The future of oil and gas investing – the million-barrel question Alan Lander, Head of Research

Despite many high-profile speeches and campaigns, and plenty of headline-grabbing data, how much has actually changed within the oil and gas sector? Have we now reached a watershed moment? We think so. Business as usual for oil and gas companies is unsustainable. If change is unavoidable, what is the role of an oil and gas company today, and are these companies still an investable proposition for a long-term, responsible, investor? As ever, the answer is not binary. A number of oil and gas companies around the world could certainly play a critical role in the path to compliance with the Paris agreement. Some will stick to their current business models, others will begin to transition, but success will only rest with a select few.

- Oil and gas remains an important component of the global energy mix even in aggressive transition scenarios.

- A clear distinction must be made between system-wide emissions and the impact of individual company emissions within that system.

- Contributing to the Paris goals as a pure-play oil and gas company is possible but increasingly difficult.

- Oil and gas majors can play an important role in energy transition.

Oil is integral to everyday life around the world. There is a huge installed base of productive assets fuelled by oil. Cars, trucks, aviation, rail, shipping and petrochemicals among many other industries depend on oil. Cheap and reliable energy, like that provided by oil and gas, also remains critical in lifting the world’s poorest people out of poverty.

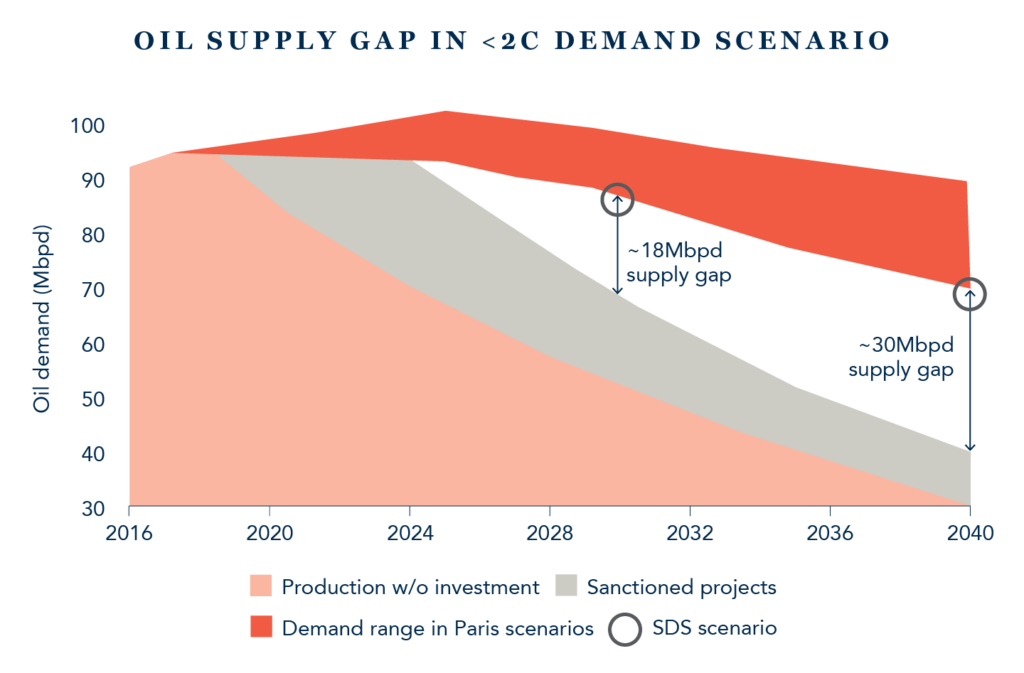

For all the talk of peak oil, demand growth has been unerring, at least pre-Covid 19. Even if we take a very progressive view of future global emissions, such as that painted by the IEA’s Sustainable Development Scenario1, demand for oil will decline at less than 2% per annum over the next 20 years2. Given the decline rates inherent in existing sources of supply will likely be in excess of that figure, new sources of oil will need to be developed alongside alternative fuels.

Oil demand will peak in the coming years, if it has not already, but the transition away from oil will be gradual, even in a relatively aggressive scenario consistent with the Paris agreement. New sources of oil supply will still be required to meet global demand.

Not all oil is created equal

It is important to recognise that not all oil is equal. As the world thinks about developing incremental oil supply, the focus needs to extend beyond which is the lowest cost barrel, to which is the both the lowest cost and lowest carbon barrel. The direct emissions of producing oil vary enormously. We believe judgements need to be made on that basis, recognition that may become essential in time with the advent of carbon taxes.

Emissions are generated at every stage in the production of oil, beginning long before the oil is combusted.

Oil and gas companies as part of the solution

Given the need to meet future demands, we do believe that, in certain circumstances, select oil and gas companies can legitimately be part of a global system targeting declining emissions. To be part of the solution, however, those companies must have low-cost, low-carbon-intensive assets. Through growth over time, companies with that approach can gain share of the oil supply, and thereby displace more carbon-intensive assets. In our opinion, that has to be viewed as a benefit to the system as a whole.

