KEY TAKEAWAYS

- Modern infrastructure and climate goals demand smarter, faster energy systems to avoid costly disruptions

- Data centres’ energy intensity is driving strong demand for efficient infrastructure and cooling solutions

- Electrification isn’t just about new energy – replacing aging infrastructure is vital for reliability and growth

In 2003, a blackout plunged more than 50 million people in Canada and the US into darkness, halting trains, silencing factories, and costing billions. It was a stark reminder of how fragile our energy infrastructure can be – and how vital electrification is to modern life. Today, as data centre demands surge, climate goals tighten, and aging grids creak under pressure, the race to electrify smarter and faster has never been more urgent. Companies that enable this transformation – those that power, automate, and stabilise our energy systems – aren’t just solving problems. They are shaping the future.

SMART SPARKS

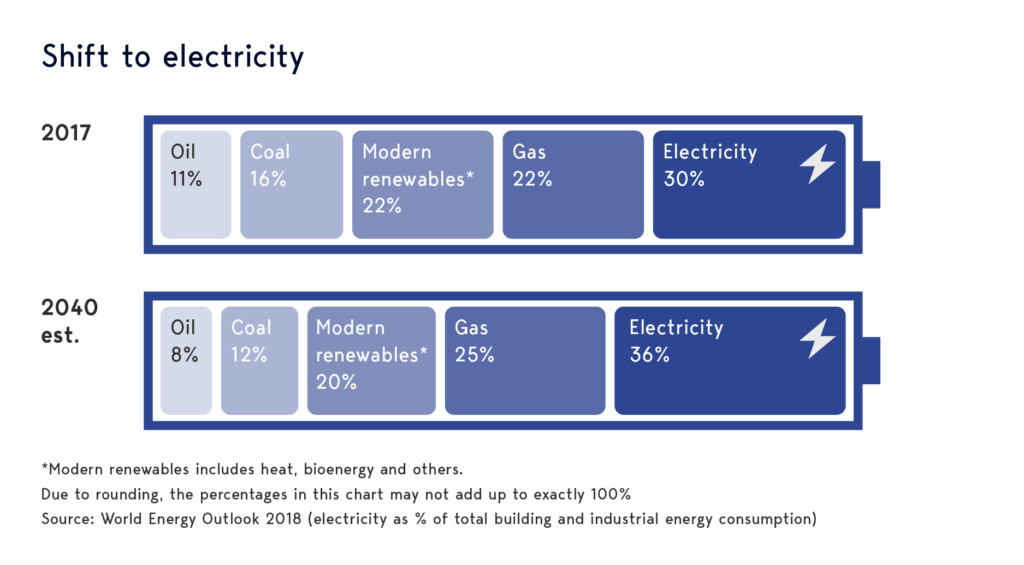

Global demand for energy continues its persistent rise. At the same time, the world’s emphasis on cleaner and more efficient sources continues to grow in significance. These are deeply entrenched trends with widely acknowledged long-term growth potential, and electrification offers solutions to both challenges.

When considering companies within Europe’s industrial sector, one might recall a landscape influenced by longstanding practices, regulatory frameworks, or established traditions. Instead, a number of companies across Europe are at the forefront of the innovation and ambition that will underpin this next chapter in the rise of electrification.

One of these is the Switzerland-domiciled ABB. Almost 50% of the world’s electricity is converted into motion by electric motors. These motors run all the time (so are not particularly efficient) unless fitted with a drive, which is akin to a brain that tells the motor to speed up or slow down. Currently only 23% of the world’s motors are optimised with a drive, and ABB is a world leader in the manufacturing of drives and motors.

More broadly, ABB helps industries automate and electrify their operations using smart technologies that improve efficiency, safety, and sustainability. For example, it helps solar farms connect to the grid, automates power plants for efficiency, and provides energy storage systems to support reliable power supply.

Another giant of the industry, Schneider Electric, similarly makes products and software that enable the digitisation and electrification of buildings, data centres, infrastructure and grids. As a global leader in energy management, it helps businesses to use electricity more efficiently. This division makes up 83% of sales, with the rest largely coming from the production of critical electrical components for use in industrial automation.

