Hydrogen – it’s a gas! Ashley-Jane Kyle, Investment Manager, Dr Gabrielle Walker

Hydrogen has not quite lived up to its potential as a source of ‘green’ energy. New technology, the ‘renewables’ revolution and global government policy changes look set brighten its long-term prospects.

There is an old industry quip that hydrogen is the fuel of the future… and always will be. Over the years, the universe’s most abundant element has been touted as one of the pillars of the green energy revolution, though as yet it has not quite lived up to that billing. However, with the world embracing decarbonisation, and thanks to technological advances, hydrogen is increasingly being seen as a key component in reducing CO₂ emissions.

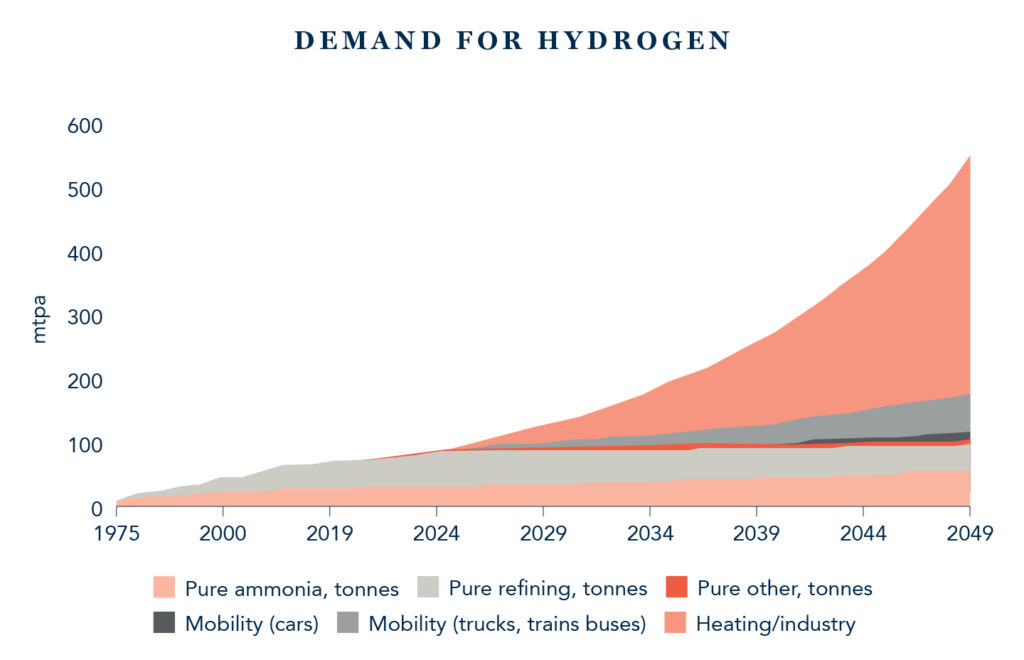

Since the 1970s, demand for hydrogen has predominantly come from oil refining, chemical and steel production industries. However its green credentials stem from the fact that, when turned into energy, it produces heat and water, but no greenhouse gases.

Powering up

The most familiar current application of hydrogen in a green energy context is transportation. Hydrogen-powered vehicles use fuel cells which convert hydrogen and an oxidant directly into electricity without combustion or kinetic motion. They are non-polluting, quieter and up to three times more efficient than gasoline and diesel-powered counterparts. Hydrogen-fuel-cell vehicles are currently the only alternative to gasoline-powered cars that can provide the same range and refuelling time of a conventional automobile. Indeed, we’ve seen some lofty expectations for market growth. The industry is targeting fuel-cell passenger vehicle numbers to reach 400 million (a 25% penetration rate) by 20501. Questions of cost, supporting infrastructure and consumer acceptance remain the principle and significant hurdles to wider adoption. Progress is being made in heavy-duty automotive applications such as trucks, trains and even ships, although this is at an early stage of development. Shipping is an important contributor to climate change as it is responsible for approximately 2.5% of global energy-related CO₂ emissions.

Solar and wind power represent the keystones of renewable energy policy. The trouble is that they are inevitably variable in the delivery of energy. Hydrogen, through water-electrolysis technology, is one of the few ways to store that energy, along with batteries. But, according to estimates, hydrogen used in heating (domestic and industrial) and industrial applications are likely to be the areas with the biggest opportunity, as indicated by the chart below showing forecast demand for hydrogen into 2049.

According to International Energy Agency data, globally, buildings account for 30% of final energy usage with 75% of that being used for heating, hot water and cooking2. Nearly half of energy used for buildings in 2017 was produced directly from fossil fuels, with natural gas accounting for 30%3. This would seem to represent a good opportunity for hydrogen to facilitate a lower-carbon footprint. In an industrial context, hydrogen is used in the oil industry to remove impurities and upgrade heavier crude, and this represents one-third of the total global demand for hydrogen. It is also central to the production of ammonia and methanol, both of which currently account for the second and third largest sources of hydrogen demand. Embedded in the expectation for growth in industrial usage is the hope that the provision of green hydrogen could aid in the cleaning up of these industries from a CO₂ perspective.

