In many countries, people are accustomed to a reliable supply of electricity. That consistency is thanks to the electrical grid system, a highly efficient network that connects producers and consumers. While grids have been around for more than a century, the traditional model is having to adapt to new methods of electricity generation and the transition to net zero.

On 4th September 1882, Thomas Edison’s Pearl Street Station began supplying electricity to a few privileged customers in New York City’s financial district. Widely credited as the first commercial power station, Pearl Street heralded a new age – Edison himself said “We will make electric light so cheap that only the rich will be able to burn candles” – although its transformative benefits were limited originally to consumers within half a mile. In time, however, the generation, transmission and distribution of electricity would evolve into vast integrated systems stretching thousands of miles and covering whole countries. These sprawling networks would become known simply as “the grid”.

The Traditional Grid

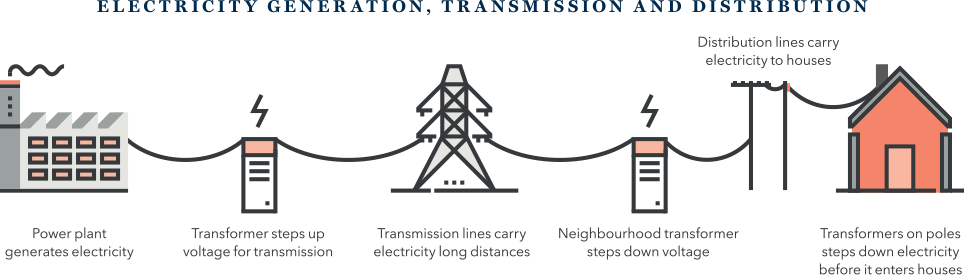

While today’s electrical grids are intricate, highly complex systems with numerous interconnections, they, like their earliest predecessors over a century ago, consist of three main stages – generation, transmission, and distribution.

Today, however, our consumption of electricity is significantly higher than it was when our current grids were established. Urbanisation, technological advances, the proliferation of electronic devices, and the demands of decarbonisation will add even greater impetus to this trend. As we ask our grids to do more, they will need to get ‘smarter’, which will require substantial investment and modernisation.

The Many Challenges Facing Today’s Grid

Alternative Power Sources

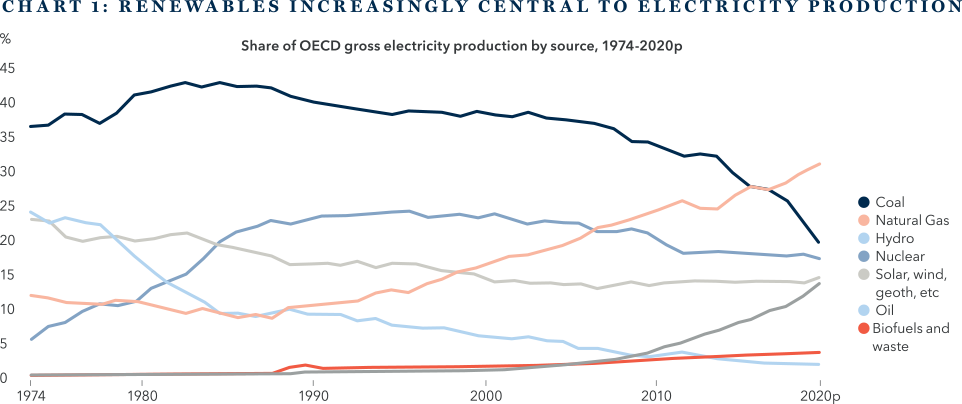

More electricity is now sourced from renewable sources (see chart 1). But whereas natural gas, coal and nuclear have consistent electricity generation profiles, those of solar and wind, the most prevalent renewable sources, are variable. This intermittency poses a challenge, given grids rely on consistency. Grids must retain sufficient capacity to meet peak demand; even a small deficit for short amount of time can result in blackouts.

Decentralisation of energy generation

Every electricity generating asset that contributes to a country’s electricity supply must be connected to the grid. When assets are connected, the voltage must be ‘transformed’ up to match the voltage of the grid. Traditional electricity generation plants have high levels of capacity for power generation in small geographic areas, which means a limited number of transformers are required to step up the power generated.

Renewable generating assets like wind and solar have a much lower power capacity per plant. This results in a requirement for the grid to invest more in connecting these assets. Renewable assets often require a large footprint and are located far from where the electricity will be consumed. This can result in losses in transmission and demands significant investment in transformers to step up the electricity generated.

Inertia

‘Inertia’ is crucially important to the stability of the grid. Many electricity generating assets still adhere to Michael Faraday’s 19th century experiment of spinning magnet inside a coil of wire to create an electric current. For today’s grid, the kinetic energy this produces is stored in the system and is referred to as the ‘system inertia’. This inertia is effectively the shock absorber of the grid, enabling it to react to small changes in power demand. Unfortunately, renewables do not create inertia. Instead, the power generated must be processed by inverters to the level at which it can be fed into the grid. In the UK, National Grid has had instances where it has been required to switch on coal power plants simply to create inertia in the grid.

