Key takeaways

- A changing geopolitical landscape is reinvigorating European defence spending

- Advanced technology is transforming warfare, with innovation as important as conventional military power

- Whilst this is creating opportunities beyond the traditional aerospace & defence companies, investors should be alert to potential headwinds

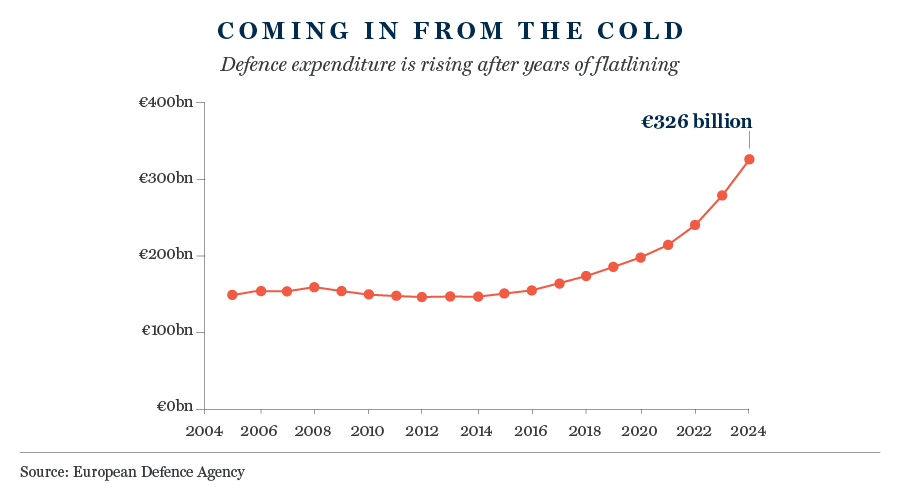

After years of underinvesting in its military capacity, Europe is rapidly increasing defence spending. Responding to the twin shocks of a threatened reduction in US military support and Russian belligerence in Ukraine, EU member states have lifted spending by 30% in recent years. A further €100bn is expected by 2027.

Those European countries that are members of NATO are likely to have to go even further. Mark Rutte, the secretary general of the transatlantic alliance, has called for a “quantum leap” in spending.

Share prices of European aerospace and defence (A&D) have reflected this surge in investment year to date, comfortably outstripping a still impressive +18% return of the wider MSCI Europe index.

Control of destiny

Walter Scott’s EAFE strategy has a longstanding underweight exposure to the A&D industry. This position is not predicated on any inherent negative bias; no industry or sector is off our research radar. Rather, we have been largely absent for reasons consistent with our investment philosophy.

Before we invest in a company, we try to establish the extent to which it has control of its own destiny. How wide is its competitive moat? Does it have pricing power? Is it too reliant on a single or small group of customers? The greater the control of destiny, the greater the likelihood a company can sustain high levels of growth and profitability over time.

For several reasons, however, traditional A&D businesses have historically lacked the necessary control of destiny we look for:

- Defence budgets, procurement policy and contract structures are partially driven by political rather than economic factors.

- Companies can be heavily reliant on single contracts.

- Contracts are often necessarily opaque due to classified information.

- Strategic autonomy is limited by the need to align with government demand.

This is particularly true of the European ‘defence primes’, the handful of large, strategic military contractors with direct government relationships and historically dominant shares of national procurement budgets.

