KEY TAKEAWAYS

- Edwards Lifesciences has had to battle investor scepticism about the future of its groundbreaking TAVR heart-valve therapy

- Supported by new clinical data and other catalysts, however, TAVR appears on the cusp of an exciting new growth phase

- Diversification into new heart therapies further strengthens Edwards’ long-term outlook

A little over a year ago, Edwards Lifesciences was in the crosshairs of investors. Having reported results that called into question its structural growth prospects, the company’s share price collapsed by more than 30% in a single day. It was an abrupt fall from grace for one of global healthcare’s true pioneers.

A revolution in healthcare

Fifteen years ago, Edwards revolutionised the treatment of aortic stenosis (AS), a serious heart condition that affects millions of people worldwide. For decades, the only available treatment was the manual replacement of the aortic valve through dangerous open-heart surgery. Potential complications and side effects from the invasive procedure seriously constrained the number of patients deemed fit for surgery.

The arrival of Edwards’ transcatheter aortic valve replacement (TAVR) in 2011 was a gamechanger. Allowing physicians to replace the diseased valve via a catheter inserted through a small incision in the leg, TAVR circumvented the need for risky open-heart surgery, expanding access to life-saving therapy and significantly reducing recovery time and hospital stays.

In the years that followed, Edwards capitalised on its pioneering work to become the acknowledged leader in heart valve therapy. Successive iterations of TAVR built further on its clinical benefits. The technology quickly developed into the company’s flagship growth engine, with long-term demand supported by ageing populations and increased AS awareness.

Excessive pessimism?

It was fear that the TAVR growth engine was faltering that triggered the violent market reaction to the company’s 2024 second-quarter results. A marked slowdown in quarterly sales prompted management to downgrade full-year expectations, citing hospital capacity constraints and workflow bottlenecks that would ease in time.

More bearish investors took a less sanguine view, however. The slowdown had less to do with temporary headwinds, they argued, than the fact the therapy had reached maturation. Procedure growth would consequently be structurally lower in future than previously anticipated.

In our view, while the downgrade in guidance was disappointing, the bear case against Edwards didn’t just ignore important catalysts for continued strong TAVR growth, it underestimated significant opportunities in other, less-mature parts of the business. That perspective has been bolstered by subsequent news flow, as well as a visit by two members of Walter Scott’s Research team to Edwards’ HQ in Irvine, California.

Expanding the opportunity

Since last year’s speedbump, TAVR sales have reaccelerated, prompting management to raise full-year guidance for 2025. Bottlenecks have cleared (as anticipated), and there has been a “renewed focus” on AS among physicians.

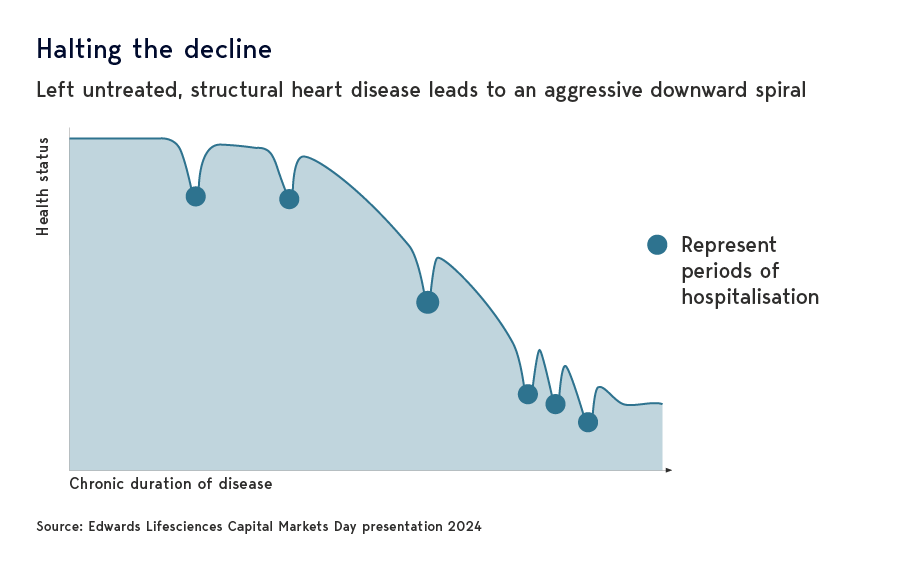

Clinical developments have also moved in TAVR’s favour. For many years, the approach to AS was to intervene only once a patient presents with severe symptoms. This is despite nearly one-third of all severe AS sufferers experiencing no symptoms and nearly twice as many patients presenting with moderate rather than severe symptoms.

However, TAVR now has approval for asymptomatic patients and, subject to clinical trials later in 2026, will potentially receive approval or moderate sufferers, expanding the addressable market even further. Add to this encouraging clinical data regarding TAVR’s continued efficacy and the therapy’s growth prospects remain compelling.

New growth engines emerge

Arguably even more exciting is the evolving opportunity for Edwards’ transcatheter mitral and tricuspid therapies (TMTT). These minimally invasive procedures are designed to treat mitral and tricuspid regurgitation, two heart valve-related conditions that left untreated result in poor quality of life and increased mortality.

As with TAVR, Edwards’ innovative catheter-based solutions help those patients deemed ineligible for surgery due to frailty or comorbidities. The addressable global population runs into the millions and continues to grow due to societal ageing, lifestyle-linked diseases, and better diagnosis.

Current projections are for Edwards’ TMTT portfolio to generate US$2bn in sales by 2030 – a fourfold increase on 2025. In time, management believes the market could be bigger than TAVR, presenting a growth opportunity stretching out over many, many years.

C-suite confidence

Our optimism in Edwards’ prospects was reinforced during our November meeting with CEO Bernard J. Zovighian at the company’s California headquarters. TAVR, he believes, is entering a dynamic new growth phase, driven by clinical trials that are broadening the eligible patient population. Add in the rapid acceleration of TMTT, and the outlook for the next decade is exceptionally promising.

For years, Edwards was often seen as a pure play on TAVR adoption. That is starting to change. The rise of TMTT has already begun to reshape perceptions, and the company’s early moves into other underpenetrated areas, such as aortic regurgitation and structural heart failure, signal a deliberate strategy to diversify and strengthen its growth profile. After the gloom of summer 2024, a brighter narrative is emerging.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.