Key Takeaways

- ASML’s cutting-edge lithography technology is integral to the semiconductors that power the global AI revolution

- The company’s recent investor day revealed that AI-related demand is growing rapidly

- We expect ASML to continue to build on its unique position in the semiconductor supply chain

Last month, I was in the Dutch town of Veldhoven to hear the management team at ASML brief investors on the company’s long-term strategy. The update came at an opportune moment. The previous month, ASML’s third-quarter results had triggered volatility across the semiconductor sector, with its own share price falling 16% in the process.

The catalyst for the sell off was the announcement of a more moderate growth outlook for 2025 and a decline in quarterly orders for ASML’s lithography machines. Understanding why this news should have sparked such widespread volatility requires some context.

No ASML, no AI

Spun out of Dutch electronics giant Philips in the 1980s, ASML is the dominant player in lithography, the process of transferring patterns onto silicon wafers using light. Importantly, the company holds a monopoly position in the most advanced iteration of the technology, extreme ultra-violet (EUV).

Capable of producing incredibly small and complex patterns, EUV allows manufacturers such as TSMC and Intel to compress more transistors on a single semiconductor. Without it, securing the massive computational power demanded by AI chips would be extremely challenging. ASML is one of the few companies that can legitimately claim to be indispensable to the AI revolution.

Reflecting its linchpin status in the global semiconductor supply chain, the company’s fortunes are often viewed as a barometer for the wider industry. They are also increasingly parsed for clues to the health of AI-related demand. October’s news was clearly interpreted by some investors as a worrying indicator for both ASML and for others in the semiconductor ecosystem.

A Question of Time

We took a more sanguine view, seeing little of long-term concern in the results. Quarterly orders, always lumpy at ASML, are a poor gauge of the company’s progress. Furthermore, the downward tweak to the 2025 outlook reflected three factors that were more about timing than any structural decline in demand.

First, Samsung and Intel, both major customers of ASML, have been deferring capex due to the ongoing struggles of their semiconductor foundry businesses. Both are suffering from low production yields and a lack of customer interest in their efforts.

The result is a deferral of capex and a requirement for less leading-edge lithography equipment over the next few quarters. TSMC, ASML’s largest customer, is the obvious beneficiary of this and would ultimately replace demand should Samsung and Intel fail to sort out their challenges.

Second, demand for DRAM and NAND memory has been more sluggish than expected. Reflecting this, some of the main industry players such as Micron, Samsung, and Hynix have deferred spending by a few quarters to manage the slower than expected upturn in demand. All have new fabrication plants under construction, which will require ASML’s technology, so we are confident that this investment will happen. The only question concerns timing.

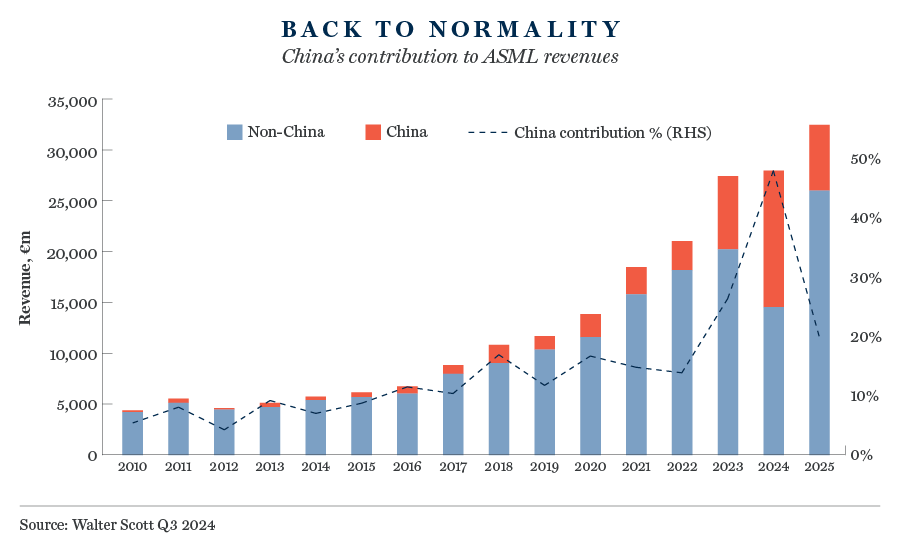

Finally, demand from China is normalising. Having made an outsized contribution this year, the country’s share of overall sales will fall back to a more normal 20% next year. This reversion is simply happening a little earlier than expected.

To 2030 and beyond

If some investors did have questions about ASML’s long-term growth trajectory, November’s investor day should have gone a long way to answering them. Led by new CEO Christophe Fouquet, management outlined a convincing roadmap for growth for the next five years and beyond.

