You’re not shipping freight. You’re shipping a promise

Greg Gantt, President & CEO, Old Dominion Freight Line

It all started with a single truck. In 1934, Earl and Lillian Congdon founded Old Dominion Freight Line, a one-vehicle business shipping parcels along a 94-mile route between Richmond and Norfolk, Virginia. With Earl as driver and Lillian running the business from the Congdon family home, Old Dominion (OD), so-called after a name given to the state of Virginia in early colonial times, got its first break the following year when it was awarded a route operating certificate by the Interstate Commerce Commission. Soon the business was trading in its domestic surroundings for a dedicated loading terminal. The OD growth story was up and running.

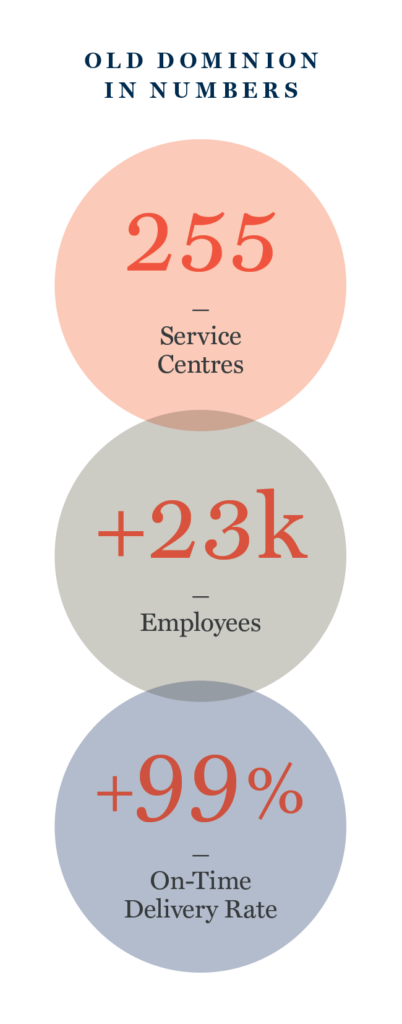

Nearly nine decades later, OD is one of the largest less-than-truckload (LTL) carriers in the US, with 255 service centres across the country’s 48 contiguous states. The Congdon’s single truck, acquired in a swap for the Chevrolet Earl’s parents had gifted the couple on their wedding day, is now a fleet of some 57,000 tractors and trailers.1

The Vital Link

Trucking is the backbone of the US domestic supply chain, accounting for some 80% of transportation revenues. Of that figure, the overwhelming majority comes from what is known as full truckload, where carriers transport a single shipment from origin to destination. Much smaller, but increasingly important, is LTL. More complex than full truckload, LTL involves multiple shipments from multiple customers on a single truck. The freight is then routed through a network of service centres, where it is often transferred to another truck with a similar destination.