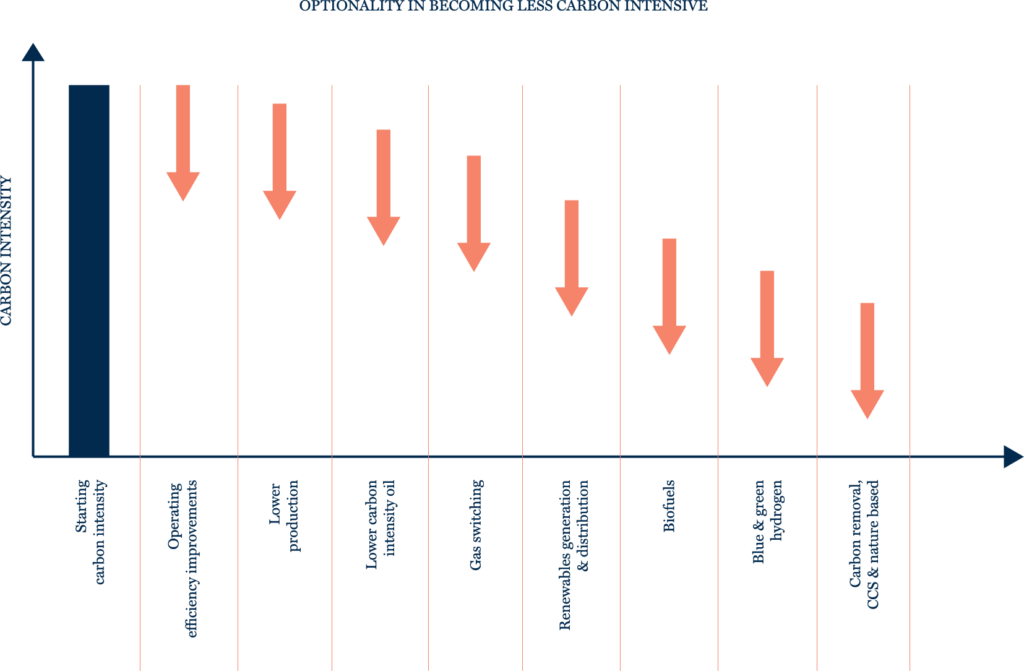

Careful analysis and selectivity is required. By virtue of their size and diversified asset base, many oil and gas majors will be unable to meet the conditions required for more sustainable production growth over the medium term. These businesses will either decline or transition. Only companies that follow that latter path will meet the criteria to merit consideration as a long-term investment candidate. Not all companies will have the depth of commitment, or deep financial pockets, to transition. As the world evolves its energy mix away from carbon, huge investment is required. However, viewed positively, the majors currently have access to cheap capital to finance this investment and, in many cases, have transferrable skills and experience as well as the benefit of existing supply chains thanks to legacy businesses. We can therefore have confidence that some, but not all, oil and gas companies will successfully transition to pursue both less carbon-intensive oil and growth in other low-carbon assets.

Demonstrating the challenge: an example of a planned transition strategy

Building a long-term investment case

We believe that, if executed well, a transitioning oil and gas company can be part of the solution that the world needs in terms of emission reduction, and also be a successful long-term investment. Large, cash-generative legacy businesses across the oil and gas sector can be used to fund the huge investment required in new, low-carbon sources of energy. Such investment, combined with a gradual decline of the legacy business in line with demand, has the potential to create a managed transition that is consistent with the goals of the Paris agreement3. Therefore, we believe that it is possible to make an environmentally positive investment case for some select oil and gas companies.

However, at present, the market appears to tar all oil companies with the same brush. Having belatedly recognised the environmental challenges being faced, it has been too easy to jump to a simple, catch-all conclusion. In short, the pervasive market view is that they are all polluting companies in a declining industry that won’t make successful investments. We don’t agree.

The picture is just too complex to make industry-wide judgements. There are too many variables, and the long-term risks and opportunities so broad, that a short-term catch-all conclusion is simply not valid. We believe that certain oil and gas companies will continue to have an important role to play and, in the right circumstances, will contribute to a cleaner system, whilst supporting ongoing economic development.

A bottom-up investment approach is critical. Success will depend on the particular make-up of an oil and gas company’s asset base and the carbon requirements of production. Success will also depend on making the right transition investments in areas with clear competitive moats and good synergies. Even with the necessary financial strength, management commitment and shareholder support, transition is far from straightforward or certain of success.

There is no guarantee that we will find companies with the characteristics we require, but we haven’t stopped looking.

Important Information

This article is provided for general information purposes only. The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored. The opinions expressed in this article accurately reflect the views of Walter Scott at this date, and whilst opinions stated are honestly held, no reliance should be placed on them when making investment decisions.