Energy economist and historian, Peter Tertzakian was one of the speakers at Walter Scott’s inaugural Edinburgh conference back in 2008. Joining us again at our fifth Research Conference in May, he summarised his thoughts on investing in energy today. The outlook is undoubtedly uncertain but sharing lessons from history and appreciation of the risks, Peter shared his optimism around the change to come, and the investment opportunities. This is an extract from his conference presentation.

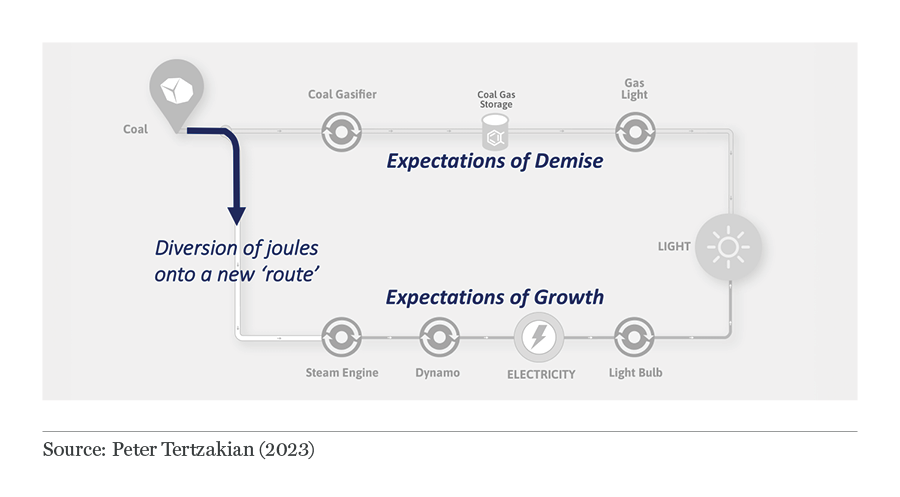

Energy is a supply chain of joules and the notion of conversion is critical to its function. You start with some primary source of energy and cascade it along conversion nodes. Every joule of energy must be accounted for and go to some end use. And all forms of energy can be put into a conversion device to produce a different form of energy.

A light bulb converts electrical energy into light energy. The background infrastructure everywhere in our modern society has thousands of conversion devices. So, in energy transition, it is not simply a case of going from coal gas light to electric light or combustion vehicle to electric vehicle. It involves a wholesale change in a system’s supply chain.

New forms of transport have always required an infrastructure of energy supply before they are useful. When petroleum cars emerged in the 1900s, drivers on long journeys had to ensure there were enough gas stations along the way. Electric vehicles are no different which is why in the 2000s a big push began to build out battery-charging stations. And, for any ecosystem or industry to function, each component of the supply chain needs to make money. If petrol stations didn’t make money, they would close and the whole supply chain would fall apart.

Look on the roofs of most residential houses and you’ll see a chimney. In the UK, this represents the combustion paradigm that has been with us since the industrial revolution. Look closer and you’ll see TV antenna. These have long been substituted out, as we’ve moved through cable to wireless and 5G. Transitions have been fast in telecommunications but in the world of energy they have been much slower and fraught with other types of infrastructural issues that make it difficult to achieve.

In the early 1800s, the lamps on London’s bridges were lit by gas lights, which was the result of the coal gasification process. Then in the 1870s Joseph Swan, the Thomas Edison of the UK, invented a light bulb and there began the transition from coal gas lighting to incandescent light.

The force of change that prompted society to move off the established route of gasification was technology, and the dogged determination of the likes of Edison, Swan and Nikolai Tesla gave us a new route that was superior in delivering the utility that we wanted.

Policy before technology

Technology is part of the story in today’s transition, considering the remarkable gains in solar energy and batteries. But the driving force is policy. There is an imperative to reach net zero by 2050, so this is far more of a forced transition than a natural one driven by technology.

Understanding this leads us to some of the themes of investment. Because the existing infrastructure continues to have value – it’s not obsolete like a TV antenna or a satellite dish, it has value on a balance sheet – therein lies one of the many complexities to consider. Should we shut all these old factories, or completely refurbish them with new technologies? Or is there the possibility that there are ways of renovating the interior using different technologies?

There is justified talk of getting off fossil fuels and onto renewables but it’s not just about the supply side, there’s all the infrastructure in the middle and how it gets from, say a wind farm off the coast of Scotland, to power the lights in this conference room.

