Few things better reflected the world’s desire to move on from the restrictions of Covid-19 than the post-pandemic travel boom. Amadeus IT, the world’s leading provider of IT solutions and distribution systems to the global airline industry, has been a significant beneficiary of this ‘revenge travel’.

In 1988, a group of European national airline carriers (Air France, Iberia, Lufthansa and SAS) pooled their distribution systems in a bid to generate economies of scale and spur productivity improvements. Today, the merged entity, Amadeus IT, is a key enabler of the global travel industry, with dominant positions in two behind-the-scenes industries: Air Distribution and Air IT Solutions.

Powering Global Travel

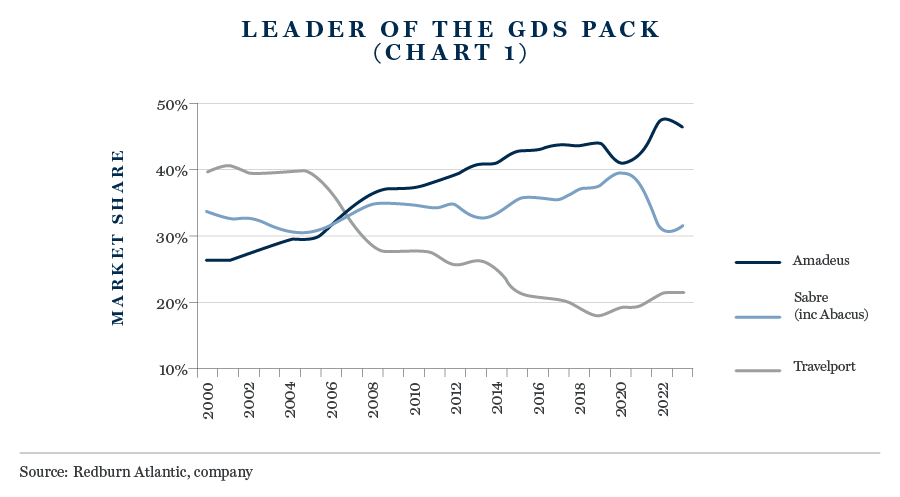

In Air Distribution, Amadeus is the world’s leading global distribution system (GDS) provider (see chart 1), aggregating inventory from hundreds of airlines which is then presented in real time to “travel buyers” (predominantly online and offline travel agencies) in a comprehensive, secure, reliable and unbiased manner. When a subscribed travel agency makes a booking, Amadeus receives a fee.

Amadeus IT is a key enabler of the global travel industry

Offering benefits across the travel ecosystem, a GDS provides airlines with exposure to a global audience, and travel agencies with comprehensive booking solutions. This creates powerful network effects – the more comprehensive the GDS, the more attractive it is to travel agencies; the greater the number of travel agency subscribers, the more attractive the GDS is to airlines. It’s a virtuous circle that works in favour of scale players, of which none are bigger than Amadeus.

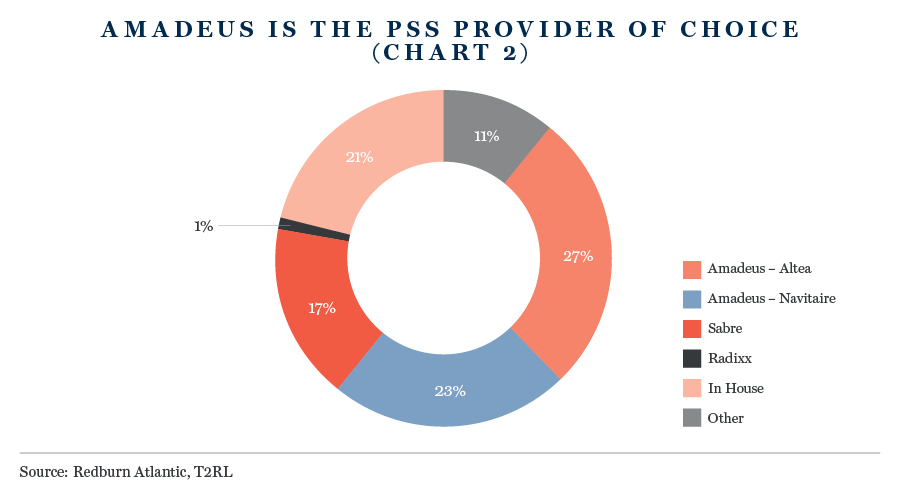

In Air IT Solutions, Amadeus derives most of its revenues from its Altéa and New Skies Passenger Service Systems (PSS). These software-as-a-service solutions allow airlines to outsource and automate mission-critical business processes, such as reservations, inventory management, departure control and e-commerce. Not only does this improve the service the airlines can offer, but it reduces their maintenance and development spending.