DATA DEMANDS SURGE

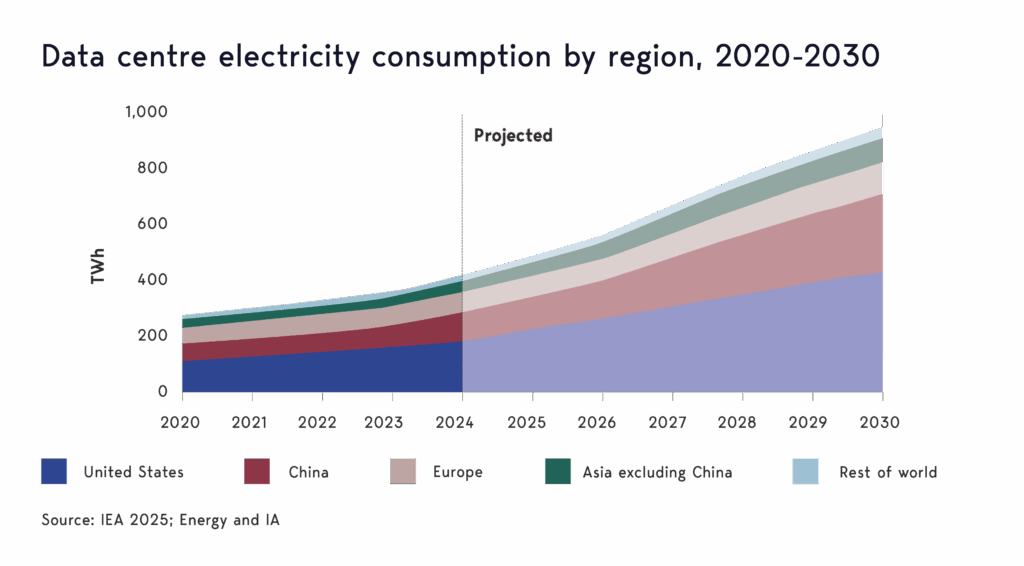

Data centres are becoming significant contributors to global electricity demand, due to the increasing use of cloud computing, artificial intelligence workloads, streaming services, and the expansion of connected devices and digital services across various industries. These vast facilities take up huge swathes of land and are notoriously energy intensive.

For ABB and Schneider, data centres are proving to be strategically important with plenty of room to grow. They currently account for roughly 6% and 20% of their orders respectively. Data centre sales for Schneider have grown at double-digit rates since 2017. The crucial advantage for the French group is its breadth of coverage, allowing it to become a leading provider of energy infrastructure for this industry. It provides software that monitors how much energy servers and cooling systems use. It then adjusts cooling levels in real time to prevent overheating while using the least amount of electricity possible.

STATESIDE PRODUCTION

Despite President Trump’s recent decision to impose a 39% tariff on Switzerland and 15% on the EU, ABB and Schneider should see minimal impact from the additional duties, given their “local for local” strategies around the world.

In the US specifically, ABB recently announced that it would be investing $120m, having invested more than $500m there over the last three years. Schneider also announced a $700m+ investment plan in the US. Combined with previous US investments in 2023 and 2024 to enhance its North American supply chain, this will bring its total to over $1bn this decade.

Both companies have been moving in this direction for some time, with Schneider, for example, having been operating a multi-hub model for many years. The company benefited from this during the Covid period, when global supply chains faced significant disruptions. Since then, the model has been subsequently reinforced, targeting 90% regional sourcing and manufacturing. Today, 83% of products sold in the US are sourced or made there. R&D is also localised due to increasingly bespoke regional requirements.

Although tariffs on imports are very likely to push up costs, in a recent conversation with ABB, the tone was relatively relaxed that these second-order effects could be passed on to customers.

REVIVING THE GRID

It is not all about the demand for new energy. Given the age of established energy infrastructures around the world, replacement is equally important. The last thing national governments need, especially when attracting new investment to their shores, is an unstable power supply. Step forward National Grid.

It is a UK-based company that operates and maintains electricity and gas networks in both the UK and north-eastern US. Significant investment is required over the coming decades in the electricity utility sector. This is driven by a need to meet growing energy demand, the transition to renewable energy sources, and the replacement of ageing assets. National Grid benefits from operating as a regulated monopoly, earning a consistent and largely pre-determined return on capital.

PLUGGED INTO TOMORROW

Over the long term, as the demand for electricity continues, given their market-leading positions, these three businesses should all be beneficiaries of the shift. They also operate in a complementary fashion. For example, as National Grid steps up its capital expenditure programme in its distribution and transmission networks, this benefits ABB and Schneider which lead the way in providing electrical equipment.

Fundamentally, if you believe that electricity is part of the world’s future energy supply, it is vital to connect, and stay connected, to the grid. From factories to data centres and hospitals, businesses and governments cannot afford to lose power supply. The reliability, quality and ability to deliver provide real pricing power to these businesses which are quite literally keeping the lights on.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.