KEY TAKEAWAYS

- Switzerland’s pharmaceutical heritage has fostered a network of supply-chain manufacturing

- Tecan’s growth is driven by next generation gene sequencing, for accurate diagnosis

- Belimo powers climate control in iconic buildings worldwide, including the White House and the Burj Khalifa

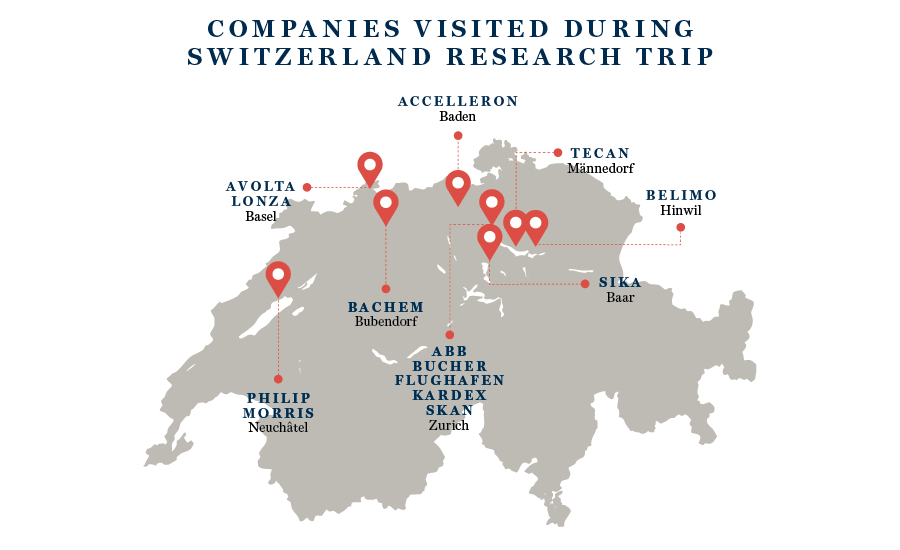

The lakeside village of Männedorf, surrounded by woodland and set beneath snow-capped mountains, is home to one of the most advanced diagnostics firms in the world. Tecan supplies laboratory automation products to life sciences and diagnostics businesses around the world. Taking the train alongside Lake Zurich to get there, with the sunshine glistening on the water, my colleague Jay McLeod and I agreed that its employees have a particularly enviable commute to work.

Meeting the management team, we heard about some of the long-term tailwinds driving growth for Tecan. For example, in next- generation gene sequencing, there are over 100 preparation steps needed to decode DNA or RNA sequences, a process that would be nearly impossible to scale without lab automation. This technology enables scientists to identify genetic mutations and diagnose disorders with speed and accuracy.

One of Tecan’s most interesting technologies is its phase separator, which can isolate plasma from a patient’s blood. It has applications within liquid biopsy, plasma collection banks, biobanks and mass spectrometry. The machine can detect various liquids within a sample without using cameras, instead using pressure sensors which distinguish changes in viscosity within a sample. The device is fully automated and does not touch the cells in the sample because of the pressure-sensing technology. Clinicians can regulate the pressure and sensitivity of the machine easily through Tecan’s software. Liquid biopsy won’t be a replacement for tissue tests, but the technology is growing rapidly and has a lot of applications for the monitoring of patients diagnosed with cancer.

Given Switzerland’s strong pharmaceutical heritage, it is no surprise that Tecan isn’t the only business with a critical position in the healthcare supply chain. These companies, many of them known as contract development and manufacturing organisations (CDMOs), offer outsourcing services to global pharmaceutical companies throughout the lifecycle of a drug, from development and small-scale production for clinical trials to commercial-scale manufacturing.

Like Tecan, Bachem is based in a small unassuming town, Bubendorf. It is one of the world’s leading suppliers of peptides, the active ingredient in diabetes and anti-obesity GLP-1 drugs – with a 25% market share. As GLP-1 production attempts to catch up with demand, the key drugmakers are scaling up significantly. The market opportunity for Bachem is tremendous and it doesn’t need to pick the winning pharmaceutical company to do well, it just needs to continue supplying its many customers while spreading its bets.

Similarly, the upside to being a CDMO is that, unlike the drug companies producing the GLP-1s, Bachem has no patent cliff. That said, there are several key questions around how successful the company will be in scaling its capacity and how it would fund the long-term expansion required.

Also within the GLP-1 space, SKAN is another inconspicuous business that is integral to the growth of these drugs. It is a leading manufacturer of aseptic isolator solutions for almost all large biopharmaceutical companies globally. These isolators are critical for the filling of vials and syringes for injectable drugs. The human body has natural defence mechanisms protecting it against contamination of oral drugs, but not injectables. The isolators produce an environment that is 1,000 times cleaner than clean rooms.

