Electric vehicles charging ahead Jamie Zegleman, Investment Manager

The stars are aligning for electric vehicles, but investors will have to be careful in choosing the right companies to take advantage of investment opportunities that the growth in this sector affords.

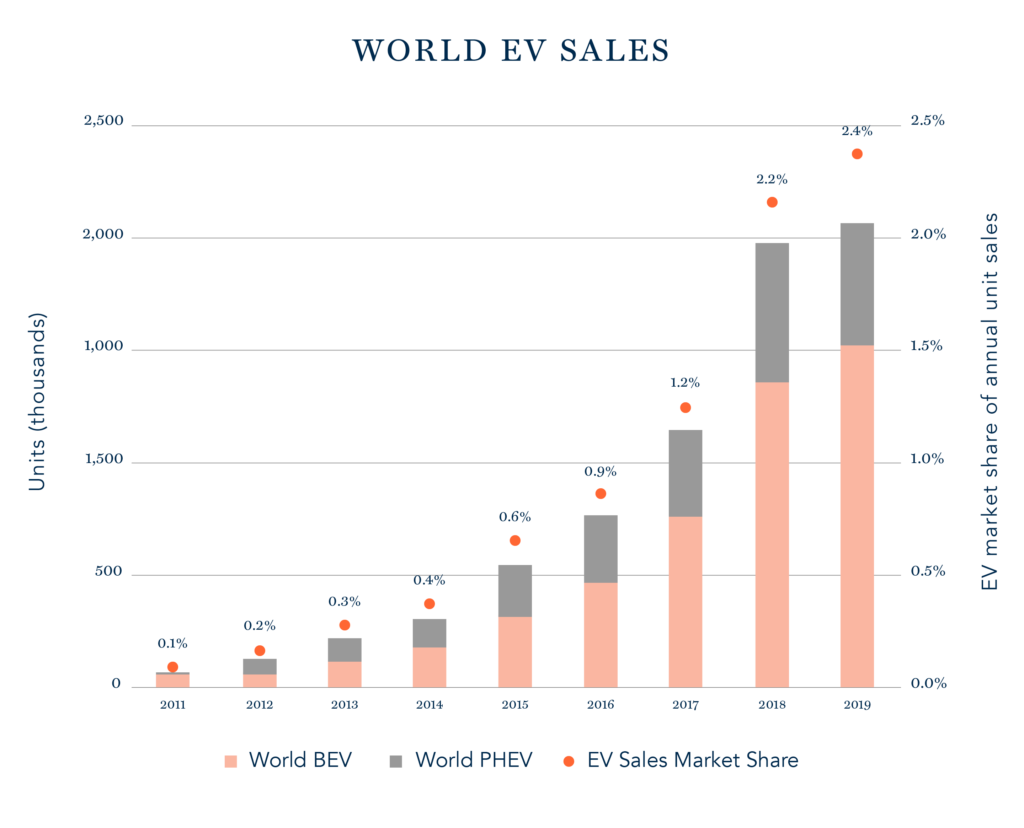

What kind of car will you buy next? Increasingly, the answer seems to be electric. Global unit sales of electric vehicles (EVs) – both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) – have grown at a compound rate of 47% year on year since 2014 and around two million were sold in 20191.

Globally, transportation accounts for around a quarter of direct CO₂ emissions from fuel combustion and road vehicles account for nearly two-thirds of this2. Consequently, the electrification of vehicles has the potential to drive a material reduction in the world’s emissions.

Despite the rapid growth seen in the last decade, however, penetration remains at a nascent stage. Electric vehicles accounted for less than 3% of total light vehicles sold in 2019. For all the excitement, consumer doubts about cost, infrastructure, driving range and even their green credentials remain.

Consumer concerns

“Don’t electric cars cost a lot more?” “Range is poor and where will I charge it?” “Are they really better for the environment?” These common misgivings are either increasingly being addressed, or are already misplaced.