Trucking is the backbone of the US domestic supply chain

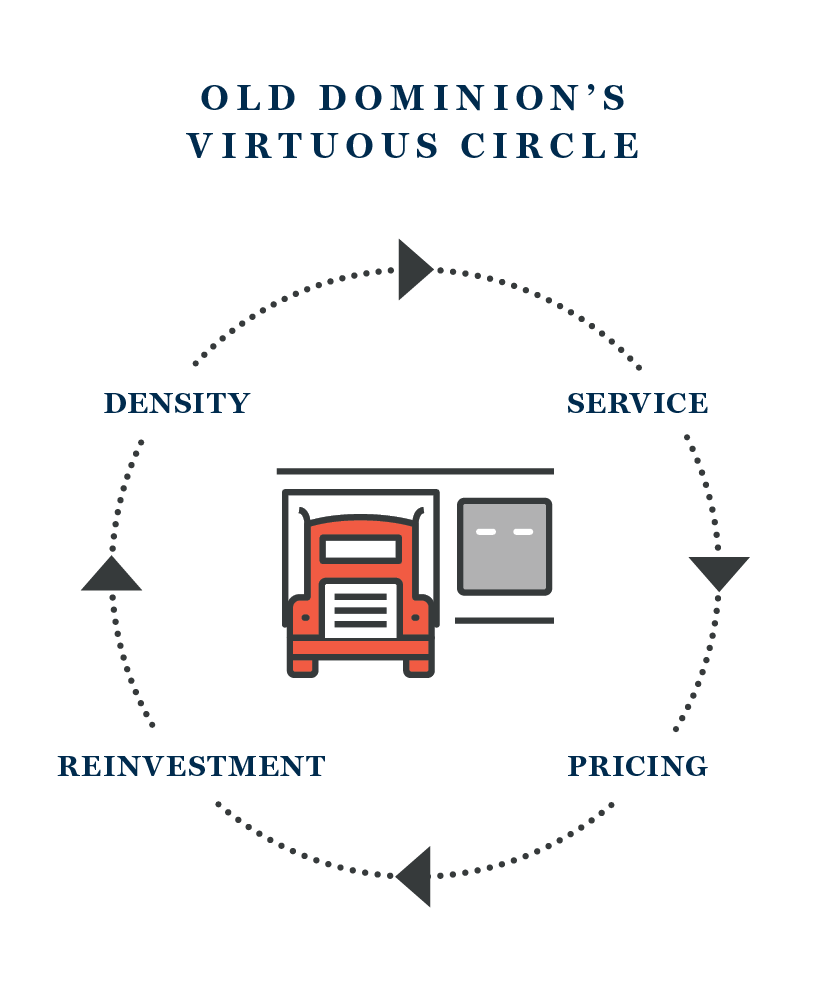

Arguably, nobody does LTL better than OD. Ranked the number one LTL national carrier for quality for thirteen consecutive years, the business is considered the premium offering in the industry.2 It’s not hard to see why. In 2022, more than 99% of OD deliveries arrived on time and cargo claims were a mere 0.1% of revenues.3 This remarkable level of reliability allows the company to charge a fair premium relative to the competition and has helped drive two decades worth of market share gains. In 2002, OD had a 2.9% share of the $19 billion LTL market. By 2021, that figure had risen to 11.4% of a $46 billion market.4

Delivering the future

There are strong structural reasons for believing that OD can maintain this impressive growth trajectory and make further inroads into the broader LTL market. Fundamental to success in LTL is having an extensive network of local pickup & delivery stores alongside larger regional distribution hubs. Without this, the business can prove very unprofitable. But building such a network isn’t easy and it certainly isn’t cheap. It’s the primary reason that unlike full truckload, which is a highly fragmented industry, LTL has consolidated around a handful of scale players with the financial muscle to build, maintain and extend the necessary infrastructure.

In the last decade, OD has invested $2 billion in establishing a network that criss-crosses the US. Its density represents a huge barrier to entry. But where the company really steals a march over the competition is in how it operates that network. OD is obsessive about operational excellence and pulls every lever possible to make it happen.

OD has invested $2 billion in establishing a network that criss-crosses the US

Unlike peers who typically lease their service centres, OD owns and operates nearly 90% of its real estate. Whilst undoubtedly more capital intensive, ownership gives the business greater control of destiny. Whereas competitors have only limited control over design and planning, OD can build centres to a specificity that maximises efficiency.

The same goes for trucks and trailers. Whereas most competitors are either using leased equipment or outsourcing to contractors, OD owns its fleet, which is customised to internal specifications to improve efficiency. OD also conducts extensive employee driving and handling training. If you’re contracting out these jobs to a third party, how can you ensure consistency of service? That sense of ownership is integral to the OD culture, something in which the company takes great pride.

Considered the best place to work in the industry, OD staff are well paid and enjoy industry-leading benefits, career progression and a promote-from-within mentality. And funnily enough, when you pay people well and treat people well, they tend to stick around and work hard. Lower employee churn means not only lower training costs but also better service ratios.

The OD Advantage

We experienced first-hand OD in action during a recent visit to one of its service centres in Kernersville, North Carolina. Attention to detail was evident everywhere, from the meticulous positioning of loading bays to the packing of freight onto vehicles. Nothing was left to chance. Staff were fastidious in their use of cargo straps and air bags to hold everything in place and minimise the risk of damage in transit. And before every vehicle door closed, a photograph was taken and sent to the site supervisor. Staff were rightly proud of a 99.4% on-time service record.

Kernersville was the OD competitive edge in microcosm. An engaged and committed workforce focused on giving customers what they are paying for – the most reliable and efficient service available. It’s an advantage that owes something to the principle of obliquity: the idea that goals are often best achieved indirectly. In its pursuit of providing the very best LTL service in the market, OD has also grown to be one of the biggest and most profitable. Others, perhaps more direct in the search for profitability, have been less successful.

As e-commerce continues its exponential growth, demand for LTL will also rise. But so too will the demands placed on the LTL carriers. In the age of nextday delivery, building an operation capable of 99% on-time delivery will be harder and more expensive than ever. Thanks to its near nine-decade focus on operational excellence, OD is already one step ahead of the competition.

Sources:

1,3,4 Old Domion Freight Line Investor Presentation 2022

2 Mastio Quality Award

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.