When it comes to renewables, investors struggle to analyse the comparative value of the different routes from energy source to the end user. For example, in a survey of investors we found there was no consensus on how to analyse, manage and monitor the risk and return of a biofuel plant compared to a solar farm, compared to an electric vehicle.

The survey also revealed a common refrain from people grappling with the future of energy is that they struggle to explain some of these new technologies clearly enough. This is a problem because if a CEO or investor can’t describe what an anaerobic digester does, then the default position is not to invest.

This stands in stark contrast to oil and gas, where we have more than a century of history in investing in rocks underneath the Earth’s surface with drilling rigs to tap into the joules of energy that are in chemical form. Crude oil and natural gas are forms of chemical energy that have value. This is an easy story to understand.

But with the imperative to migrate capital allocation away from subsurface joules, energy investing has become more disparate. There’s a tendency to take these assets and put them into what are called buckets or verticals. We know how to put oil and gas into a bucket of real assets, but where do we put agriculture, anaerobic digesters, hydrogen fusion? So the default is not to put it anywhere and move on and invest in something else.

The Investors’ Conundrum

This new capital stock above the ground is much more difficult to understand. Fossil fuels – coal, oil and natural gas – still comprise more than 80% of the joules at the primary source. From a dollar investment perspective, the value of those joules is 95%.

That’s because wind and sun have no value. This is good news from a consumer perspective but from an investor perspective it suggests that margins are thin and there’s not a lot of value. The value of assets below the ground is immense and so the conundrum is what to invest in to gain exposure to energy.

For the last 30 years, I’ve built maps to show the different routes for channelling joules to the end users. Using the example of mobility, the map takes the primary sources of energy – coal, gas oil, wind and sun – and plots the various permutations involved to turn the wheel of a light duty vehicle.

The aim is to find the most efficient way to get from A to B. This depends on the constraints of each permutation, which can be overlaid on a map. There are thousands of permutations but the role of policymakers in forcing people to take a different route – though carbon taxes, measures to phase out combustion engines, or funding the preferred route through the public purse using capital incentives – is hugely significant and has a distorting effect.

Policy is a force of change for diverting or attracting capital and ultimately the market share of joules. Each route is a supply chain of joules, and like any chain it is only as strong as the weakest link. So if a policy goes away, then the whole route falls apart.

In democratic societies, it’s very easy to shred policies and that makes it hard to quantify risk.

When understanding policy, there are three factors to consider. The first is influence and how material the policy is in driving the internal rate of return.

The second is endurance and whether a policy can survive political change. Many infrastructure projects last 30 or 40 years, but many policies only last for ten.

The third factor is volatility. A lot of policies today are based on carbon, and carbon markets are volatile. The value of carbon in the future is something that is glossed over. In an ideal world, carbon goes to zero. Does that mean the credits go to zero too?

The whole risk return paradigm of investing in new energy is in very uncertain territory because of the mispricing of policy. But that can also be an opportunity. If you understand the policy, you can almost create route-to-route policy arbitrage.

Returning to the TV antenna on top of the roof. No-one with a TV antenna was able to predict that we would get television signals streaming on our phone. That’s why it’s hard to predict what will happen over the next 27 years.

A number of mega-trends have emerged. The first is innovation by incumbents because companies are realising that energy transition is not going to be very fast like it is in the digital world

The evolution to 2050 will be incremental. There are going to be many surprises that we haven’t even thought about and the trick is to monitor those routes and the congestion in them.

A number of mega-trends have emerged. The first is innovation by incumbents because companies are realising that energy transition is not going to be very fast like it is in the digital world.

The second is green-on-green competition, and the question of which of these competing technologies will emerge. There will be winners and losers.

The third is the exploitation of mispriced policy risk. On one hand, you can use the notion of policy risk to not invest in something. But on the other, policy is directing a lot of public funds into certain areas. And the trick is knowing when to get out; to understand when a specific route makes no sense and anticipating that the market will wake up to it.

Finally, this all creating an immense amount of disruption and distortion, which makes it the most amazing time in my 40-year career. This creates massive investment potential. You just have to know where to look and how to use the map to navigate the different routes as well as navigate the complexities and permutations.

This is an edited transcript of a presentation given by Peter Tertzakian at Walter Scott’s Research Conference in Edinburgh on 10 May 2023.

Important Information

The statements and opinions expressed during Walter Scott’s Research Conference and in all post conference communications, including this article, are those of the guest speaker, be that an external speaker or employee of Walter Scott, at the date stated and do not necessarily represent the view of Walter Scott, The Bank of New York Mellon Corporation, BNY Mellon Investment Management or any of their respective affiliates.

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

Any information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.