Paying staff has always been an administrative challenge. Unfortunately for many employers, it’s a problem that is only getting worse as changing employee expectations and ever more red tape increase the burden still further. Little wonder that companies are increasingly looking externally for a solution to their payroll headache.

Paying staff is complicated. Calculating pay cheques and payroll taxes, distributing payments, paying the relevant authorities and maintaining regulatory compliance are just some of the challenges faced by businesses large and small. Throw in an ever-shifting legal landscape and you have a heavy administrative burden that not only consumes significant resource but also carries considerable risk.

Unfortunately for most employers, the payroll headache is only getting worse. The rise of the ‘gig’ economy, increased use of freelancers, ‘on-demand’ pay, and the globalisation of the workforce are exposing companies to rapidly changing employee expectations and yet more red tape. Navigating this evolving backdrop is no easy task.

Unfortunately for most employers, the payroll headache is only getting worse

Enter the payroll processors – companies providing employers with solutions to simplify their payroll responsibilities, ranging from basic online self-service tools to fully outsourced packages. Improving back-office functionality may not set the pulse racing for some, but it’s a corner of the market that we think continues to enjoy several powerful structural tailwinds.

Most obvious is the role of payroll processors as problem solvers. By alleviating a major headache, these companies add tangible value to a company’s business model, improving efficiency and reducing risk. Small wonder more and more management teams view this as an attractive option in an increasingly complex environment. But despite increasing adoption, this is a trend still in its infancy. Paychex, the US-based payroll firm, estimates that only some 10%-15% of the eight million companies in the geographic areas in which it operates currently use the services of a payroll processor. There is still a huge amount of business to go after.

Importantly, that business tends to be ‘sticky’. Having outsourced payroll, customers are understandably reluctant to incur further costs and technological upheaval by reverting to an in-house operation or switching providers. This creates a high degree of recurring revenue, a highly desirable attribute – predictable revenue streams allow companies to invest for the future with real confidence. Incremental margins are also excellent; adding an extra employee to a payroll system costs the processor very little.

