Pre-extract from The Research Journal, Issue 14.

Threatened by geopolitical tensions and protectionist trade policies, globalisation, the multi-decade megatrend that did so much to shape today’s economy, would appear to be, if not dying, then at least in retreat. For the global technology industry, one of the most potent symbols of our interconnected world, this shift has significant consequences.

If I was asked to name a poster child for globalisation, I might opt for the semiconductor supply chain. Geographically diffuse yet deeply interconnected, this archipelago of hundreds of thousands of global suppliers and manufacturers is a hymn to the benefits of specialisation and comparative advantage. Hyper efficient and cost effective, for decades it was a model that served the technology industry and wider economy well.

Less discussed were the fragilities inherent in such a dispersed and, at times, opaque structure. In an era when globalisation was in the ascendancy, this was perhaps understandable – the risk of severe disruption to such a well-oiled machine seemed remote. In the present era of pandemics, protectionism and elevated geopolitical risks, this optimism can look a little like complacency.

As the merits of this hyper-globalised supply chain come under increasing scrutiny, any conversation about its future is today more likely to involve talk of resilience and ‘de-risking’ than efficiency. It is a shift in emphasis that could have profound consequences. But how realistic is de-risking really and what might it cost, both financially and in terms of efficiency?

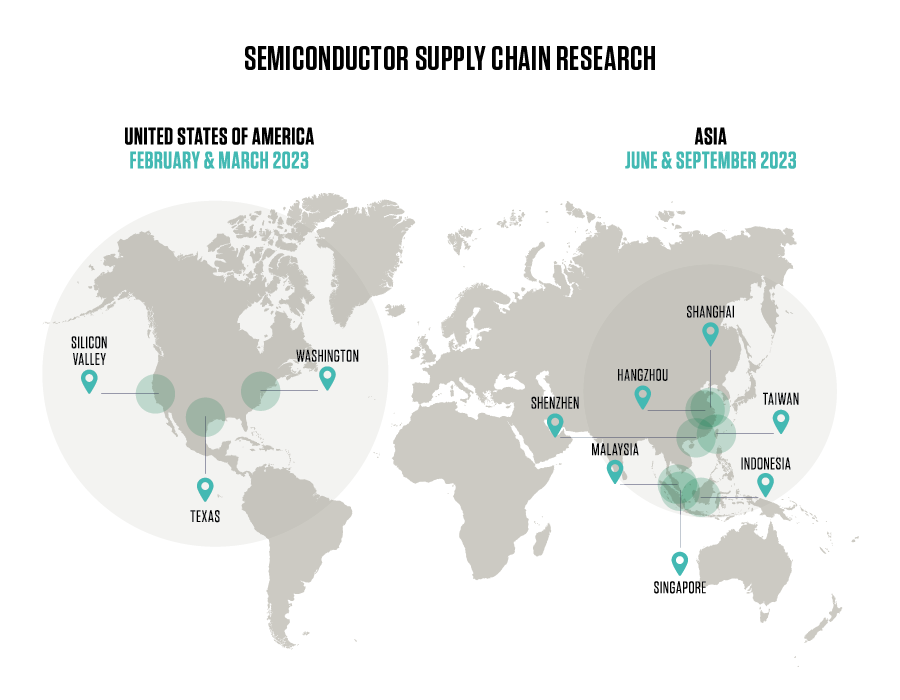

To build on our existing understanding of this process and its trade-offs, last year I travelled to various locations integral to the semiconductor and technology supply chains, including the US, China, Taiwan and some of the critical assembly hubs in South-East Asia, to speak with management teams, policymakers and industry representatives (see map).

From Silicon Valley and Washington DC to Shanghai and Hsinchu, these trips were also an opportunity to question those at the sharp end of the industry about the geopolitical risks that have in large part precipitated the current desire for greater supply chain security.

Nvidia’s stupor mundi

The new Nvidia DGX B200 is a wonder of modern technology. A single, unified AI platform that enables businesses to handle vast datasets at every stage of the AI pipeline, it is the most powerful system of its kind ever assembled, significantly more so than its predecessor the DGX H100.

Underpinning the DGX B200 is the Nvidia-designed GB200 semiconductor, which whilst unquestionably a testament to the innovative genius of Silicon Valley, also happens to be manufactured by TSMC in Taiwan. So too the overwhelming majority of the tens of thousands of components that comprise the DGX B200 system.

In truth, the DGX B200 is only possible because of an elaborate global supply chain comprising myriad stages. So too any number of today’s technological products and systems, from data centres and commercial airliners to medical equipment and solar panels.

Take the humble smartphone. Its semiconductors are likely to have been designed in the West but manufactured, packaged and tested in Taiwan or China. Assembly of the finished product probably took place in a factory in China, India or Vietnam.

To state the obvious, this routing of many hundreds, or in the case of the DGX B200 many thousands of parts through a network of dispersed suppliers is hugely complicated stuff. Even if just one component fails to turn up on time and in the correct location, disruption ensues. Yet the efficacy of today’s supply chains has served to conceal their complexity, leading some to underestimate the challenge of de-risking.

