Key takeaways

- South Korea has a rich ecosystem of cutting-edge companies offering opportunities for investors

- The country’s memory chip players look well placed to retain their stranglehold on the market

- AI will be an important driver of demand for many South Korean tech companies

South Korea has long traded at a valuation discount to global peers, due in large part to its classification as an emerging market and a record of dubious corporate governance and complex ownership structures. Yet, it is also home to some genuinely high-quality companies, many of which sit at the cutting-edge of technological development.

On a research trip to the country in February, both facets of South Korea Inc. were on show. As well as encountering companies with frustratingly opaque structures, my colleague Alan Lander and I met with several others that occupy venerable positions in structurally growing markets with compelling long-term prospects.

Reform on the agenda

On first inspection, South Korea is a tough sell at present. Indicators suggest the economy is slowing, whilst the political environment remains deeply uncertain following the impeachment and incarceration of President Yoon Suk Yeol in December. Meanwhile, the KOSPI, the country’s main index, endured a chastening 2024, down 20% in US dollar terms. Dig a little deeper, however, and there are reasons for measured optimism.

In a bid to close its valuation discount, South Korea’s Financial Services Commission last year launched the ‘Corporate Value Up Program.’ The idea is to try and replicate the success of Japan’s corporate reform story, which has helped to spur equity returns of late.

Similar in scope to its Japanese incarnation, ‘Value Up’ consists of a package of initiatives aimed at reforming corporate governance, boosting the equity market, and accelerating inbound investment. And while progress so far has been halting, it is worth remembering that reform was also a slow burn in Japan. Furthermore, we are likely to see ‘Value Up’ given greater priority if, as expected, the Democratic Party forms South Korea’s next government.

Something else that piqued my interest was talk of decoupling between South Korea and China. It appears that some companies are increasingly shifting their focus away from China due to geopolitical sabre rattling and aggressive business practices. One business we spoke with has made significant market share gains as its customers have started to prioritise domestic over Chinese suppliers.

We also heard how geopolitical tensions between the US and China are playing into the hands of corporate South Korea. Whether it is semiconductors, battery manufacturing or heavy industry, the country is in a unique position to fill gaps in global supply chains that Western companies are creating by diversifying away from China.

A tech powerhouse

As bottom-up investors, however, what excites us most about South Korea is its technology sector. Like its east Asian neighbour Taiwan, it has carved out a strategically significant position in the global technology ecosystem, most notably in memory semiconductors. Through chip production majors Samsung Electronics and SK Hynix, Korea has secured a majority share of this market.

Historically, the memory market has been deeply cyclical, characterised by brutal downturns. The most recent began in 2022-23, when an inventory glut, tepid demand, and geopolitical tensions combined to crush sales. While the upswing has taken longer than expected to arrive, 2025 is shaping up to be the year recovery takes hold.

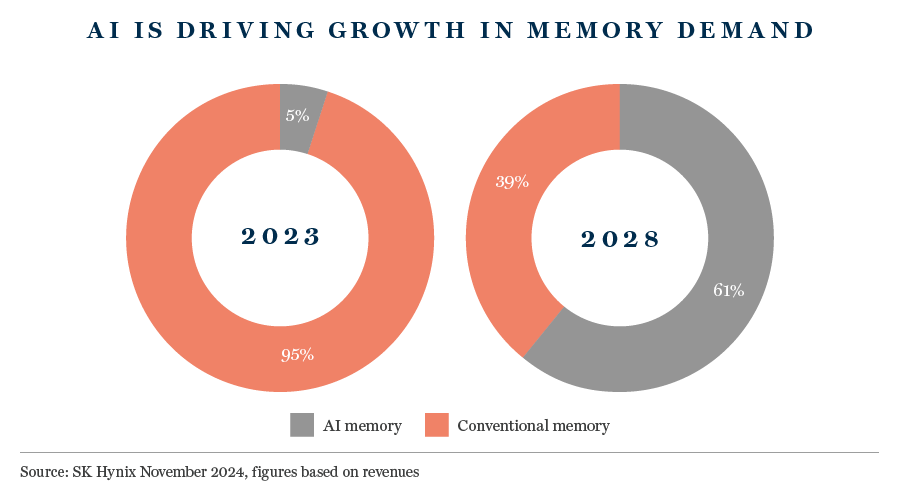

SK Hynix looks particularly well placed to capitalise on this upturn, which we expect to be more pronounced than in previous cycles due to swelling AI and data centre demand. Hynix is the market leader in High Bandwidth Memory (HBM), a technology that delivers high-speed data transfer and low power consumption. HBM is used in applications that require high-performance computing, including AI.

During our meeting, the company spoke confidently of maintaining leadership in HBM. Unlike ‘traditional’ memory chips, customers are less focused on cost and more concerned with securing reliable products built to bespoke specification on time and at scale. Supplying the likes of Nvidia and Broadcom, Hynix is currently the only player with the capacity and experience to meet this demand consistently.

Is China a threat?

Given HBM is around five times more profitable than DRAM (dynamic random-access memory), Hynix fully expects further competition to try and enter the market. China’s leading memory chipmaker, ChangXin Memory Technologies (CXMT), made headlines earlier this year when news broke that it had developed HBM capabilities.

Should South Korea’s memory chip players fear this Chinese encroachment? Not according to Hynix. This is an industry with formidable barriers to entry, with ever-increasing technological demands and spiralling capital-intensity making it extremely difficult for new entrants to catch up with incumbents.