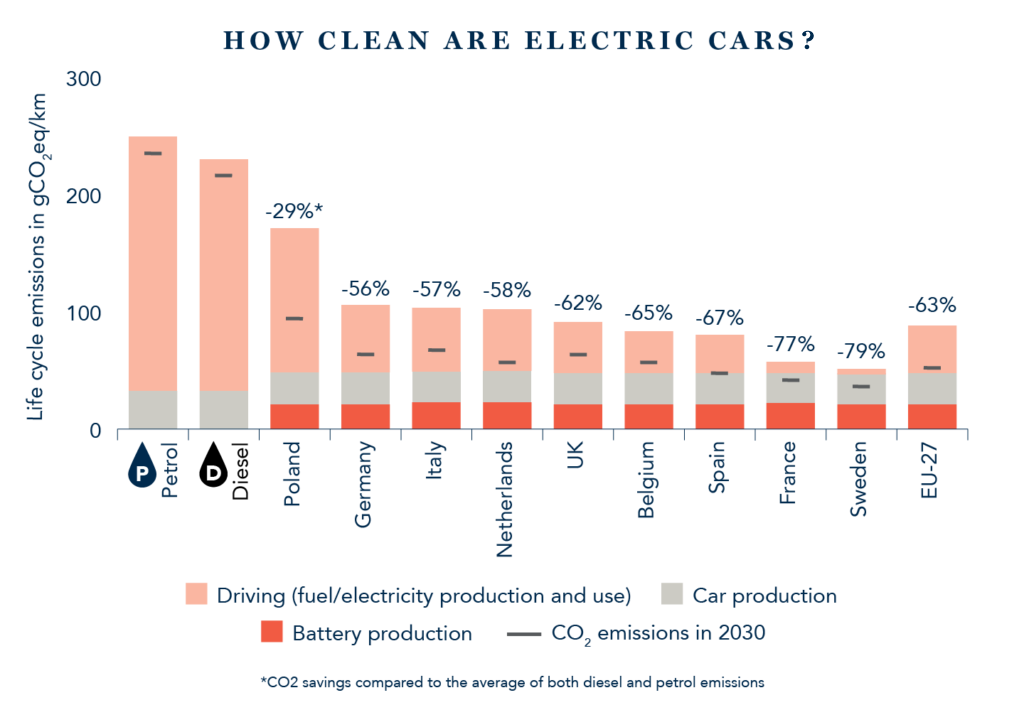

Electric vehicles are certainly not emission free, but life-cycle assessments which focus on total emissions generated over the course of a vehicle’s life generally come out in their favour. Emissions arising from the production process are higher, largely due to the battery manufacturing process, but this is more than offset by the lower levels of fuel emissions during use. Importantly, this advantage will increase over time as renewables become a larger part of the world’s electricity mix, as scale improves production efficiency and as battery recycling systems are developed. The key point is that, taking everything into account, EVs offer significant CO₂ savings over petrol and diesel vehicles.

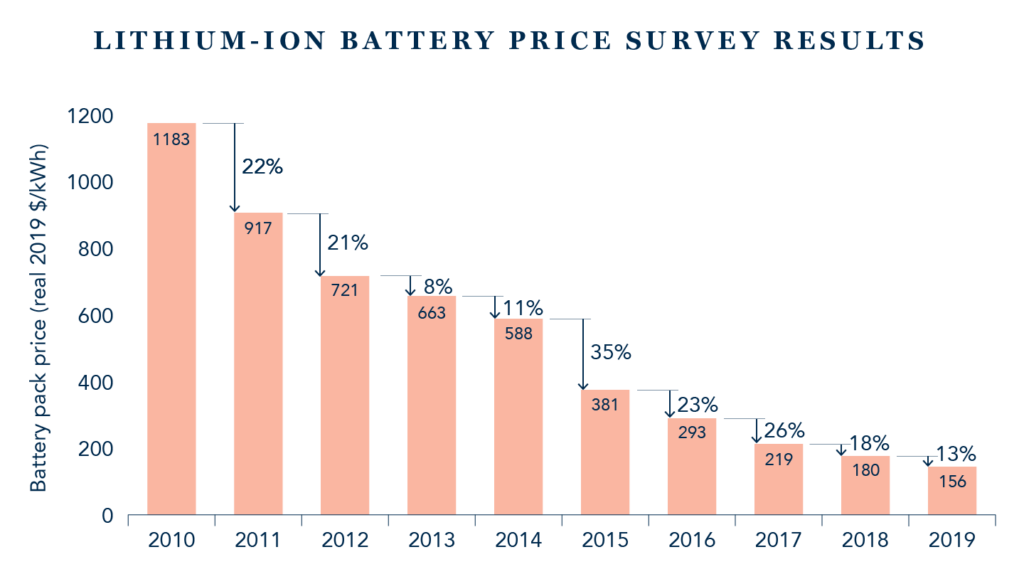

Cost headwinds are also diminishing. The battery accounts for the majority of the upfront-cost differential between an electric and a conventional vehicle, which can be $10,000 or more. However, battery costs have come down dramatically in the last decade (see graph below) and powertrain-cost parity with conventional internal-combustion engines is now expected in only a matter of years, with further improvement likely beyond that. Even including the higher upfront prices though, there is good evidence that the total cost of ownership of an electric vehicle has already reached parity. The running costs of an electric vehicle are materially lower due to far lower fuel costs. Factor in lower expected maintenance costs (due to less moving internal parts), purchase subsidies and the increased prevalence of vehicle leasing, and electric vehicles often already make a compelling case.

Battery-efficiency improvements have not just improved cost, but also range. Put simply, the cheaper and smaller a battery cell (whilst maintaining energy capacity), the more can be packed into a vehicle. Meanwhile, gas-station operators such as Alimentation Couche-Tard, oil majors like Total and auto OEMs like Tesla are investing more than ever in charging infrastructure, increasing the availability and speed of chargers. This is particularly important for mass adoption, as not all consumers have the access to at-home-charging enjoyed by the early EV converts.