SKAN’s future growth is underpinned by the healthcare industry’s trend towards injectables and protein-based drugs, which can’t be sterilised by heating without being denatured (losing their structure). It should be a clear beneficiary of rising GLP-1 popularity so long as injectable variants continue to grow, and, as with the rest of the GLP-1 story, supply is constrained. The entire industry can produce only a limited amount of isolators per year. SKAN, along with competitor Getinge, accounts for more than 50% of this supply.

Lonza, headquartered in Switzerland’s healthcare heartland of Basel, is the world’s leading CDMO. It also plays to another powerful long-term growth trend – biologics. These medications, made from living organisms such as bacteria, yeast or mammalian tissue and cells, are especially complex and costly to develop and manufacture. The global market for biologic drugs was estimated at $413bn in 2025 and is expected to grow at a low-double-digit rate.

What makes Lonza unique among CDMOs is its combination of a broad service offering, proprietary technologies and global manufacturing footprint. Customers typically engage with Lonza throughout the entire lifecycle of a product from development to commercial launch. This means that the early-stage product pipeline provides excellent visibility of future growth in commercial manufacturing, which represents the bulk of Lonza’s revenues.

Interestingly, Lonza did not start out as a healthcare business. In the late 19th century, it was an electric utility provider which diversified into a complex industrial conglomerate. It was not until the 1980s and 1990s that it turned its hand to the sector it now dominates.

We also met some interesting businesses in the industrial sector. One of the most memorable was Belimo, which makes components, control valves and sensors for heating, ventilation and air conditioning in buildings. Its products can be found installed in the White House, the Empire State Building and the world’s tallest building, the Burj Khalifa in the United Arab Emirates.

We had a tour of Belimo’s largest factory, which is home to half of its global workforce. What really stood out was the manufacturing line, which felt more like a cavernous open-plan office than a factory floor and whose workforce was almost entirely female because of the fiddly assembly involved. There was however one fully automated line with robots which cost around $1.25m and could reportedly replace 20 people. In time, management hopes to roll out these robotic lines more widely.

Lonza did not start out as a healthcare business

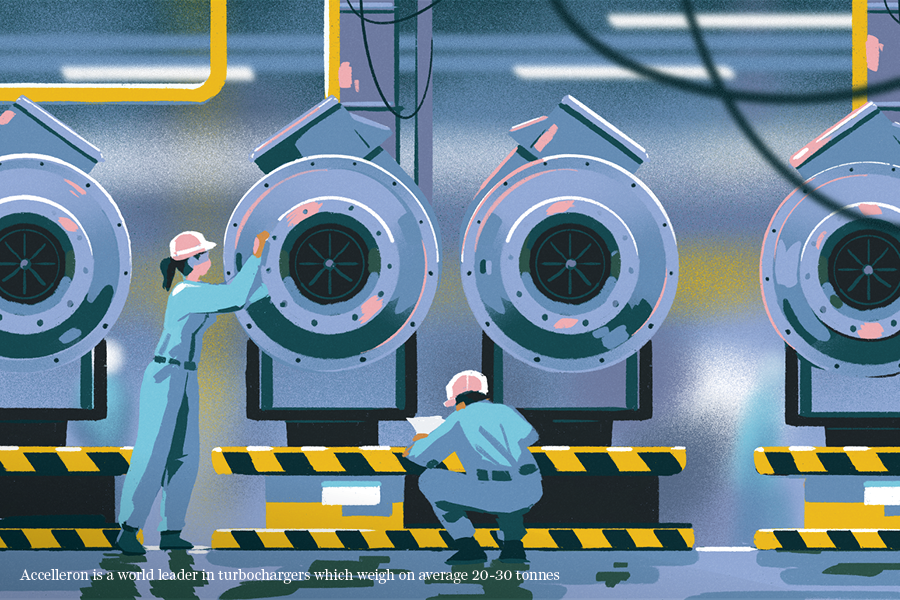

Tucked away in the town of Baden, more famous for its mineral hot springs, is the headquarters of Accelleron. Spun out of the global electrification and automation engineering business ABB in 2022, it is a world leader in designing and manufacturing turbochargers for medium to low-speed engines. Over 50% of sales go to the marine industry and Accelleron plays a crucial role helping ships to go faster with fewer emissions.

In contrast to the intricate work we witnessed at Belimo, these turbochargers weigh an average of 20-30 tonnes – roughly the same size as an adult male humpback whale. Witnessing the sheer scale of these industrial operations first-hand can give you a sense of what a business does in a way that no amount of reading company reports ever will.

While our visit was somewhat whistle-stop – we saw 13 companies in five days – those that we met certainly exemplified that Swiss skill for being at the forefront of their industries through innovation, precision and quality. They proved that world-class businesses don’t always emerge from sprawling cities. Perhaps that is the power of the fresh Alpine air.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.