We believe investors should have exposure to both the US and international equity markets at all times. By complementing US exposure with holdings in leading international companies, investors can upgrade the quality of their portfolio and achieve greater diversification.

Investing internationally provides the freedom to pursue the very best investment opportunities regardless of where they happen to be listed:

- International markets are home to a host of exceptional companies that will help to shape or will benefit from powerful structural growth trends in the global economy.

- The businesses are not narrow plays on their domestic economies. They are typically global multi-nationals deriving a significant portion of their earnings from overseas.

- Many leading international companies have no US analogues. To be solely exposed to the US leaves outstanding investment opportunities on the table.

We believe the key to unlocking the greatest benefits from international investing is a selective investment approach that prioritises high-quality businesses capable of generating, and sustaining, high levels of earnings.

Walter Scott’s deep company research continues to identify long-term growth opportunities across a spectrum of countries and sectors.

Amadeus IT

By 2043, the International Air Transport Association predicts the number of global passenger journeys will have more than doubled to 8.6 billion. How can investors align with this trend? One way is to buy volatile, asset-heavy airlines. Another could be to invest in key enablers of the air travel industry.

Most people probably haven’t heard of Amadeus IT, but the chances are they’ve used its services without even realising it. Its technology brings together airlines, travel providers, platforms and passengers. Market-leading global distribution and passenger service systems facilitate everything from online transactions and reservations to check-in and boarding.

Based on today’s run rate, Madrid-based Amadeus will board nearly half of the 8.6 billion airline journeys in 2043. It boasts more than double the revenues of Sabre, its closest US peer, is considerably more profitable, with superior margins and a far stronger balance sheet.

AIA Group

Ten years ago, half of the global middle class, some 1.5 billion people, was in Asia. Five years later, the figure had risen to 2 billion. By 2030, the number is expected to increase by 75% to 3.5 billion.

One by-product of this rising prosperity is greater demand for insurance and savings products that can protect and enhance wealth. The need for private insurance provision is particularly acute in Asia due to inadequate state-funded retirement incomes and medical and welfare services.

Thanks to a presence in 18 markets across the region, few companies are as well-placed to capture this huge opportunity as AIA Group, the largest listed company on the Hong Kong stock exchange and one of the world’s leading life insurers. No US company can match the scale of its exposure to Asia’s life insurance opportunity.

Atlas Copco

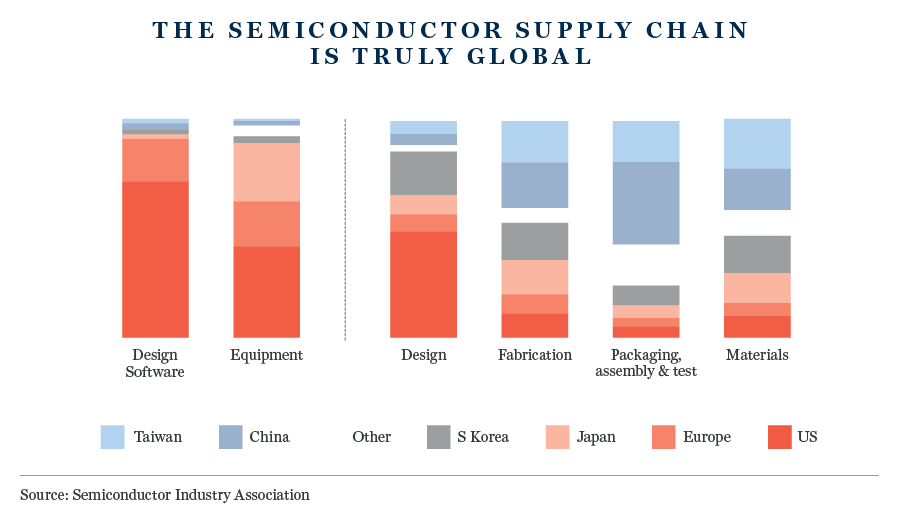

The proliferation of semiconductors is one of the most powerful (and well known) long-term growth trends in the global economy. While the US dominates certain steps of the industry’s supply chain, it has only a limited presence in others. TSMC, for example, manufactures 90% of the most advanced chips.

But the likes of TSMC and the Silicon Valley tech giants couldn’t do what they do without a complex chain of suppliers providing pivotal products and services. Many of these companies are located outside the US (see chart below).

Sweden’s Atlas Copco manufactures and services productivity solutions across a range of industries. It is the dominant producer of vacuum technologies used at multiple stages of the semiconductor manufacturing process.

Vacuums maintain the clean, often particle-free, conditions required for semiconductor fabrication. As chips continue to shrink in size and the manufacturing process increases in complexity, so the number of steps using vacuums also increases, driving ongoing demand.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.