An electric future

Progress on key consumer concerns is such that electric-vehicle demand is on the cusp of very significant growth. Many governments have thrown their weight behind the electric revolution, via stringent emission standards. Many aim to ban the sale of new combustion-engine vehicles within the next few decades. Spurred on by the success of Tesla and pushed by emission regulation, traditional manufacturers are upping their game. By 2022, there will be over 500 different EV models available globally3, significantly increasing consumer choice.

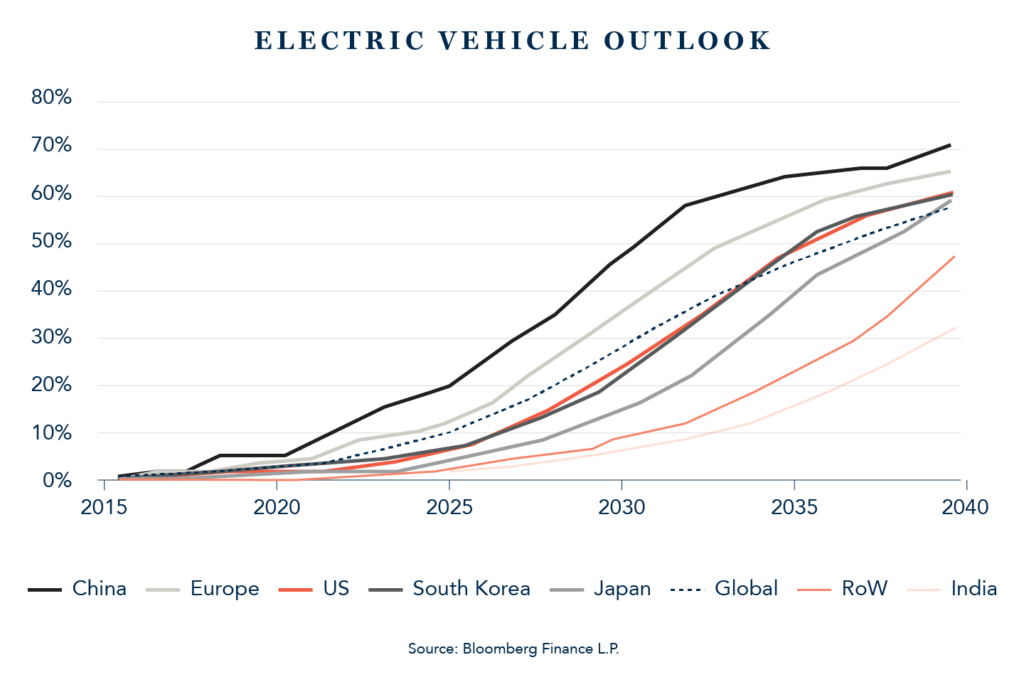

Predictions on the rate of adoption are many and varied but there is gathering consensus that the coming decades will see rapid growth of electric-vehicle usage. Bloomberg New Energy Finance estimates there will be 116 million electric vehicles on our roads by 2030 and that, by 2040, around 60% of all new passenger vehicles sold will be electric4. Evidence increasingly suggests this is a perfectly possible, perhaps even probable, scenario.

Investment implications

So far, we have found that companies with the most direct exposure, such as vehicle makers or battery manufacturers, are yet to meet our investment requirements. Some traditional vehicle producers will successfully manage the transition, but the path is fraught with risk − given the significant changes to the manufacturing process required in a sector characterised by high levels of capital intensity, weak balance sheets, and fierce competition. Battery manufacturers face the prospect of fantastic demand growth but high valuations, lacklustre profits, and again, intense competition, make investment today challenging. Amongst the new entrants, only Tesla has successfully developed a genuinely robust brand. However, while it has enjoyed an almost evangelical following, it has only recently achieved profitability and will need to continue to redefine the industry in the face of increased competition from incumbents going forward.

A variety of interesting opportunities lie within the supply chain. Electric vehicles will require new production lines with different workflows. Automation companies such as Cognex, Keyence, Fanuc and SMC stand to benefit as the vehicle industry invests. Such equipment is also used heavily in the battery-production process. Electrification is also furthering the rise of electronic-component content within vehicles. Today, electric vehicles contain more than double the semiconductor content of traditional vehicles, which is great news for the analogue semiconductor businesses like Infineon and Texas Instruments, and connector businesses such as Amphenol and TE Connectivity. Electrification is also ushering in a new breed of car – redefining the car ‘experience’, where autonomous driving functions and greater connectivity potentially open up new avenues of growth within the sector and those who supply the software that enables it.

Mass adoption will have far-reaching implications for governments, corporates and investors alike. But, overall, the future for electric vehicles looks bright, which is good news for emission levels in the future, and provides plenty of investment opportunities to further explore.

Important Information

This article is provided for general information purposes only. The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored. The opinions expressed in this article accurately reflect the views of Walter Scott at this date, and whilst opinions stated are honestly held, no reliance should be placed on them when making investment decisions.