Solving the Intermittency Conundrum Paul Loudon, Investment Manager

A lack of reliability and a mismatch between supply and demand are barriers to greater use of renewable energy. Could battery storage be the answer to this problem?

Regrettably, the sun does not shine every hour of every day (indeed, it seems rarely to shine at all in Scotland). Nor does the wind blow on a predictable or continuous basis. As such, the two dominant sources of renewable energy suffer from the famous problem of ‘intermittency’. Compounding matters further, energy demand peaks once the sun goes down so there is a clear mismatch between how we humans use energy and the supply of renewable power. How then can we build a reliable and clean energy system if the two main sources of renewable energy are themselves unreliable and fail to correspond neatly with demand?

The answer could lie in battery storage. The unrelenting rise of electric vehicles has driven rapid advancements in battery technology in recent years. The same lithium-ion batteries used to propel electric vehicles ever-increasing distances can also be crammed into a large rectangular box and used as a giant energy-storage system. Not only can these battery-storage solutions mop up excess power from wind and solar farms, relieving strains on the grid during times of bountiful wind and sun, but they can also release that power into the grid when the sun stops shining or the wind stops blowing, solving the intermittency conundrum.

Battery storage – the holy grail?

Reprinted by permission. Copyright © 2021 Bank of America Corporation (“BAC”).

In Practice

Battery storage solutions come in many guises, from the nitty gritty of grid-management applications to simple home-energy storage solutions. Ultimately, however, they all serve the same purpose – helping to match energy supply and demand more effectively.

The most easily deployable and scalable are home-energy storage solutions, also known as ‘behind-the meter’ storage. These involve installing wall-mounted boxes in people’s homes that can store energy from rooftop solar panelling during the day, before releasing it at night when energy usage spikes. The Tesla Powerwall is probably the best-known example and, at under $10,000, it can make economic sense in a sunny area with expensive tariffs.

On a much larger scale, ‘renewables-plus-storage’ solutions − sites that pair renewable-energy generators alongside energy storage − have gained significant traction in recent years. Major developers are increasingly offering a storage solution alongside wind and solar assets, greatly enhancing the overall efficacy of a renewables project. Perhaps the most obvious benefit of this approach is the ability to store excess renewable energy for up to four hours, thereby smoothing the day-to-day supply profile.

While seasonally driven storage disparities mean it is not possible for the grid to move to 100% renewable energy, renewables-plus-storage has the potential to turn renewables into a quasi-baseload solution (the minimum amount of electric power required by the grid at any given time). In turn, this will be instrumental in driving renewables penetration higher.

Equally as important, if somewhat more esoteric, is the role battery storage can play in facilitating grid services. A grid is about more than simply the generation and transmission of electrons. To be effective, innumerable functions need to happen behind the scenes. Frequency regulation, spinning reserve, voltage support, load balancing and system peak shaving are all essential functions that battery storage is well suited to perform.

Storage is also likely to form an integral part of industrial power procurement as more commercial and industrial premises move to a self-generation plus battery storage model. Shopping malls, warehouses and large office blocks are just some examples of where companies could look to employ the technology to burnish their green credentials.

The Economics of Battery Storage

Clearly, there are many uses for battery storage, but how do the economics stack up? In truth, this varies widely and depends on how the technology is deployed and the location of the installation. Installing storage makes more sense in sunnier climes with high power tariffs, plentiful labour and ample space.

The key determinant of storage system costs, however, is the price of lithium-ion batteries. Here, progress in recent years has been hugely encouraging, with a dramatic reduction in costs helping to lower the overall cost of battery storage.