More airlines are migrating to outsourced PSS providers, with Amadeus the preferred option by some distance (see chart 2). Again, the long-term opportunity is skewed towards scale players; it makes intuitive sense for airline partners to share common IT platforms.

And despite this more widespread adoption, the outsourced PSS opportunity remains significant. By way of example, Delta, United, Turkish, Allegiant and Emirates collectively account for six hundred million passengers boarded every year, yet all five still operate in-house PSS technology. Given the chaos the airline industry has endured in recent years, few have been willing to consider large-scale technology transitions. As things settle down, expect that to change.

Through its Air Distribution and Air IT Solutions businesses, Amadeus is exposed to the long-term growth in global airline travel, a trend that has been outstripping global GDP growth since the 1970s. The drivers of this story are myriad, from the expanding emerging-market middle class and the rise of low-cost airlines to increased global inter-connectedness and growing consumer demand for ‘experiences’ rather than ‘things’. It’s a trend predicted to continue over the coming decades, with demand for air travel projected to double by 2040, an annual average rate of 3.4%. Over eight billion annual passengers are expected by 2040, up from around four billion in 2019.1

Demand for air travel [is] projected to double by 2040

The relentless rise of air travel has not been enough in itself to shield the core airline industry from considerable volatility, which has historically proven a notoriously demanding business in which to operate. By comparison, Amadeus is relatively insensitive to economic cycles and gyrations in fuel prices. Revenues linked to travel volumes rather than ticket pricing, multi-year contracts with airlines and travel agents, extremely high client retention rates, and geographical diversification confer a resilience that would be the envy of many an airline.

That’s not to say the business is immune from exogenous shocks, the most recent example of which, the Covid-19 pandemic, had a devastating short-term impact. Since the easing of restrictions around the world, however, revenues and volumes have rebounded sharply. More fundamentally, the dynamism of the post-pandemic recovery in air travel more broadly has been the perfect validation of the strength of the industry’s underlying long-term growth trend.

The next growth engine?

Amadeus is now leveraging its expertise in air travel to make serious inroads into another, intricately linked long-term growth trend, the hospitality industry, offering a suite of solutions covering everything from sales and reservations to catering and property management. Initially centred around an internally developed guest reservation system for large hotel chains, the Amadeus Hospitality Platform was boosted in 2018 by the acquisition of TravelClick, which brought with it innovative cloud-based solutions, including a central reservation system and guest management solution for independent and mid-sized hotels.

More rooms globally are booked through the Amadeus central reservation system than any other

Unlike the oligopolistic Air Distribution and Air IT markets, distribution and IT in hospitality are highly fragmented, with no clear market leader. Market penetration is also significantly lower in an industry that has historically been slow to apply technology (most hospitality operators still rely on in-house systems). This is starting to change, however, as the industry looks to garner deeper market insights, drive sales opportunities and adapt to changing traveller habits and expectations. Thanks to Amadeus’ existing expertise and elevated levels of R&D, industry players view its offering as one of the most innovative in the market, with Marriott and IHG amongst a list of high-profile customers.

Although this segment of the business is still in its investment phase, management speaks confidently about the prospects for future growth and market-share gains. The long-term goal is to deliver to the hospitality industry the same step-change in functionality and efficiency that the Altéa PSS platform brought to the airline industry. If it succeeds, Amadeus will have further established itself as a key facilitator of global travel & tourism, one of today’s most compelling long-term growth stories.

Sources:

1 IATA https://www.iata.org/en/iata-repository/publications/economic-reports/global-outlook-for-air-transport—-june-2023/

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.