Furthermore, CXMT’s capabilities at present stretch only to HBM2, a second-generation product first mass-produced by Hynix and Samsung Electronics almost a decade ago. Commercialising more advanced iterations of the technology (Hynix is currently developing HBM4) will be incredibly difficult due to the restrictions imposed by the Dutch government on Chinese companies procuring ASML’s extreme ultraviolet lithography machines, a vital production technology central to leading edge HBM development.

More than just memory

The proliferation of AI should also prove a tailwind for those companies upstream of the large memory players. South Korea’s tech ecosystem features a host of materials, service and equipment providers, many of which provide pivotal inputs to the chip industry.

If ASML is an arms dealer to the semiconductor industry, Hansol Chemical provides the ammunition. Hansol’s high-purity hydrogen peroxide (H202) is used by both Hynix and Samsung as an etching and oxidizing cleaning agent. Demand for H202 has been hit hard by the downturn in the memory market, while the steep rise in the price of liquefied natural gas, a key input into H202, has compressed margins. These headwinds are now easing, however, and Hansol was confident in the long-term outlook when we met with the business in Seoul.

The manufacturing process of any chip involves multiple steps, and between each step the wafer must be cleaned. It is here that H202 is used. The longer the process and production line, the higher the consumption of H2O2. Accordingly, the evolution of advanced HBM technology will be an important driver of future demand.

Hansol’s precursors business is also set to benefit from AI-related demand. Precursors are chemicals used in processes to deposit thin films on wafers. Despite being a late entrant to the market, Hansol has performed well against higher-profile global competitors, such as Merck and DuPont, and now counts TSMC, Samsung and Hynix as customers.

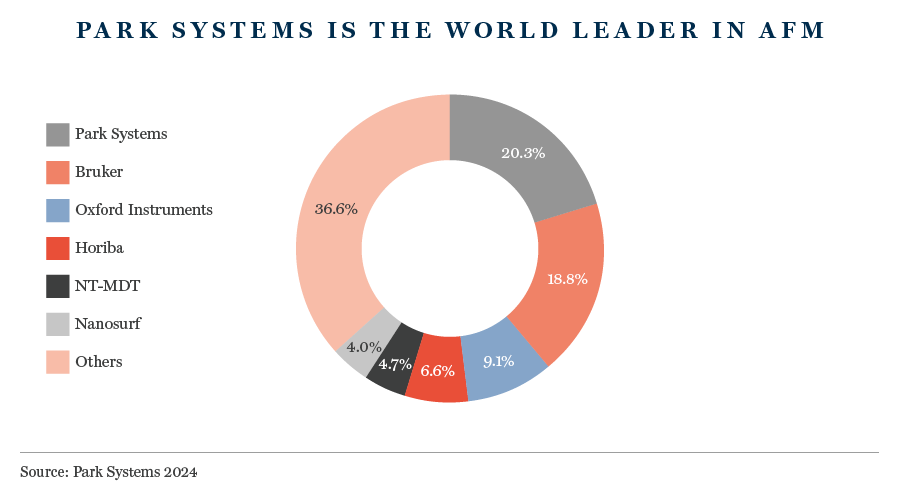

Another business operating in an important niche in the semiconductor industry is Park Systems, the world leader in atomic force microscopes (AFM). Invented by a Nobel prize-winning physicist in 1985, the AFM is an essential tool for operating in the nanoscale world, where objects are too small to see with traditional microscopes.

Known for their ease of use and high levels of accuracy, Park’s AFMs can analyse shape and physical properties at the nanometre level, crucially without touching or degrading the sample. Every global semiconductor producer is a customer, as are many of the world’s major research organisations.

Despite the technology having been commercially available for nearly four decades, the AFM market is still in its early stages, with market size estimates relatively vague. However, Park believes the market can grow at a compound annual growth rate of 11% until 2030, driven primarily by the miniaturisation and increased complexity of semiconductors.

As chips get smaller, incrementally more advanced and expensive AFMs will be required to inspect chips and analyse defects. Park Systems, with a government-secured patent of its non-contact and more accurate technology, appears ideally placed to capture this structural growth opportunity.

Better than botox?

Away from the semiconductor space, we enjoyed an interesting meeting with a company carving out a niche in a very different area. In a nation famous for its Botox industry, Classys provides a range of high-intensity focused ultrasound (HIFU) and radio frequency devices that stimulate the same lifting and tightening effects as traditional Botox and facial filler treatments. Cheaper and quicker than Western alternatives, treatment with these devices is also less painful, with no requirement for anaesthesia.

Classys operates a classic ‘razor-razorblade’ model. Clinics purchase a Classys device and then buy on average 10-12 cartridges every year. The margins on both are exceptional. Of the estimated 5,500 clinics that offer HIFU treatment, Classys told us that over 3,000 use its devices. Around one-third of these are in the famously affluent Gangnam district of Seoul.

Having established a dominant position in South Korea, the business is now growing its presence in international markets. Thanks to strong growth in Brazil and Thailand, last year it sold some 800 of its radio frequency devices overseas, having originally expected to sell 300. With regulatory approval now secured in the US, that number will grow further in 2025.

A repeat of Classys’ domestic success in the world’s biggest market would significantly enhance its long-term growth potential. The question is whether it can do so whilst maintaining its current levels of profitability?

_____

After 11 meetings across 5 days, we left South Korea in little doubt that it should remain firmly on our research radar. An emerging market in name only, it boasts a business environment and technology sector that stand comparison with Europe and developed Asia. Not every company we met was of sufficient quality to merit further analysis, but several will be the subject of further work in weeks and months ahead.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This article may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.