Unaddressed hearing loss is estimated to cost the global economy almost US$1 trillion every year.1 From impaired communication and cognition to social isolation and diminished employment opportunities, the implications of reduced hearing are manifold and profound. As the global leader in implantable hearing solutions, Cochlear has been a pioneer in the treatment of this pervasive but under-treated health challenge for over four decades.

It was during a trip to the beach that Professor Graeme Clark experienced his eureka moment. Inspired by his father’s struggles with hearing loss, Clark had been exploring potential remedies for the condition since his days as a PhD student at the University of Sydney.

Convinced that an electrode placed into the cochlea (the spiral-shaped cavity in the inner ear) could stimulate hearing nerves, Clark had been grappling with how best to do so without inflicting damage to the ear. With the help of a shell and a blade of wild grass, he found his answer. By twisting the grass between his fingers, Professor Clark was able to alter the stiffness of the blade, allowing it to be inserted along the spiral of the shell. The design concept for the world’s first multi-channel cochlear implant was born.

Unaddressed hearing loss is estimated to cost the global economy almost US$1 trillion every year

Whereas traditional hearing aids make sounds louder, cochlear implants stimulate the hearing nerve directly, enhancing the clarity of sound and improving the recipient’s ability to understand speech. For patients with severe or higher hearing loss, the devices can deliver superior outcomes for both hearing and quality of life.

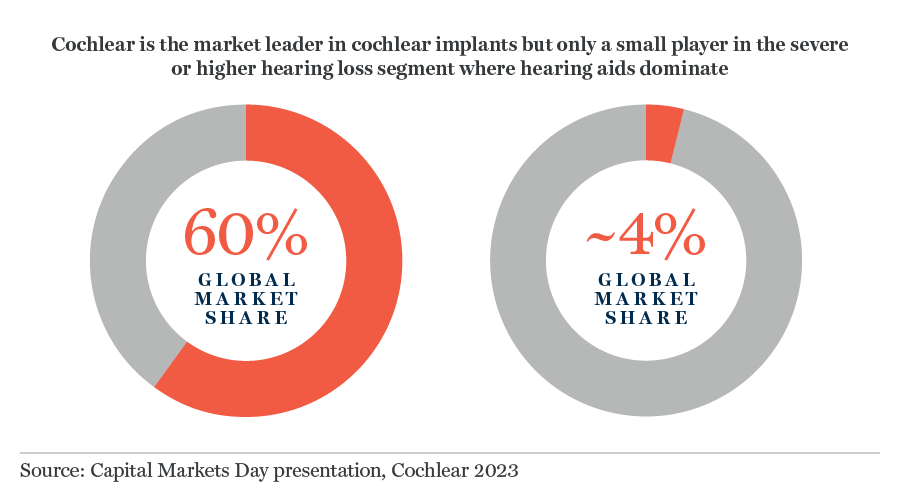

For over four decades, Sydney-based Cochlear has been the acknowledged leader in this transformative technology. In that time, the company has provided over 750,000 devices worldwide, establishing itself as the dominant player in the global hearing implant market with 60% share.2

Yet despite the acknowledged benefits, less than 5% of people with severe or higher hearing loss are treated with an implantable solution. Whilst cochlear implants have long been the established standard of care for children born with hearing loss, adoption rates amongst qualifying adults are significantly lower. Stigma, fear of surgery, and cost all play a role in this, although the most fundamental barrier is the lack of a clear and consistent pathway to diagnosis and treatment. Indeed, most adults who would benefit from cochlear implants are unaware even of their existence. As Cochlear’s CEO observed pithily in Walter Scott’s first meeting with the company “Our greatest competitor is ignorance.”

But as new research continues to shed light on the costs and consequences of hearing loss and the relative benefits of implants, we can expect to see adoption rates rise, creating a significant long-term opportunity for Cochlear.

Less than 5% of people with severe or higher hearing loss are being treated with an implantable solution

According to the World Health Organization, “hearing is a key aspect of functioning at all stages of life; and its loss, unless appropriately addressed, impacts society as a whole.” Sufferers can experience impaired communication and speech, as well as diminished education and employment prospects. For some, a lack of hearing can result in social isolation and loneliness, whilst there is a growing body of evidence linking hearing loss to cognitive decline. Hearing loss, for example, is the single largest modifiable risk factor for dementia.3 Combined, the social and economic costs are estimated at US$ 980 billion every year. For ageing societies with pressured healthcare systems, the need to prioritise treatment is particularly acute.

Research continues to accrue showing that implants have a vital role to play in tackling this issue. A recent study calculated the net societal benefit of cochlear implants by age group, estimating that adults and seniors with progressive profound hearing loss with a cochlear implant had a positive net benefit of €275,000 and €76,000 respectively in terms of reduced educational costs and increased productivity.4

Hearing loss…is the single largest modifiable risk factor for dementia

For Cochlear, future growth is predicated on both growing the implant market and maintaining and extending its dominant position within the market. For the former, establishing a consistent process for diagnosing and referring adult patients is key and the company commits considerable resources to building on the existing clinical and economic evidence, developing a consistent set of referral guidelines, and driving implant awareness through engagement with hearing professionals and patient advocacy groups.

Innovation, meanwhile, is central to evolving Cochlear’s current position of dominance. A relentless innovator since inception, Cochlear has built a worldwide portfolio of 1,700 patents and patent applications. With 550 employees working across innovation centres in Australia, Belgium and Sweden, it boasts an enviable suite of products and services.

Each year, Cochlear spends the equivalent of 12% of revenues on R&D, strengthening its pipeline and delivering enhancements to outcomes, lifestyle features, reliability and connectivity.5 Last year, a smaller, lighter sound processor was launched, helping recipients hear conversations more clearly, particularly in noisy situations. Satisfyingly, innovation not only helps consolidate and grow Cochlear’s market-leading position, but by improving the end-user experience it also drives greater implant adoption.

This dual growth strategy requires long-term planning and investment. Building a referral pathway takes time, as does product innovation. Both demand considerable sums of money. But over its history, Cochlear has proven adept at R&D that benefits both patients and the market. As awareness of the myriad costs of hearing loss grows, this Australian pioneer is well-placed to play a pivotal role in addressing a pervasive but still largely unaddressed medical condition.

Sources:

1 World report on hearing: executive summary. Geneva: World Health Organization; 2021

2 Capital Markets Day presentation, Cochlear 2023

3 Dementia prevention, intervention, and care: 2020 report of the Lancet Commission

4 Cost-benefit Analysis of Cochlear Implants: A Societal Perspective

5 Capital Markets Day presentation, Cochlear 2023

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.