Key Takeaways

- Despite a run of disappointing performance, the healthcare sector offers diverse and exciting opportunities for investors

- Powerful long-term trends are unlocking new sources of earnings and profitability

- These multi-year tailwinds will prove more consequential for the long-term investor than nearer-term challenges

It has been a disappointing past 12 months for investors in healthcare. Returns from the sector have trailed far behind those of the broader market due to the convergence of several headwinds.

Despite this, we believe that healthcare continues to offer investors exciting and diverse long-term opportunities. Recent weakness has, in our view, only served to make many of these opportunities more compelling.

Before considering the arguments in support of this bullish outlook, we should look at some high-level drivers of recent underperformance.

- Investors have heavily favoured high-growth technology and AI-focused companies.

- Lower post-Covid demand for certain products and services and the related drawdown of pandemic-era inventories.

- Policy uncertainty in the US.

The first two factors we think can be categorised as cyclical and short-term concerns, respectively. The first is simply a fact of investing: sectors and themes move in and out of fashion. The challenges outlined in the second, whilst having caused considerable distortions and upheaval, are gradually working their way through the system as pandemic shocks recede – supply chains and inventories are finding an equilibrium.

Policy uncertainty in the US is more difficult to quantify, being too early to gauge the efficacy of President Trump’s efforts to reduce drug prices. Similarly, in the absence of concrete details on pharmaceutical tariffs, it is difficult to speculate on their long-term impact.

Viewed from a long-term perspective, however, we think these headwinds are more than offset by powerful structural growth trends. These trends present global healthcare companies with significant scope to not only maximise existing revenue opportunities but also to unlock new sources of earnings and profitability.

- Ageing populations are driving demand for healthcare services, particularly chronic disease management and long-term care.

- Innovation and technology are leading to groundbreaking advancements in drugs, devices, diagnostics, treatment and surgery.

- Personalised care is being enabled by genomics, AI and data analytics, leading to increased adoption of precision medicine and more tailored treatments.

- Emerging markets, notably China and India, are spending more on healthcare.

A HIGH-QUALITY OPPORTUNITY SET

Contrary to the common view of the sector as a narrow play on pharmaceuticals and biotechnology, it comprises a diverse group of high-quality companies, spread across sub-industries with distinct growth dynamics.

A good example is Coloplast, a Denmark-based developer of products for people with intimate healthcare needs. Around two-thirds of revenue comes from ostomy and continence care, where Coloplast is the acknowledged global leader. The remaining revenue comes from urology, advanced wound care, and voice & respiratory care.

Coloplast has experienced a difficult 2025 year to date, due to slightly weaker-than-expected results, a full-year guidance downgrade, and the surprise departure of the CEO. Management attributed the guidance downgrade to a product recall and a temporary slowdown in ostomy care.

These short-term headwinds do not undermine our long-term investment rationale for Coloplast, however.

The company operates in structural growth markets, which are beneficiaries of ageing populations and rising standards of healthcare in emerging markets.

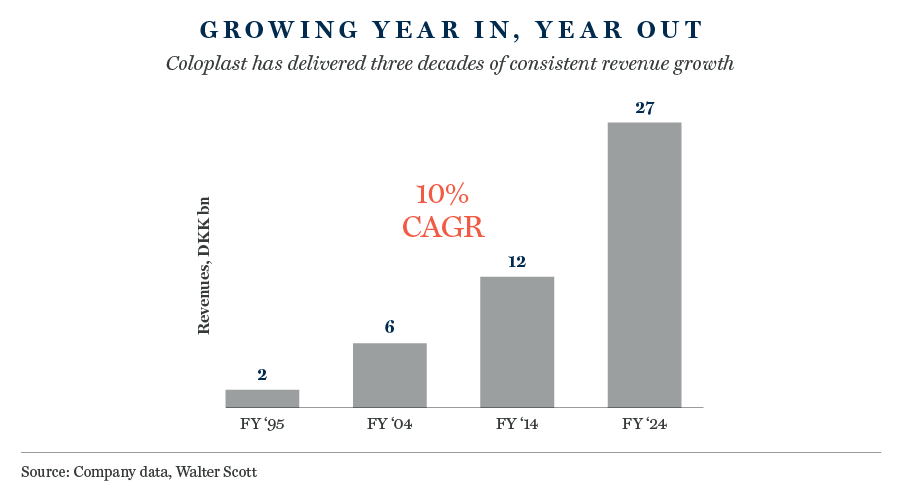

The business has an established track record of delivering robust earnings growth, cash flow generation, and return on invested capital. These strong fundamental characteristics are the result of Coloplast’s ability to grow faster than the markets in which it operates and a laser-focus on operational efficiency.

Growth prospects have been further bolstered through strategic acquisitions in fast growing niches, complementing the steadier growth of ostomy and continence care. Strengthened by these new growth drivers, the outlook for Coloplast remains compelling.

MERCK KGaA – PRIMED FOR GROWTH

Merck KGaA is another company that has experienced sustained share-price pressure in 2025. Although not a pure healthcare business (~20% of revenues come from its electronics division), the company derives around 80% earnings from its life sciences and biopharmaceutical operations.

The former focuses on consumable products, such as research-use chemicals, bioprocessing equipment and testing kits, whilst the latter is prominent in immunology, oncology, and fertility. Both are highly profitable and exposed to long-term growth trends in healthcare.

When we met with Merck recently it was clear that the weak share price is a source of frustration. Management believes the market has been overlooking strong operational performance, focusing instead on tariff risks and cuts to scientific research funding in the US. (The reorientation of supply chains in recent years should insulate much of the business from tariffs).

