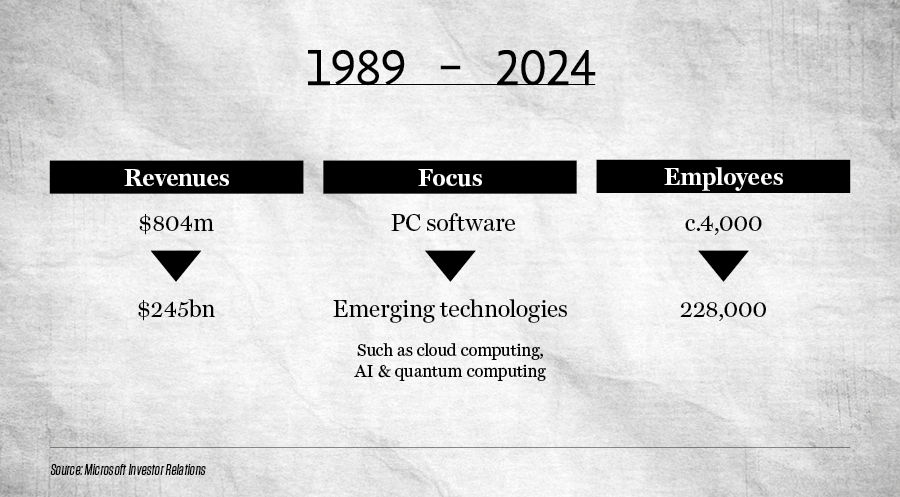

Our archives of company research and investment opinion are both valued and regularly accessed. These records help us learn important lessons. They remind us of innovation and disruption over time and underline the enduring traits that define world leading companies. In 1989 we noted that Microsoft was well positioned to exploit trends. The company’s marketplace has changed dramatically but that statement remains as true today as it was then. Thanks to its success, scale, financial firepower, culture and people, its leadership has endured.

MICROSOFT

March 1989

Market Capitalisation $2,599 million

BUSINESS AND PROSPECTS:

Microsoft develops, markets and supports wide range of microcomputer software, including operating systems, languages and application programs, as well as books and hardware for business and professional use. Three proprietary operating systems for microcomputers are marketed: MS-DOS, designed for the IBM PC in 1981 and now used on more than 300 other computers; MS-OS/2, designed to run on the new generation of computers based on the Intel 80286 and 80386 computer chips; and XENIX, a UNIX based multiuser operating system. Microsoft’s “windows products” provide an environment that allows users to run several programs at the same time and supplies a foundation for the new generation of graphics based applications. Application software is offered for both the MS-DOS and Apple MacIntosh environments.

INVESTMENT RATIONALE/OUTLOOK:

The long term case for the industry is very promising; with an installed base in excess of 20 million MS-DOS/PC-DOS microcomputers. With the introduction of the OS/2 operating system, the market is set for a new generation of application software designed for multitasking and expanded memory. In sum, Microsoft is well positioned to exploit the trends fuelling overall growth in the microcomputer industry. The company has a wealth of opportunities that could enhance its dominant position, as well as several challenges. And while some incursions are likely to be made by competing products, Microsoft should continue to lead the industry in the years ahead. The prospective multiple of 15X is well supported by future growth in excess of 25%.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.