- The Big Picture

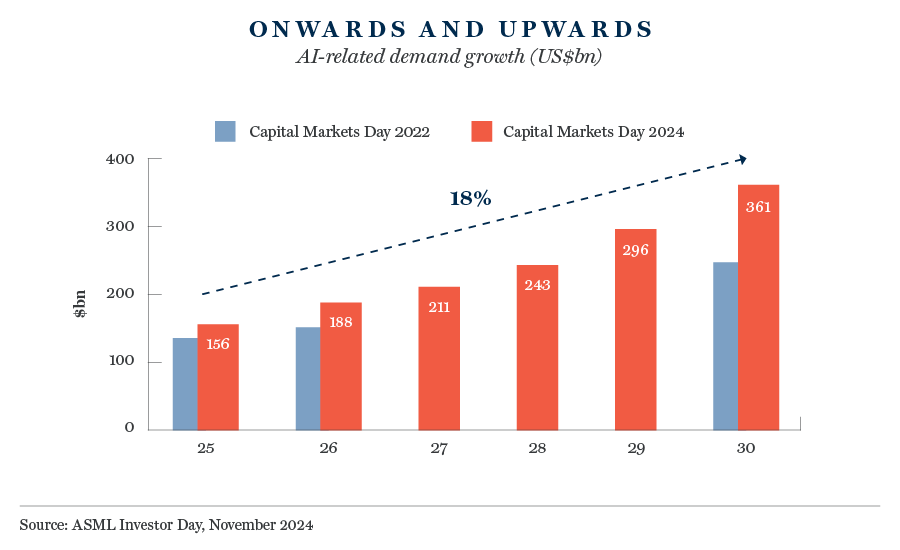

At ASML’s previous investor day in 2022, the company set out expectations for the semiconductor market to be worth over US$1 trillion by 2030, a compound annual growth rate (CAGR) of 9%. Two years later, this is still the company’s base case. Growth expectations remain on track. What has changed, however, are the drivers of that growth.

- AI to the Fore

The big change to ASML’s growth projections is the contribution from AI-related demand. The servers, storage and datacentres segment, which is the main beneficiary of the growth in AI, is now expected to account for ~40% of total 2030 demand, a significant increase from 2022 estimates. Summing up this step-change, Mr. Fouquet quipped “we see our society going from chips everywhere to AI chips everywhere”.

Interestingly, these estimates appear conservative when compared to those recently issued by other industry players AMD and Nvidia. Should their more ambitious forecasts prove correct, that would constitute considerable upside for ASML’s 2030 guidance.

- Mainstream Markets Slowing But Still Growing

Alongside this AI-driven growth, ASML revised down the 2030 growth forecasts for what it calls its ‘mainstream markets’. To a degree this was expected. With the semiconductor industry only just starting to emerge from its worst cyclical downturn since the global financial crisis, demand from end markets such as PCs, smartphones and automotives has been sluggish. These markets will still grow, many at a healthy pace, but their overall contribution will be lower going forward.

- Challenges Bring Opportunities

The transformative potential of AI hardly needs reiterating. By some estimates, it will add between $6 and $13 trillion dollars to global GDP by 2030. If AI is to deliver on this promise, however, Mr. Fouquet stressed that “major, major innovation” is required.

The challenge for the semiconductor industry is how to deliver the highest possible computing power and transistor density at the lowest possible cost and with the lowest possible CO2 emissions. If this is going to happen, semi manufacturers will have to step up investment in ASML’s EUV technology. As a consequence, demand for EUV is expected to comfortably outstrip the 9% growth rate of the wider chip market.

- Perpetual Innovation

From its earliest days in a “leaky shed” next to a Philips’ office in Eindhoven, ASML has been a relentless innovator. Since the commercial release of the first EUV machine in 2018, the company has overseen a quarter-on-quarter improvement in the technology’s productivity and availability (the length of time the machine is in operation). From producing less than 140 wafers per hour in 2018, these workhorses of the semiconductor manufacturing process now churn out more than 220. That figure will increase again to 250 with the release of the NXD:4000F machine in 2027.

Conviction remains high

The roadmap for growth outlined at November’s investor day was further validation of our long-term investment case for ASML. With its mission-critical technology and deep competitive moat, the company should remain both an enabler and a beneficiary of one of the most exciting structural trends in the global economy.

In a play on its vital but niche role in the semiconductor ecosystem, ASML styles itself “the most important tech company you’ve never heard of”. As the business builds on its unique position and as AI launches the next chapter in the industry’s remarkable growth story, there appears little chance of that importance diminishing soon.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.