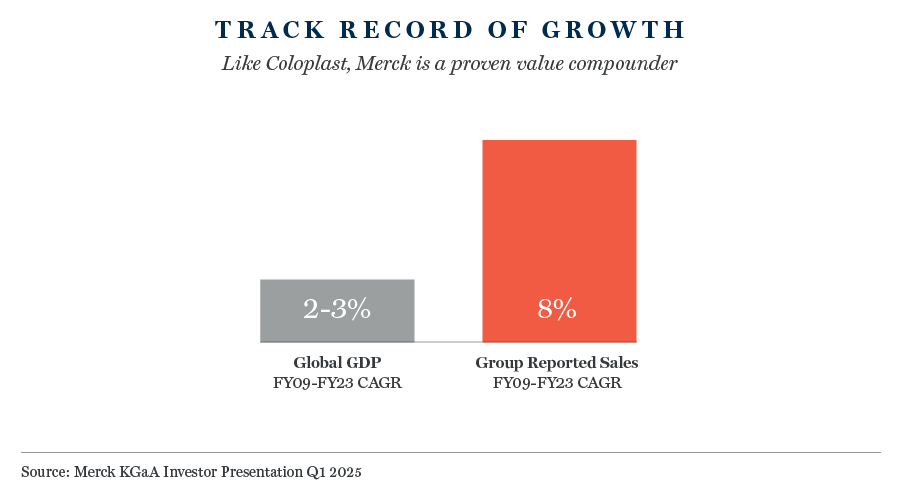

We agree with this assessment. Merck is executing well as it emerges from a transitional period during which it was forced to address supply chain challenges, and it reinvested heavily for future growth. As this cycle draws to a close, the business appears primed for an acceleration in growth.

Further bolstering the outlook is the acquisition of SpringWorks, a US-based leader in rare tumour therapeutics, which adds another growth string to Merck’s bow.

NOVO NORDISK’S ‘ANNUS HORRIBILIS’

One of the most high-profile underperforming healthcare companies over the past 12 months is Novo Nordisk. The Danish drugmaker’s share price has declined sharply due to a series of well-documented challenges, among them supply chain disruption; underwhelming trial results; competitive pressure from lower cost ‘compounders’; market share concerns; and uncertainty around drug pricing. The recent removal of the CEO has further dented investor confidence.

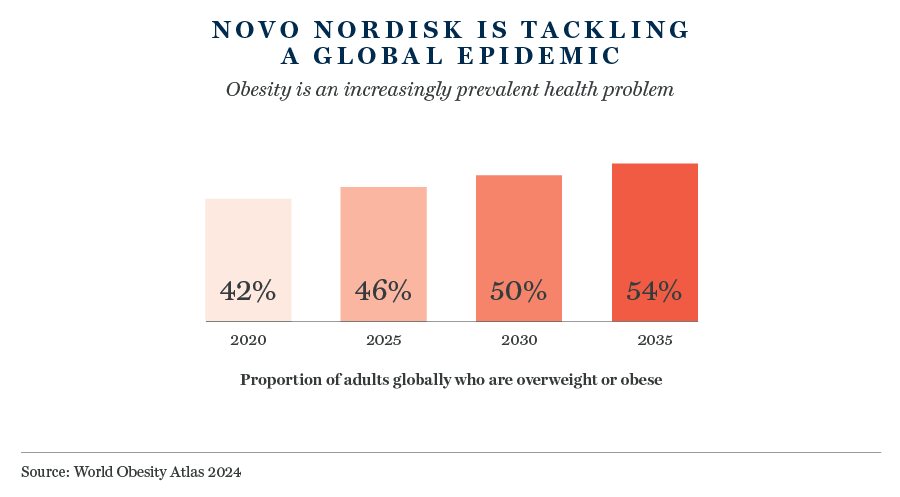

Despite this litany of worries, we think Novo is a company with good long-term growth prospects. Type-2 diabetes and obesity are large, underpenetrated global health problems and Novo is a global leader in the treatment of both conditions.

From a more granular perspective, we think some of its recent challenges are either less onerous than imagined or are short-term in nature. For example, the business has addressed its supply chain constraints, adding significant manufacturing and packaging capacity. The impact of the compounders should also ease now that the grace period for pharmacies to make or sell compounded versions of Novo’s treatments has ended.

Despite this positive assessment, we are conscious that Novo has work to do to dispel concerns about its long-term growth outlook. In the near term, we will be watching three indicators closely:

- US prescription growth, indicating the effectiveness of the marketing push against Eli Lilly and the compounders.

- The 2026 launch of oral semaglutide, the first oral GLP-1 obesity treatment.

- Progress on amycretin, a next-generation obesity and diabetes drug with promising early results that suggest it could be more effective for weight-loss than both Wegovy and Eli Lilly’s Zepbound.

For now, we think the market is taking a ‘glass half empty’ view of Novo, focusing on near-term challenges and management missteps at the expense of long-term fundamentals. This is a highly profitable business with a strong balance sheet, prominent positions in significant growth markets and an R&D engine with few peers.

STAYING THE COURSE

The past year has tested the resolve of healthcare investors, but we remain confident in the sector’s long-term potential. From demographic shifts and technological innovation to rising demand in emerging markets, the drivers of future growth are both diverse and durable. Over time, these multi-year tailwinds will prove more consequential for the long-term investor than nearer-term challenges.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.