KEY TAKEAWAYS

- Common elements in the air we breathe help power the modern economy

- Producing industrial gases is a complex and capital-intensive business, and leading companies in the sector enjoy strong competitive moats and resilient earnings

- The future looks bright with plenty of opportunities in growing industries and evolving applications such as the hydrogen economy

Given investors’ fascination with all things AI and tech, it’s easy to overlook a couple of unsung heroes that generate impressive profits, year after year, out of thin air.

Linde plc and Air Liquide SA dominate the global market for industrial gases such as oxygen, nitrogen, argon and hydrogen, yet rarely appear in headlines or stir discussion among investors.

There are good reasons for that. “They’re so incredibly reliable and consistent,” says Investment Manager Lindsay Scott – and, yes, a bit boring too, she acknowledges.

However, their humdrum nature is precisely what makes them interesting companies, she says. Despite a distinct lack of glamour, Linde and Air Liquide are essential cogs in the global economy: “If they ceased production, the whole world would know about it.”

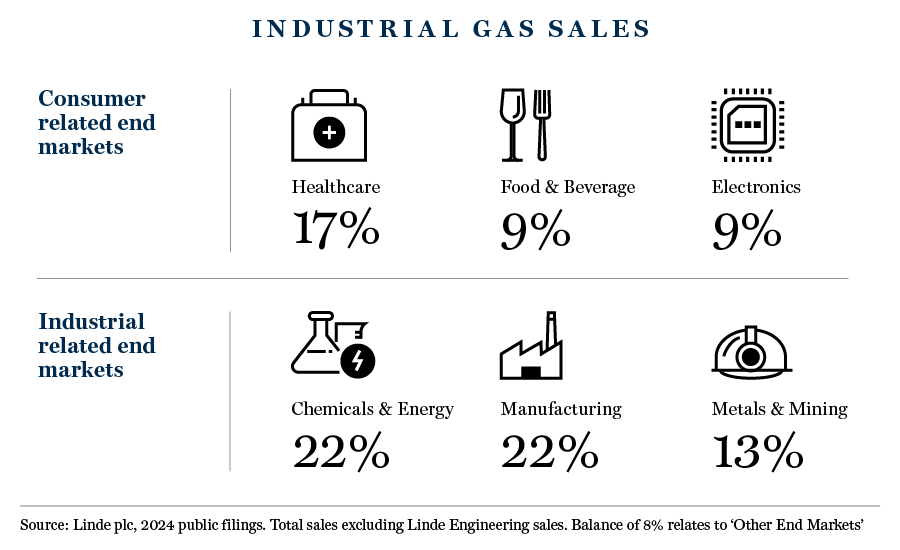

That is no exaggeration. Oxygen is used in every hospital as well as in steel mills and wastewater treatment. Nitrogen is a key component of many fertilisers and is important in food storage as well as in the production of most electronic components, including computer chips. Argon can be found in electric light bulbs and thermal windows and also plays an essential role in welding. Hydrogen has been touted as a key energy source of the future.

Producing gases like this on a commercial scale is a daunting task. While oxygen, nitrogen and argon are all found in the air we breathe, the business of separating them from the atmosphere demands a formidable level of technical expertise as well as massive investments in giant air separation units.

Then there is the not-so-simple matter of actually getting gases to customers. Delivery means building huge pipelines, filling tanker trucks or transporting heavy containers of high-pressure gas.

So why would investors choose to put their money into such a demanding business? Precisely because it is so demanding. “The barriers to entry are very high,” Scott says. That helps deter would-be competitors and protect the incumbent players.

A mere three players now control the bulk of the industry. The two biggest are Air Liquide of France and the Anglo-Irish Linde. They are followed by a smaller US-based competitor, Air Products & Chemicals Inc. Together, the big three command roughly 70% of the global market. Linde alone poured nearly $5bn into capital expenditure in 2024, Scott states.

Their deep commitment to the sector gives the industrial gas giants an astonishing degree of pricing power. They typically demand that major clients sign long-term ‘take or pay’ contracts that oblige the customer to either buy a minimum quantity of gas for the next 15 or 20 years or pay painful penalties.

“I don’t know any other industry that has 15-to-20-year contracts” of this nature, Scott says.

Consequently, the price of industrial gases rarely goes down, even in times of economic distress. “Over the past 20 years, prices have only gone in one direction,” she says.

This surprises many investors. They lump industrial gas producers together with cyclical commodity producers and expect their earnings to fluctuate as dramatically as those of miners and oil pumpers.

In fact, the earnings of the big gas producers have marched steadily higher, with only rare exceptions, through all the economic upheavals of the past 20 years. While the bottom lines of most natural resource companies have swung wildly with shifts in commodity prices, profits at Linde or Air Liquide have risen with nearly escalator-like smoothness.

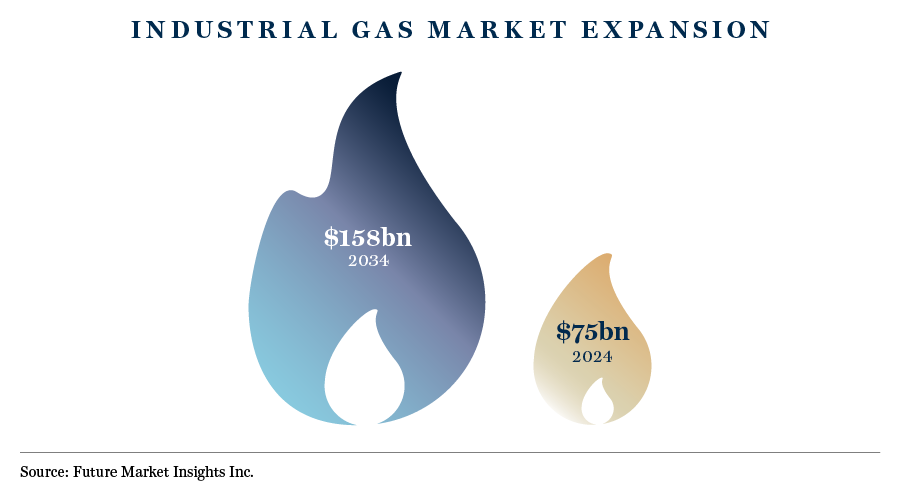

The future looks equally promising, thanks to a myriad of opportunities in growing industries.

Linde and Air Liquide supply much of the hydrogen and oxygen that fuel commercial space rockets. They also produce the nitrogen that semiconductor fabrication plants use to keep their production lines free of contamination. In addition, they are riding the decarbonisation wave in manufacturing by devising ways for cement and steel producers to capture and sequester greenhouse gases.

Even bigger opportunities could lie ahead if a climate-challenged world is forced to shift away from fossil fuels and towards a more sustainable hydrogen-based economy. If so, industrial gas will be used to heat homes, fuel machinery and produce decarbonised steel. Companies such as Linde and Air Liquide would find huge new markets for their hydrogen expertise.

That is the hope, at least. Scott prefers to downplay expectations. She cautions that even if the shift to a hydrogen economy materialises exactly as predicted, it will be five to seven years before a significant number of hydrogen projects begin to boost results.

And that’s fine by her. One of the things she admires about the gas giants is their patient view of the future, which aligns well with the Walter Scott investment approach.

“These companies are absolutely long-term focused,” she says. “It takes years to build production facilities and then once they’re operational, they’re operational for decades.”

For investors in the industrial gas giants, that long-term focus means a high degree of confidence about how the future will unfold. Boring? Maybe. But not to anyone who likes the prospect of a reliable stream of profits for years to come.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.