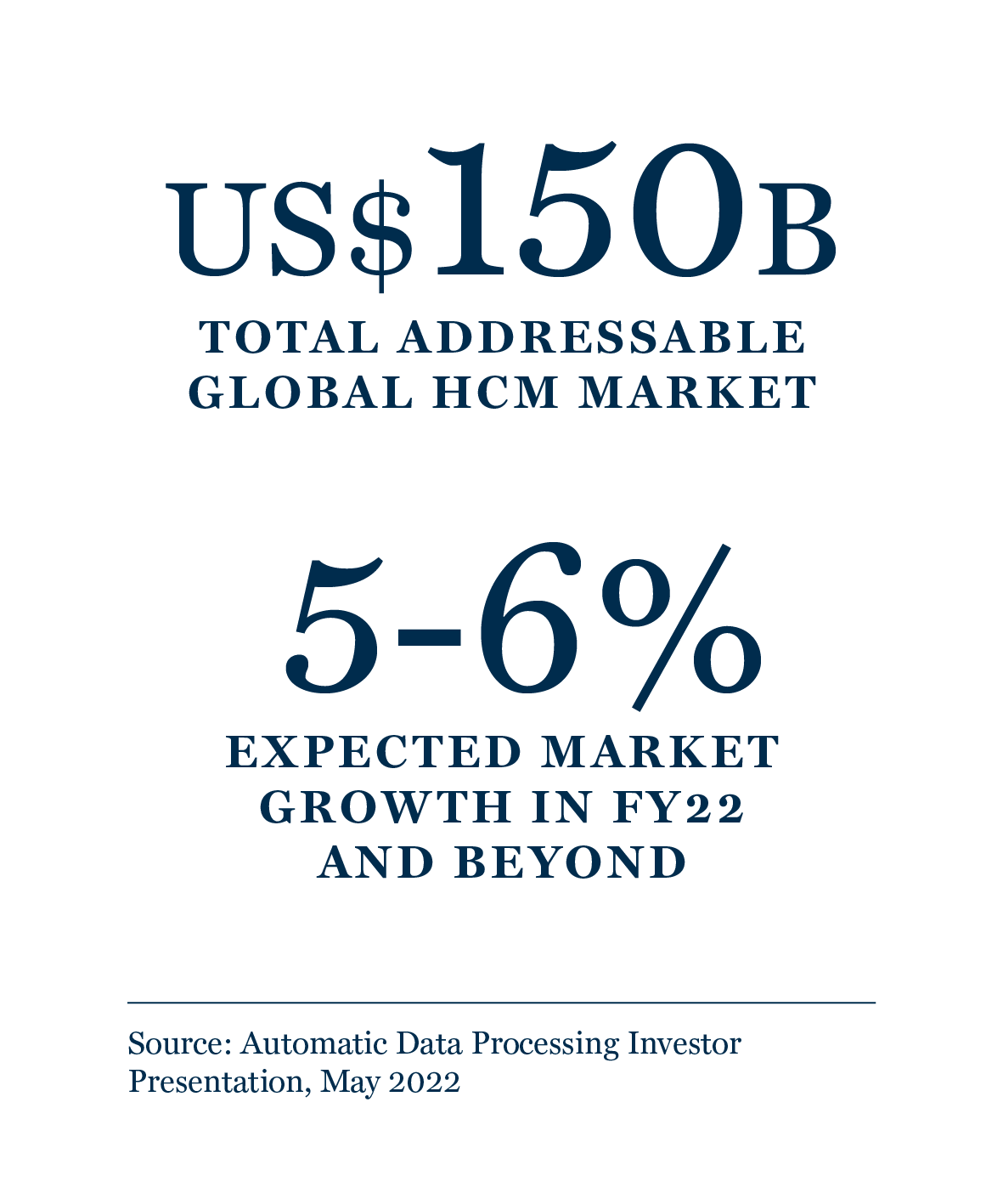

This attractive business model now extends across much more than simply payroll. As employers increasingly explore new ways to simplify their administrative processes and maximise employee productivity and engagement, payroll processors have evolved to offer a range of human capital management (HCM) solutions, from HR services and benefits administration, to time management tools and compliance expertise, embedding them further in the businesses of their customers.

Automatic Data Processing (ADP) is the world’s leading provider of payroll, HCM and business outsourcing solutions, with a brand, financial profile, and distribution reach that put it at a significant advantage to its peers. In the US alone, the company processes the pay of an estimated one in six private sector employees. But while its scale and size are clear strengths, the perception of ADP as something of a ‘legacy’ provider is not. The aggressive expansion of new, supposedly more technologically advanced, market entrants has led some to question ADP’s ability to maintain its market-leading position.

ADP has been leveraging M&A and product development to make inroads into new and under-penetrated areas

Such pessimism ignores the journey ADP has been on since current CEO Carlos Rodriguez took the helm in 2011. Alert to looming changes in the operating landscape, Mr Rodriguez took the decision to transform ADP from a traditional sales-and-services operation to a software-as-a-service business with technology at its heart. Directors with technology expertise were hired, innovation centres established, and large long-term investments funded. These initiatives are now bearing fruit and ADP looks well-placed to capitalise on what it sees as the five key industry trends of the future: the evolution of work, pay, HR, business, and technology.

Reflecting this, ADP has been leveraging M&A and product development to make inroads into new and under-penetrated areas, such as management of freelancers, financial wellness, and pay flexibility. As the owner of the largest global dataset in the industry, there is also the opportunity to lead the drive towards greater adoption of Artificial Intelligence and Machine Learning in HR departments.

Rochester, NY-based Paychex offers a similar suite of products to ADP but is primarily focused on the huge SME market. The average Paychex customer has less than 20 employees and of the eight million companies in the regions in which it operates, more than 99% are estimated to have less than 100 employees. While this remains a highly fragmented market, Paychex has established itself as the dominant player through not only the quality of its products, but also through recommendations from existing customers and certified public accountants.

Paychex’ Flex platform…sets it apart from much of the competition

As with ADP, one area of concern for Paychex is the increasingly competitive landscape of recent years. In truth, this is more perception than reality. While more players have entered the market, few compete head-to-head with Paychex, lacking its SME focus and expertise. Genuine competition sits with those software-as-a-service and account management software operators offering light-touch in-house payroll services.

Paychex’ Flex platform, a full-service integrated suite of HCM solutions widely considered the best software package on the market, sets it apart from much of the competition, however. A one-stop shop for payroll, HR admin, time & attendance, and retirement records is a compelling alternative to a patchwork of in-house and third-party providers. Not only has Flex helped Paychex consistently add customers in recent years, but it’s also helped improve customer loyalty, with retention rates now in the region of 85%.

Differentiated, innovative and cash generative, we believe both Paychex and ADP have the attributes necessary to navigate the fast-evolving payroll and human capital management landscape. The opportunities open to both are not only sizeable but growing. Shifting employee expectations and the seemingly inexorable increase in complexity were already driving employers to seek external solutions in the years prior to Covid-19. But the changes wrought by the pandemic have added still-greater impetus to that trend. Challenges around remote working, higher staff turnover, and the demands of a tight labour market are headaches that companies can do without. Paychex and ADP can provide the remedy.

Our consistently applied research process is framed to identify companies capable of meaningful and profitable long-term growth. That will typically depend on multiple and varied factors but will often rely on fundamental trends and shifts in the way we live our lives or how companies operate. At times, this analysis involves looking beyond the obvious ‘headline’ companies and considering vital processes and parts. With that lens, we often find companies that play a critical role in a particular industry, with competitive positions, technological advantages and strong relationships. They can be global leading but still relatively unknown. Payroll processing is an industry that very much falls into that category.

Stock Examples

The information provided in this video relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.

Important Information

This video is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This video may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.