Corporate Japan has long lagged its developed world peers in IT investment. That’s set to change, however, as the country looks to overcome its demographic challenges and boost productivity. For Tokyo-based OBIC, this shift in corporate mindset should prove a powerful long-term growth opportunity.

During a speech in 2020, Japan’s then Minister for Administrative Reform lamented his country’s resistance to technological change in the workplace. “Why do we need to print out paper?” asked Taro Kono, questioning the widespread prevalence of legacy technologies such as the fax machine. By clinging to the old ways of working and failing to invest in its IT capabilities, Kono-san argued, corporate Japan was hindering its own productivity. His job, he declared, was to “clear the road of obstructions to allow the Ferraris and Porsches of digital innovation to speed through.”

Time for Change

Given Japan’s long association with technological innovation, this status as IT investment laggard will likely come as a surprise to many. The scale of the underinvestment might also raise a few eyebrows. Not only does Japan have the lowest IT investment-to-GDP ratio of any developed economy, but its companies commit some 15% less in capital expenditure to IT investment than their US counterparts. Rather than viewing IT as a means of enhancing the development of new products and services, reforming business models and supporting the use of new technologies, too many Japanese corporations have seen it simply as a tool for cutting costs.

The consequences of this myopic approach are becoming increasingly clear. By 2025, an estimated 60% of the software systems used in Japan, more than 40% of which were developed in house, will be over twenty years old. Over the same period, the annual cost of maintaining these systems will triple to US$120 billion. Long neglected, Japan’s antiquated IT infrastructure is hampering rather than helping efficiency and productivity.

By 2025, an estimated 60% of the software systems used in Japan… will be over twenty years old

Fortunately, there is growing recognition within Japan that this has to change, and change quickly. An ageing population and growing worker shortages (it’s estimated that Japan will be short of six million workers by 2030) mean that productivity gains are no longer a ‘nice-to-have’ but rather a ‘must have’. Understood as key to securing the necessary productivity gains, IT investment will grow robustly over the coming years as a result.

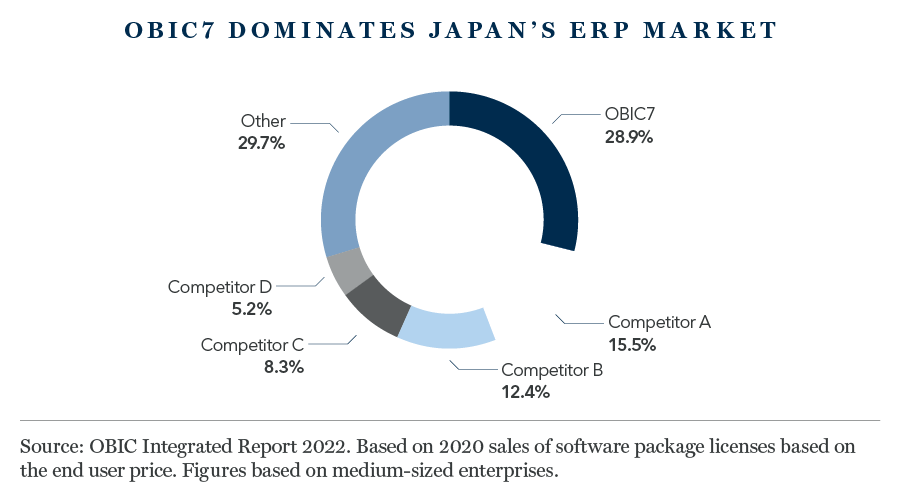

Few companies are better placed to benefit from this long-term upswing in IT spending in our view than Tokyo-based OBIC, the leading provider of customised enterprise software solutions to Japanese medium-sized companies (defined as companies with annual revenues between ¥10bn and ¥100bn). Founded in 1968, OBIC sells and services one product, the enterprise resource planning (ERP) platform OBIC7, which is customised and integrated according to the specific requirements of each customer. The dominant ERP amongst Japanese medium-sized companies for more than two decades, OBIC7 boasts a market share greater than the next two largest competitors combined.

In common with many great companies around the world, OBIC’s business model is a relatively simple one. A single product designed, integrated and serviced for customers by a single company, with no requirement for third-party consultants or third-party service providers. Over the decades, this simplicity has enabled OBIC to focus its research energies on building the best ERP platform available to corporate Japan. Years of continuous improvement have resulted in a highly flexible product that offers thousands of customised modules across hundreds of industry verticals.

In common with many great companies around the world, OBIC’s business model is a relatively simple one

For competitors, such strengths are very hard to replicate, particularly those international companies that struggle to scale their platforms in Japan due to the country’s corporate idiosyncrasies. All of this gives OBIC a highly defendable position within its chosen niche. Add in a reputation for service excellence, and it becomes clear why the company enjoys customer retention rates in the high 90s%.

The Obic Way

Underpinning this formidable business model is OBIC’s famous corporate culture. Guided by one of the company’s two corporate philosophies – “company growth starts with employee growth” – it’s a culture that emphasises the integral role of employees and employee engagement in the company’s success. Employees, only ever recruited directly from university, are given extensive training and learn to work in the ‘OBIC Way’, an approach nurtured carefully by chairman and founder Masahiro Noda. Remuneration is amongst the best in the industry and employee retention is high: the average OBIC employee is 36 years old and has been with the company for over 13 years. This matters in a country where competition for technology talent is fierce.

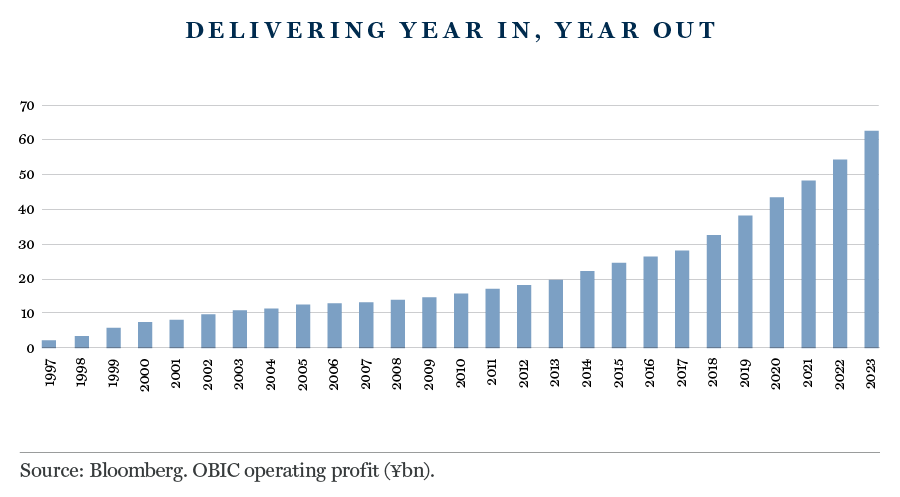

A stated aim of the OBIC Way is to discover “new ideas and innovations every day”. It’s an ambition that owes much to the Japanese concept of kaizen, the idea of continuous improvement. Witness the relentless evolution of OBIC7, where each new iteration is superior in breadth and depth to the previous incarnation. This commitment to constant improvement helps in part to explain OBIC’s outstanding long-term growth record: since 1997, operating margin and operating profit have grown every year. If your modus operandi is enabling others to become more efficient and productive, it certainly helps if your own business has been walking the walk for nearly three decades.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.