the world has changed…

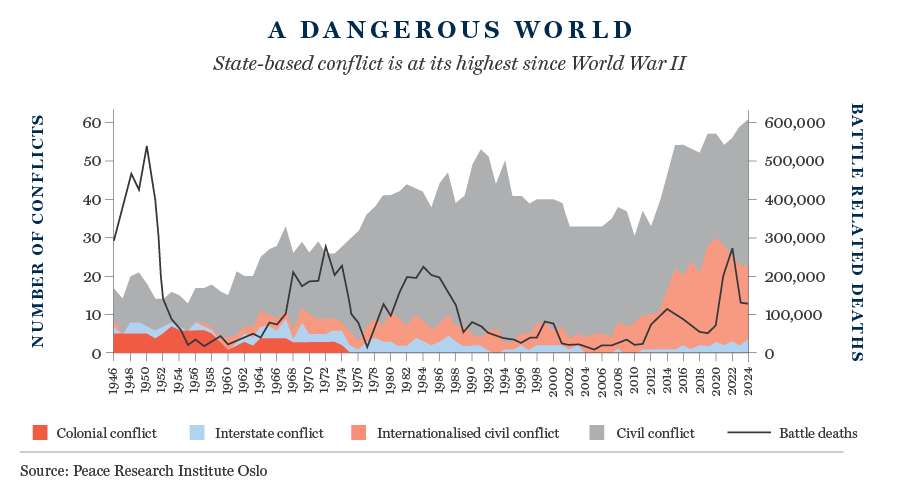

According to the Peace Research Institute Oslo, 2024 marked a historic peak in state-based conflicts, with 61 active conflicts across 36 countries – the highest number recorded since 1946. Given today’s proliferation of geopolitical tensions, it is hard to argue convincingly for this trend to meaningfully reverse in the medium term.

Faced with an increasingly fractious world, defence budgets are likely to continue to grow as governments make up for years of underinvestment. Judging by the recent performance of A&D companies, the market clearly shares this view.

Has this changed how we think about potential opportunities in the A&D sector? Before reaching any investment conclusions, it is important to think about what higher defence spending might look like.

…and so has warfare

The structural increase in spending outlined above is happening at a time when warfare is undergoing a technological transformation. The conflict in Ukraine is a petri dish for the use of advanced technology for military purposes, notably drones and AI. According to a recently published paper by Chatham House “Ukraine has built a defence-tech ecosystem that is reshaping the rules of modern combat.”

The ability to withstand Russia’s vastly superior manpower has not just been due to individual technologies, however. It is also the result of Ukraine’s ability to “regularly outpace Russia in the innovation cycle.” Put simply, warfare is being disrupted by technology more frequently and with greater impact than at any time in history.

There is already evidence that governments are taking the lessons of Ukraine on board. In the UK, the government’s recent Strategic Defence Review vowed to establish “a leading tech-enabled defence power.” “With technology changing warfare so quickly,” the review warns “business as usual is no longer an option.”

brains over brawn

The evolution of warfare reorients the compass for investors looking to gain exposure to the structural tailwind of higher defence spending.

If incremental advantage in conflict now lies in disruptive technology rather than sheer mass of conventional weaponry, we can expect the companies providing the former to secure a greater share of future defence spend. More cybersecurity, sensors and software, less bombs, bullets and tanks.

This shift in emphasis presents opportunities for more specialist tech-focused A&D players, as well as non-A&D tech companies, to muscle in on rising procurement budgets at the expense of the defence primes. Here, the US offers a glimpse of the future.

Tasked with developing the ‘Golden Dome’ missile defence system, the US Department of Defense is encouraging the involvement of non-traditional contractors with “innovative and disruptive capabilities”. Expect similar exhortations from European governments.

Furthermore, whilst we continue to question the control of destiny of the primes, more specialist A&D players and tech companies have greater scope to innovate and deliver value-add capabilities. This should allow them to further grow their share of procurement budgets.

potential snafus

We are alert to the potential investment opportunities arising from the evolving geopolitical and military landscape. In recent months, members of the Research team have visited A&D and related companies in Germany and Sweden, as well as in the US.

Our conversations with management teams have provided valuable insights into not just the positives of the current spending tailwind, but also the challenges. The need to invest significantly in capex to fully capture potential opportunities, for example, or the difficulties of ramping-up production to meet rising demand.

There are two other points that we believe merit close consideration when thinking about potential A&D opportunities:

- First, one does not have to be an inveterate cynic to view political rhetoric with a degree of scepticism. A Europe of straitened government finances is one where difficult choices must be made and not every electorate will find the trade-offs demanded by higher defence spending palatable. Don’t bank on every ‘promise’ of investment materialising.

- Second, we are conscious that the valuations for A&D stocks have travelled a long way in recent months, reflecting lofty expectations for future earnings growth. A great deal of good news is clearly already baked into share prices.

staying disciplined

Whether our ongoing research and analysis of specific names converts to portfolio investments will hinge on our assessment of their ability to reliably compound earnings over our long-term investment horizon. The world might have changed, but our commitment to rigour and diligence remains the same.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.