Electrification of transport

The electrification of transport will generate a huge increase in future electricity consumption. Investment in the grid will be crucial to building the infrastructure required for the transition away from internal combustion engines. National Grid’s ‘Grid Guide to the Decarbonisation of Transport’ provided an example of the change required. The UK has set a target of every motorway service station in England having at least six high-powered open access charge points by 2030. Today, a motorway service station without electric vehicle charging capabilities requires around 1MW of grid capacity. Under the government’s plans, National Grid estimate grid capacity requirement will increase to 18-20MW per service station. An added complication is that service stations, which are typically between cities, are located at areas of minimal grid coverage. This goal will require a huge amount of investment into high power lines to get provide service stations with the required power.

To meet these challenges, the traditional grid is evolving, using new technologies to change the way providers and customers interact, and to support the integration of renewable resources.

Welcome to the ‘Smart Grid’

“A smart grid is an electricity network that uses digital and other advanced technologies to monitor and manage the transport of electricity from all generation sources to meet the varying electricity demands of end users.” International Energy Agency

The beginning of the smart grid – smart meters

In our pre-internet age, traditional electricity meters, manually read, were limited in what they could monitor and report. As technology developed, this changed. Today, traditional meters are giving way to smart meters, the most common enabler of the smart grid. Smart meters give providers the ability to bill customers not only on how much electricity they use but also when they use it. For electricity users, they provide greater oversight of usage and pricing, allowing them to consciously limit how much they consume. Consumption can be automatically adjusted to reflect pricing, with appliances used and vehicles charged at times when electricity prices are low – usually overnight.

Smart meters brought about an interesting shift in the grid. Previously, when electrical demand was high, grid operators brought more power generating assets online. These assets predominantly used fossil fuels, which can be quickly turned on or off, unlike renewable assets. Now, with a more informed consumer and superior technology, the demand curve for electricity can shift as well as the supply curve.

In 2015, the UK’s Department of Energy & Climate Change conducted research on the benefits of domestic consumers installing smart meters. The findings demonstrated that smart meters delivered an average annual reduction in electricity consumption of 2.3% when compared to traditional meters.1

The next phase of the smart grid

As electricity grids around the world experience more variance in generation and demand, the ability to control grids efficiently will be crucial if society is to fully benefit from the renewables transition. The next phase in this process is the automation of grid loads and consumption.

A key enabler of load management is Advanced Distribution Management Systems (ADMS) software, which can be thought of as a digital twin of the electrical distribution grid. As the complexity of the grid increases and the volume of data rises, grid management must be both effective and cognisant of the decarbonisation agenda. As well as providing an overview of the system, leading ADMS can anticipate electricity demand and generation through historical precedent and weather patterns to ensure that not only is supply reliable but that it comes from the most efficient sources.

Software packages like ADMS will play an important role in the future of the grid but they must also be able to communicate with grid infrastructure in what was traditionally a ‘dumb’ system. This will require Smart Transformers. A crucial part of the grid, transformers act to scale voltages up or down to the level appropriate for usage. The next generation of ‘Smart Transformers’ can communicate with grid management systems. Improving grid intelligence brings efficiency improvements and reduces pollution through precise load management. It also means that predictive maintenance can be carried out, reducing black outs and overall costs.

Investment Conclusions

According to the International Energy Agency, investment in electricity grids needs to average around US$600 billion annually through to 2030 to get on track with the Net Zero Emissions by 2050 Scenario. This is approximately double current investment levels.2

Does this huge level of required investment represent an opportunity for long-term investors? Based on our extensive research and our investment criteria, the answer is no, or at least not currently.

- Throughout this project we spoke with several players in the smart meter industry. While the opportunity in Europe is limited due to high levels of penetration, there are more interesting possibilities in North America where the market is closed to Chinese and Russian competition and the requirement to modernise the grid is greater. However, while there is certainly some growth potential in smart meter adoption and the additional services provided, supply chain issues in the short term and concerns around product commoditisation in the longer term lessen the attraction.

- Certain Chinese companies exhibit many of the characteristics we look for in an investment candidate. However, many of these companies generate a large portion of their revenues from The State Grid Corporation of China. The reliance on a Chinese state-owned enterprise as a customer and the political risk of investing in companies that generate profit from crucial Chinese infrastructure weakens the investment case.

- Solutions such as ADMS and smart transformers are typically supplied by industrial conglomerates – Siemens, ABB, Schneider – where they represent only a small segment of revenues.

- Many companies currently benefit from an ‘ESG premium’ and are too richly valued, or their market capitalisation is too low for them to be considered for our clients’ portfolios.

While our research and analysis has not yet identified suitable investment candidates in the smart grid space, that does not mean opportunities will not arise over time. Our work on smart grids and indeed the wider energy transition is ongoing.

Sources:

1https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/407542/2_ELP_Domestic_Energy_Consumption_Analysis_Report.pdf

2https://www.iea.org/reports/smart-grids

Stock Examples

The information provided in this video relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.

Important Information

This video is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This video may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.