A green dream

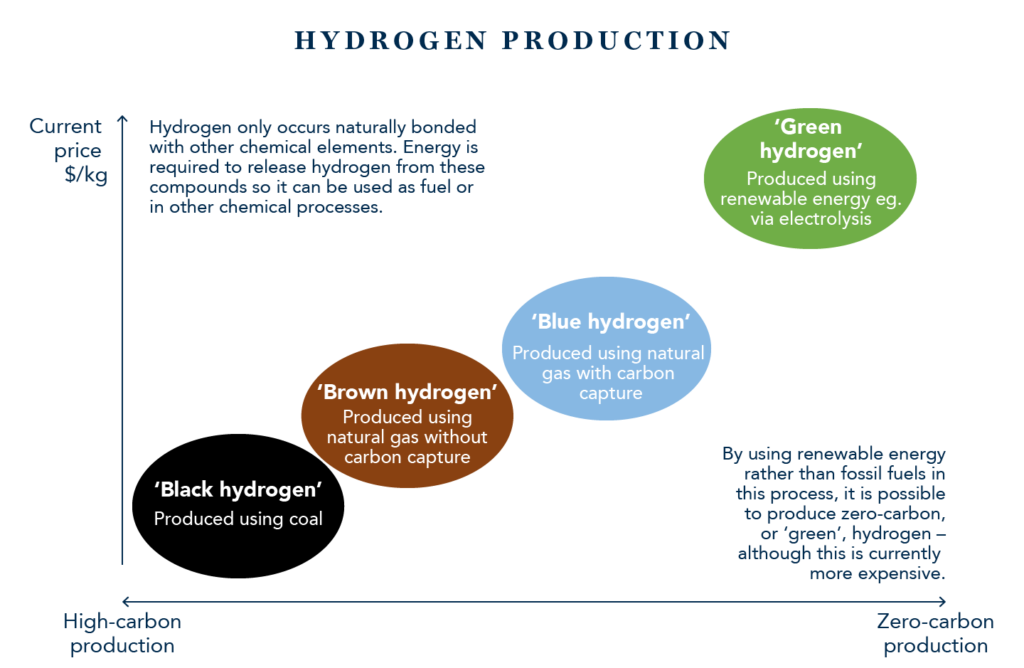

While all this sounds encouraging, there are issues. For all the talk of the ‘hydrogen economy’, the element’s green credentials are currently tainted by the way it’s made. Just under half of it is produced via a process which employs natural gas, while a similar amount is made through gasification which requires oil or coal. Both entail carbon capture costs. The Holy Grail of truly green hydrogen requires the application of renewable energy in the process of electrolysis. Electrolysis in general comprises a very small part of hydrogen production at present.

HYDROGEN PRODUCTION BASED ON INPUT ENERGY

Source: Bloomberg Finance L.P.

Hydrogen from renewable energy currently costs two to three times more than that produced from natural gas. The reality is that hydrogen will never be cheaper than the energy form used to make it, as it will always require energy to rip apart the bonds that hold the compound together in nature.

Notwithstanding this, the long-term picture for hydrogen is promising. Many factors support the use of hydrogen such as strict greenhouse-gas-emissions regulations, urban air-quality measures and better technology. The extent of hydrogen adoption and green hydrogen in particular, depends on the decline in the cost of input energy sources, i.e. cheaper renewable electricity – and that is getting cheaper and more available. Hydrogen production has to be scaled up. The Hydrogen Council estimates that, globally, $70bn needs to be spent over the next ten years for hydrogen to become a competitive energy source4, and many countries and companies now have “hydrogen roadmaps”. The industry is being given a crucial policy shove by governments. There are already 18 countries that have hydrogen in their energy transition policies; these nations represent almost 70% of world GDP5.

The Covid-19 pandemic has seen governments and society take a harder look at climate change and, correspondingly, there has been an increase in the number of announcements regarding hydrogen projects and partnerships. The European Union’s Green Deal sees hydrogen taking the stage as a significant component in achieving the avowed aim of carbon neutrality by 2050. Industry body Hydrogen Europe envisages that under its “ambitious” scenario, which assumes a scaling-up of production powered by government policy vigour and industry investment and innovation, hydrogen could provide up to 24% of total energy demand in 2050, compared to the paltry level of 2% in 20156.

Corporate opportunities

A number of companies are in prime position for a more hydrogen-based future. Industrial gas businesses, such as Linde, Air Liquide and Air Products, are well placed to take advantage of a hydrogen economy and are also leading the way with their investments into technology and infrastructure to assist in scale adoption. Air Liquide and Linde have extensive pipelines, a comprehensive hydrogen-refuelling network and electrolysers in operation. In October 2019, Linde made a strategic investment in ITM Power, a £2.4bn (as at 9 March 2021) company listed on the UK’s Alternative Investment Market that manufactures integrated hydrogen energy solutions to enhance utilisation of renewable energy.

Air Products’ management is focused on the potential for hydrogen as a transportation fuel and energy source. It is a small part of the business today, but the CEO recently stated that he believes that hydrogen will be the fuel of choice for mobility and will displace electric vehicles, suggesting that there is the potential for hydrogen to account for 70% of revenues by 2035.

Johnson Matthey is developing hydrogen-production technology focused on the more efficient use of natural gas, as well as fuel-cell technologies. Almost a decade ago, Total and five industry partners set up the H2 MOBILITY joint venture in Germany to develop hydrogen mobility with hydrogen-refuelling stations.

With the hydrogen pipedream becoming a reality, albeit over what will be a very long time scale, investment opportunities will come in various forms, either through pure plays where exposure is somewhat limited currently, or through companies that have a small-yet-growing hydrogen-related business. At Walter Scott, we look to the long term, and we’ll be continuing to analyse these opportunities as the hydrogen story unfolds.

- Hydrogen Council, Hydrogen scaling up - A sustainable pathway for the global energy transition

- International Energy Agency, The Future of Hydrogen - Seizing today’s opportunities

- Ibid

- Hydrogen Council, Path to hydrogen competitiveness - A cost perspective

- Ibid

- Fuel Cells And Hydrogen, Hydrogen Roadmap Europe

- text

Important Information

This article is provided for general information purposes only. The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored. The opinions expressed in this article accurately reflect the views of Walter Scott at this date, and whilst opinions stated are honestly held, no reliance should be placed on them when making investment decisions.