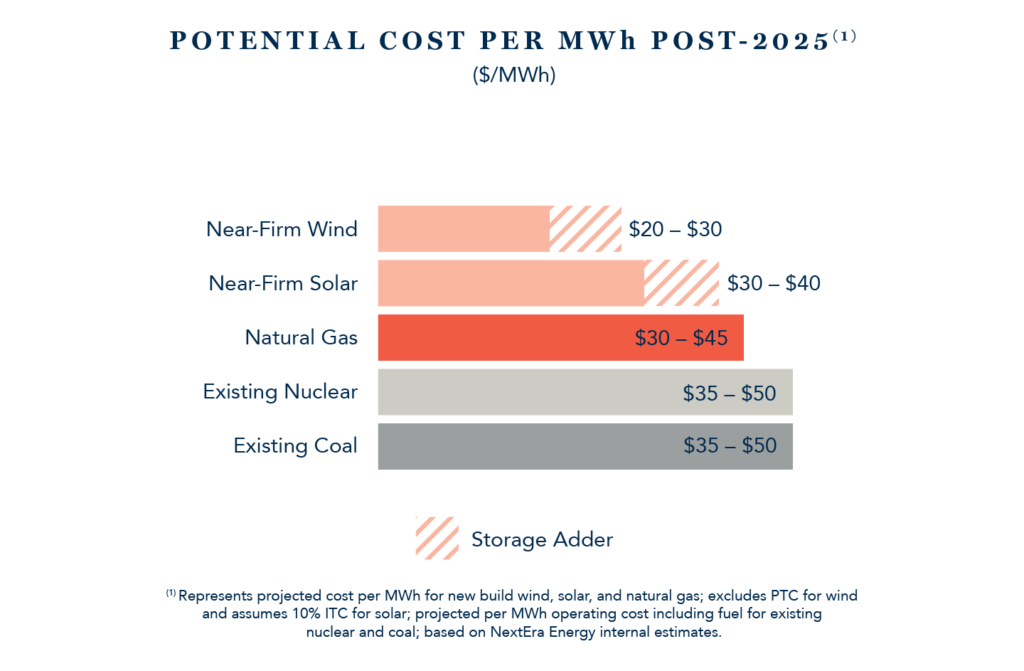

According to NextEra Energy, one of the world’s leading renewable energy companies, costs have come down so much that new wind and solar projects supplemented with a battery-storage solution can be lower cost than the fossil-fuel alternatives.

NextEra Energy

Based in Juno Beach, Florida, NextEra Energy comprises two businesses: Florida Power & Light and NextEra Energy Resources. While the former is Florida’s leading electrical utility, delivering inexpensive and reliable clean power to some five million homes, the latter is the world’s leading renewable energy producer, boasting an extensive portfolio of wind and solar assets, alongside nuclear and natural gas generation, spread across 30 US states, Canada and Spain. NextEra Energy Resources also has an exciting battery-storage business that can combine with renewables projects to help meet customer needs for a reliable, non-intermittent generation source. As the world leader in wind and solar production, NextEra is in pole position to capitalise on the inexorable rise of renewables in the North American energy mix

An investment opportunity?

While it is clear that battery storage has an important role to play in greening our economy, one of the obvious questions we are asking as investors is “what are the long-term investment risks and opportunities?” Certainly, the growth potential of the market is not in doubt. Energy research firm Wood Mackenzie expects the market for energy storage systems to triple from 0.5GW in 2019 to 1.5GW this year, before rising to 7GW by 2025. Investment bank Jefferies meanwhile predicts a 50% compound annual growth rate over the next decade.

Regrettably, identifying pure-play investment opportunities is much more challenging. Battery-storage system developers are predominantly large utility companies with sizable legacy businesses. Storage solutions on their own are not enough to create a compelling long-term investment narrative for most of these companies.

For battery manufacturers, it is important to remember that the growth of the battery-storage market will likely pale in comparison to the expansion of the electric vehicle battery market. While it is inevitable that battery manufacturers will look to tap into this market, it is a highly competitive space and margins are thin.

In the oil & gas sector, meanwhile, the large supermajors will be watching developments closely. As battery costs decline further, the shift to renewables will accelerate as their commercial viability increases. We expect those companies looking to play a part in this transition to reinvest excess cash flow from legacy assets into their low-carbon portfolios.

Important Information

This article is provided for general information purposes only. The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored. The opinions expressed in this article accurately reflect the views of Walter Scott at this date, and whilst opinions stated are honestly held, no reliance should be placed on them when making investment decisions.