediately a huge pile of excess inventory. But he had struck a confident tone, laying out a persuasive case for his proposed reset and asserting his belief in Adidas’ long-term potential.

the follow through

Eighteen months on from our meeting, Gulden’s efforts have succeeded beyond most people’s expectations. The decision to pivot back to classic models has paid off handsomely. Demand for Sambas and Gazelles has been such that new launches have been held back to maintain their appeal. (Even former UK prime minister Rishi Sunak was pictured in a pair of the former, much to the dismay of younger devotees.)

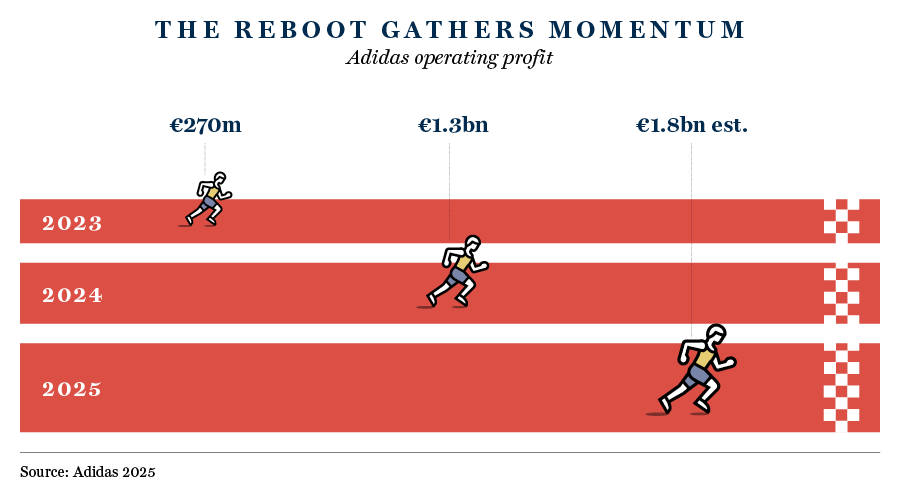

Relationships with key retailers have been revitalised, with Adidas product taking up more shelf space and customer attention. Crucially, the inventory stockpile has also been addressed and now sits at a much healthier level. The financial implications of all of this were laid bare in an excellent set of 2024 results. Revenues for the full year were up 12% at €23.7bn, with sales excluding Yeezy rising 13% year on year. Annual operating profits rose from €270m in 2023 to €1.3bn, while margins also improved.

The decision to pivot back to classic models has paid off handsomely

What of the ‘local product for local markets’ game plan? In late 2024, I met a senior representative of Adidas who praised its impact on the important China market. The business has been fostering local connections by sponsoring Chinese sports teams and athletes. Increasingly, production and design are moving ‘onshore’, making the company more responsive to domestic trends. While still early days, the strategy appears to be bearing fruit, with sales growing consistently during 2024.

are we there yet?

While declaring himself “very pleased” with 2024’s results, Gulden tempered enthusiasm by stating that “we are not yet where we want to be long term”. So, as the Adidas turnaround gathers momentum, what does the next step in the journey look like?

Most pressingly, the business will have to contend with a new era of trade tariffs. Given it has significant operations in countries such as Cambodia and Vietnam, higher import duties are an unwelcome development. However, management is confident that the Adidas supply chain has the depth, flexibility and quality to weather the tariff storm, calling it “a challenge, not a crisis”.

Beyond geopolitical concerns, the business has to broaden and deepen its product portfolio beyond the lifestyle dynamic. Fashions ebb and flow, and Sambas and Gazelles can’t remain on-trend indefinitely. However, the ‘halo effect’ from the success of its lifestyle franchises is now benefiting products in the ‘performance’ categories of running, tennis and golf.

Replicating the ‘brand heat’ of the lifestyle business in the performance division would go a long way to realising Gulden’s ambition of being “the best sports company in the world”. There are plans to leverage the popularity of the Adizero Adios Pro Evo 1 running shoe, moving into other price points and targeting the comfort and value sections of the running market.

Another area of focus is basketball, where Nike has long been dominant. Gulden speaks confidently about the prospects for the signature shoes of star players James Harden, Anthony Edwards and Damian Lillard. Further inroads into basketball and the wider US market will be a key determinant of future success.

Excellent long-term growth potential at times let down by sub-par execution

As Adidas moves into year three of its reboot, there is much to play for. The annual growth of the sports apparel industry is expected to compound at 6-7% over the next few years, with footwear growing slightly more quickly. Having put in place the operational infrastructure to support €30bn of revenues, the business has the capacity to capture a large chunk of this growth. Success now comes down to execution.

Throughout its history, Adidas has been a brand with excellent long-term growth potential at times let down by sub-par execution. There are signs that this is changing, however. With Gulden and a refreshed management team at the helm, the business is in a far better position than seemed possible two years ago. Can it maintain its current momentum? There’s more work to be done, but to invert a famous Adidas marketing slogan, nothing is impossible.

Samba: evolution of an icon

The first shoe to bear the brand name Adidas, the Samba holds a special place in the history of the German sportswear giant.

In 1949, the founder of Adidas, Adi Dassler, was searching for a shoe that would provide footballers with greater traction on icy pitches. His solution was a chunky mid-top boot with three cut-out cups in the sole for extra suction – the Samba was born. In the eight decades since, Dassler’s brainchild has moved far beyond its sporting roots to become one of the world’s most iconic shoes, selling an estimated 35m pairs in the process.

The prototype Samba bore little resemblance to the minimalist aesthetic of today’s fashion staple. The sleek silhouette we’re familiar with didn’t arrive until 1972. Sitting lower on the ankle, the new design won popularity as both an indoor sports shoe and an everyday style item.

Today, with the line between fashion and sports apparel ever more blurred, the Samba wearer is as likely to be found strolling along Bond Street or Fifth Avenue as competing on an indoor court. Collaborations with high-profile designers have succeeded in keeping the shoe fresh and relevant, while paying due homage to its timeless appeal. Fashion bona fides have been further cemented by a rollcall of celebrity fans, from Kendall Jenner and Jennifer Lawrence to Rihanna and Pharrell Williams.

More than 75 years since making its first appearance, the Samba is as popular as it’s ever been. Here’s to the next 35m pairs!

The views and opinions expressed in this article are those of the interviewee and do not necessarily reflect the position of Walter Scott.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.