Key Takeaways

- Stablecoins are growing in popularity, but there are hurdles to more widespread consumer adoption

- Visa and Mastercard are evolving and integrating stablecoin capabilities into their networks

- Rather than disrupting the two global payments giants, stablecoin could further enhance their dominance

Stablecoins are increasingly touted as potential alternatives to traditional payment methods, threatening the dominance of the global payment duopoly, Visa and Mastercard. The news that Amazon and Walmart are exploring issuing their own stablecoins had a negative impact on the share prices of both Visa and Mastercard.

A stablecoin is a cryptocurrency designed to maintain a stable value by having it pegged to a fiat currency – overwhelmingly the US dollar. This removes the volatility associated with traditional speculation-focused cryptocurrencies, making stablecoins more practical as a means of exchange.

They offer faster transaction speeds and round-the-clock settlement, and because they can bypass banks and existing payment networks, they can carry lower transaction costs than traditional payment methods. They are primarily used today for cross-border transfers and for trading crypto assets.

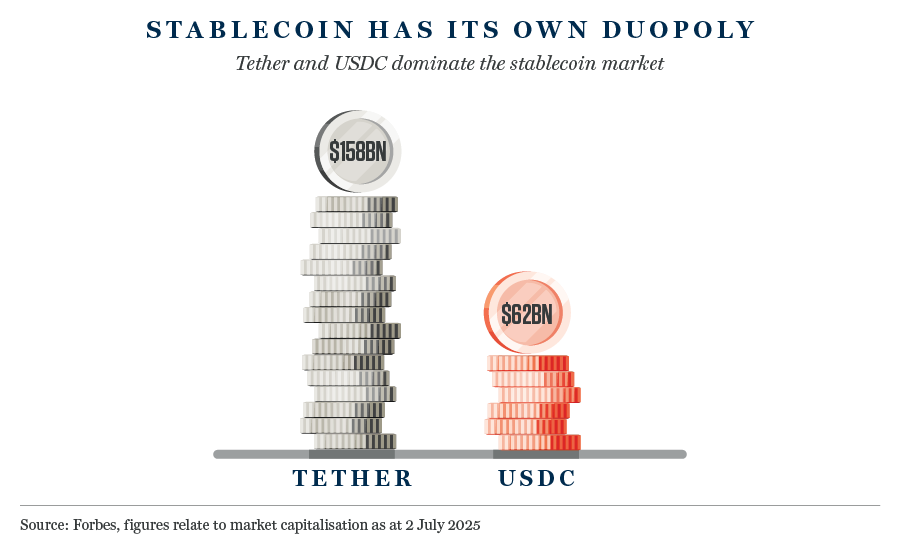

With a market capitalisation currently valued at over US$200 billion, the stablecoin market is still relatively small, although it is growing rapidly. Interest has been boosted further by the GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins), which sets out federal rules for stablecoins and proposes a regulated pathway for private companies to issue payment stablecoins. The Act represents a step forward in the development of a more legitimised industry and will likely spur further innovation.

Not everyone is as keen as the present US administration, however. In its annual economic report, the Bank of International Settlements (BIS) expressed serious misgivings about the suitability of stablecoins as an integral part of the global financial system. Lacking the “singleness, elasticity and integrity” that characterise sound money, the BIS suggested stablecoins “may at best serve a subsidiary role.” In short, the ascent of stablecoins into the monetary mainstream should not be taken as an inevitability.

There may be roadblocks ahead

Putting the more fundamental concerns of the BIS to one side, we still think some of the disruptive claims attributed to stablecoins – and the scale of the threat to Visa and Mastercard – are overblown.

In their current guise, stablecoins lack several features that would support consumer adoption:

- Widespread acceptance

- Consumer protection

- Loyalty schemes

- Credit facilities

- Fraud protection

It is also unclear whether stablecoins have as material a value advantage over debit payments as their proponents claim, given the costs of the latter have been reduced by regulation over the years.

A quick thought experiment strengthens this cautious view on near-term consumer adoption. If Walmart issues a stablecoin, could it persuade enough customers to store money in these ‘Walmartcoins’? Or will customers just buy Walmartcoins for every Walmart transaction using their traditional payment cards?

Perhaps they will just refrain from using Walmartcoins altogether. Given that stablecoins do not pay interest on balances, there is little incentive to keep large balances purely for use with a single retailer.

Merchants could offer a discount on purchases, although it is unlikely to be substantial enough to incentivise widespread consumer adoption. In addition, the larger the discount, the more it would undermine the financial rationale for the merchant issuing a stablecoin in the first place.

These barriers to entry are not insurmountable, but we do think they inhibit the rapid transformation of the consumer payments landscape that some investors envisage.

One could even argue that stablecoins are being positioned as a solution to a problem that does not exist. Visa and Mastercard have ubiquity, scale, globally recognised brands, and relationships with millions of merchants, consumers, and financial intermediaries.

Their cards work well, they are well understood, they offer rewards, and they are accepted all over the Western world. Consumer habits are notoriously tough to break, and it is hard to envisage widespread switching to stablecoins if they don’t offer tangible benefits.

The payments giants are rising to the challenge

It is also a mistake to view Visa and Mastercard as passive onlookers to the changes and challenges posed by cryptocurrencies. Neither has been asleep at the wheel, and both already offer solutions to consumers and merchants who wish to transact in stablecoins.

Mastercard, for example, has several initiatives in place, including a co-branded card that allows cardholders to use their digital assets at all locations that accept Mastercard, and a partnership to integrate a recently launched stablecoin across a range of Mastercard products and services.

Indeed, given their built-in advantages, Visa and Mastercard’s payment networks are likely to be the most effective near-term route to wider acceptance for stablecoin issuers.

More of an opportunity than a threat?

We view expectations of imminent, large-scale disruption of the global payments system as an oversimplification. Stablecoins may introduce new dynamics to the market, but they are unlikely to displace the entrenched networks of Visa and Mastercard in the foreseeable future.

Instead, the integration of stablecoins into their systems could further solidify their dominance, enhancing their indispensable role in the evolving landscape of digital payments. These payment giants have consistently demonstrated an ability to adapt to technological shifts and remain at the forefront of the financial ecosystem. We believe that this is the likely outcome in the event of more widespread stablecoin adoption.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.