Walter Scott’s Research Conference in May was the firm’s fifth event in Edinburgh. One of several constants over that time, from the inaugural conference in 2008 to this most recent event, has been an address by Professor Paul Marsh. Once again, he made a compelling case for long-term equity investment and for careful stock selection, a case based on analysis of global equity market returns from 1900 to the present day. This is an extract from Professor Marsh’s opening address.

The longer you look back, the farther you can see forward

Winston Churchill

A delve into a 123-year history of investment returns provides a lesson for what future performance might look like.

The purpose of our research on long-term returns is not just to document the past, but to analyse, interpret, and learn from it. We want to help investors understand the investment challenges they face today but through the lens of financial history.

Over the last 14 to 16 months inflation, hiking cycles and real interest rates have been the biggest drivers of asset returns. Financial history provides us with considerable evidence on the impact of these three factors on asset returns. Going back to when our data starts in 1900, spikes in inflation have tended to coincide with wars and energy crises. And we had both of those in recent years. By the start of 2020 we were at the lowest end-year average inflation rate since 1934. But by the end of 2022, inflation was up 19-fold from the 0.4% to 8%.

The purpose of our research on long-term returns is not just to document the past, but to analyse, interpret, and learn from it

Historically, high inflation rates have been bad not only for bonds, but also for equities. Although it is often claimed that equities are a hedge against inflation, this is not true. Equity returns are negatively correlated with inflation. However, over the long run, equities have beaten inflation, but that is because of the equity risk premium, not because they are an inflation hedge.

Inflation may have peaked, but historically has proved to be sticky. In a paper published recently, Arnott and Shakernia looked at inflation episodes in 14 countries between 1970 and 2022. And it showed that once inflation hits 8%, it can take a very long time to get back to your target inflation levels.

Two negative factors besides inflation have hit returns over the last 16 months. One is the cure for inflation, which is to raise interest rates. Last year, the era of ultra-low rates ended with a bang as the Fed hiked rates aggressively in the US, with other central banks around the world doing the same. Hiking cycles are typically bad news for both stocks and bonds.

The real story here is that previous generations have been lucky

The second additional negative factor was that real yields fell sharply as rates rose. The low rates we’ve had over the last two decades supported asset values but following a 2% increase in real interest rates in the space of 12 months, this has gone into reverse. That is bad news for asset values because by increasing the rate at which you discount, you are decreasing asset values.

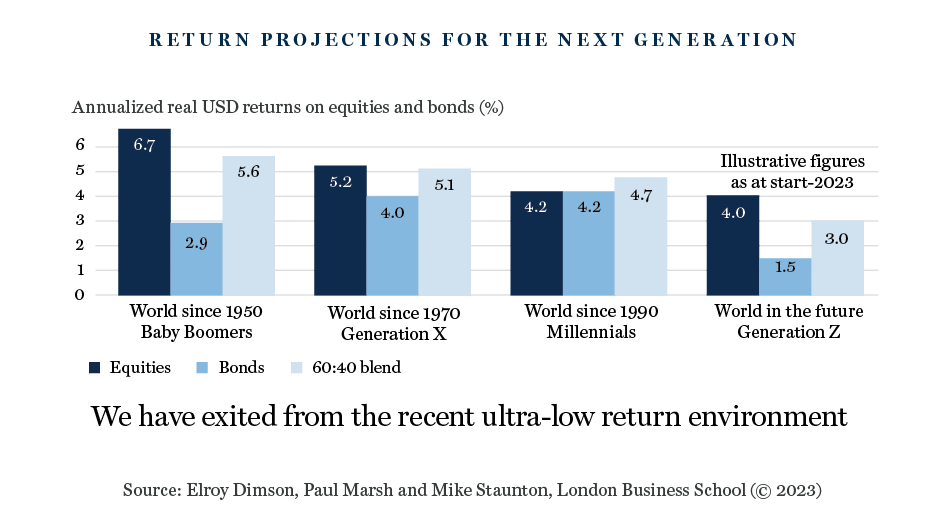

Since 1950, baby boomers have enjoyed a 6.7% annualised real US dollar returns on bonds and equities with a classic 60:40 split. Since then, returns have fallen. Generation X has seen a return of 5.2%, dropping to 4.2% for the millennials.

When looking at prospective returns I’m going to use a very simple model. The return we should expect in the future is the real interest rate plus a premium for the risk of the asset class we’re looking at. The real interest rate provides the baseline for all risky assets. So looking at Generation Z, which for you is the investment portfolio of the next 25 years, our reasonable best guess today will be a total annualised return of around 4.2% for equities and an equity risk premium of 3.5%. On an equity risk premium of 3.5%, you’ll double your money relative to cash in 20 years. The real story here is that previous generations have been lucky. They had windfall gains on stocks while Generation X, millennials and to some extent, the baby boomers also enjoyed windfall gains on bonds, which are unrepeatable.

The good news is that from that lower base, you can expect a higher return in the future

We’ve exited the ultra-low rates environment. The bad news came with a bang in 2022. Inflation, hiking cycles and higher real interest rates all lead to lower prices for stocks, bonds and real estate, but these factors should now all be priced in.

Prospective returns are now higher than they were a year ago, that’s the good thing about falling prices of assets. And the good news is that from that lower base, you can expect a higher return in the future. After a world of ultra-low rates that produced a distorting effect, we’re back to more normal parameters for risk and return.

This is an extract from a presentation given by Professor Paul Marsh at Walter Scott’s Research Conference in Edinburgh on 9 May 2023.

Important Information

The statements and opinions expressed during Walter Scott’s Research Conference and in all post conference communications, including this article, are those of the guest speaker, be that an external speaker or employee of Walter Scott, at the date stated and do not necessarily represent the view of Walter Scott, The Bank of New York Mellon Corporation, BNY Mellon Investment Management or any of their respective affiliates.

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

Any information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.