Time and Money

To reorient the existing technology supply chain to materially reduce reliance on specific geographical areas, most notably China and Taiwan (the so-called China Plus One strategy), will take time and involve a huge amount of expense. What we have in situ today has evolved over many years, a hyper-efficient structure driven by the rigorous logic of market forces. Unpicking it is akin to swimming upstream.

TSMC’s founder and former chairman Morris Chang may have been exaggerating to prove a point when he stated that TSMC chips manufactured in the US would cost twice as much as those produced in Taiwan, but he was not wrong in implying that they will be considerably more expensive.

To some extent, this will be the result of extra upfront capital expenditure. When complete, TSMC’s fabrication plant (fab) in Arizona is expected to have cost as much as four-to-five times more to build than a fab in Taiwan. It is anticipated, however, that a good proportion of this will be offset by government subsidies and tax credits. This should also prove the case in Japan and Europe, where governments are similarly providing significant subsidies and tax breaks to encourage onshore manufacturing. More onerous are likely to be the higher operating costs incurred by manufacturing outside Taiwan. To understand why, a trip to Hsinchu, Taiwan’s Silicon Valley, is explanatory.

A short bullet train-ride from the capital Taipei, Hsinchu is home to thousands of companies involved at various stages of the technology supply chain, from suppliers of plastics, ceramics and speciality chemicals to passive components such as the resistors, capacitors, printed circuit boards, and advanced cooling systems used in Nvidia’s DGX B200. Hsinchu is also home to a highly specialised workforce that runs into the hundreds of thousands. This clustering of companies and people is incredibly efficient and cost effective. Replicating such an ecosystem elsewhere would take decades.

But there is another operational factor at play in Hsinchu that other countries may struggle to recreate. In Hsinchu, the fabs run all day and all night, manned by an army of people prepared to work long and antisocial hours. In short, the work-life balance of the average semiconductor engineer in Taiwan could best be described as sub-optimal. It is hard to imagine US and European workers embracing such a gruelling work culture. So, on top of structurally higher wages in the US and Europe, TSMC will also likely be dealing with a structurally less productive workforce. Inevitably, this will lead to higher chip prices, at least in the near-to-medium term.

There are similar challenges at the ‘downstream’ stage of the process. Speaking with companies such as Foxconn and Pegatron, both heavily involved in the manufacture of products such as smartphones, consumer electronics and electric vehicles, it was clear that whilst there is real impetus behind the efforts of downstream players to diversify production, they are still heavily reliant on China. In time, the likes of India, Vietnam, Malaysia, Mexico and Indonesia should all prove alternative sources of low-cost manufacturing, but for now, none can match China for scale and productivity.

All of this should disabuse anyone still labouring under the assumption that de-risking is a quick fix. It is wholly unrealistic to think that production can simply be picked up and moved elsewhere easily, or alternative suppliers readily sourced in other locations. This is too specialised a supply chain, and capacity is not interchangeable. The entire process will create friction, generating cost inflation and inefficiencies as manufacturers push against natural market forces. Consumers do not want to pay more for their electronics and companies do not want to sacrifice margins. It is unlikely that both will get their way.

The veneer of de-risking

Nothing in my conversations with companies at all stages of the production process made me think the industry is anything less than fully committed to the process of de-risking. Management teams are acutely aware of the need to adapt to the demands of geopolitical reality and to do so quickly. They may not like it – after all, many are being asked to make their businesses less efficient – but they understand the rules of the game have changed and will not be changing back anytime soon.

On the current trajectory, some 15-20% of leading-edge fabrication is scheduled to happen outside Taiwan and China by 2027. This will enable Nvidia to say that some of its chips are made in the US. Apple will be able to tell its US customers that some of its phones are made in India rather than China. But in truth, this will be akin to a veneer of de-risking; Western companies will still be heavily dependent on Taiwan and China. Even on a ten-year horizon, whilst a more material degree of de-risking is possible with a lot of hard work and plentiful government subsidies, both countries will continue to have a major presence across the supply chain.

Risks without frontiers

This leads us to geopolitical risk and how investors should think about it in the context of technology. To take one very high-profile example, there is a tendency to view the risk of a Chinese invasion of Taiwan through a rather narrow, localised lens, to see a potential conflict as a Taiwan-specific risk.

Certainly, there is no denying that a full-scale war with China would be devastating for TSMC. It is, understandably, something about which the company is regularly grilled. Rarely, however, does Nvidia have to field comparable questions, nor Apple, nor Tesla.

Yet, if Taiwan were to be invaded, these Silicon Valley behemoths would see production go close to zero for multiple years. It would be an economic disaster for countless US tech companies, the global economy and global stocks markets. Some estimates put the cost to the world economy at US$2.5 trillion per year, significantly worse than the impact of the Great Financial Crisis.

In an ecosystem as interconnected as the semiconductor supply chain, risks have scant respect for borders. As such, they should be considered holistically. In recent years, management teams globally have had to reacquaint themselves with the old saying “a chain is only as strong as its weakest link.” Investors would be wise to do the same.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.