A turbulent few years for Hong Kong has led many observers to suggest the city’s star is on the wane, particularly with Beijing exerting greater influence on day-to-day life. But on a recent research trip to the city, investment manager Alan Lander heard a very different story. Across a series of meetings with business leaders and company management teams, the message was one of confidence and optimism both from an economic and from a socio-political perspective.

Hong Kong is not what it was, we are told. The legacy of anti-government protests and draconian Covid lockdowns, combined with the authoritarian grip of Beijing, have wrought lasting damage on Asia’s world city and financial capital. No longer the place where East meets West, the Fragrant Harbour finds itself surpassed in standing by its old rival Singapore. Western commentators have lined up to lament its demise.

For those of us exposed to the persistent drumbeat of gloom-ridden op-eds in the Western media, it would be relatively easy to succumb to this declinist narrative. After all, nobody can say that recent years haven’t been testing for Hong Kong. That the city has undergone some significant changes in that time is also not in doubt. But on a recent research trip to the city, we heard a very different message. Across a series of meetings with business leaders and company management teams, the story told was one of confidence and optimism both from an economic and from a socio-political perspective. Yes, Hong Kong has changed, but contrary to received wisdom in the West, this is not necessarily a bad thing.

Nobody can say that recent years haven’t been testing for Hong Kong

The pessimistic view of Hong Kong’s prospects appears to rest largely on two connected issues: the national security law introduced by Beijing in 2020 and encroaching ‘Sinicization’, which critics argue will rob the city of the laissez faire spirit responsible for its trademark dynamism. Neither appeared to hold much fear for those we met with, however. Most spoke positively about the national security law, arguing that it had restored some much needed stability and helped to clarify what is and what is not the remit of the Hong Kong government. Some suggested that the law was in fact less onerous than similar pieces of legislation in the West.

On the creeping ‘Sinicization’ of the city, there was also minimal concern. Whilst the increase in Chinese influence is clear to see post pandemic, this was always the ultimate direction of travel. And although Hong Kong is becoming a more Chinese city, it is not becoming another Chinese city. Beijing understands that the differences between Hong Kong and Mainland China are fundamental to its role as an international gateway. As such, we should expect the status quo for those doing business to endure.

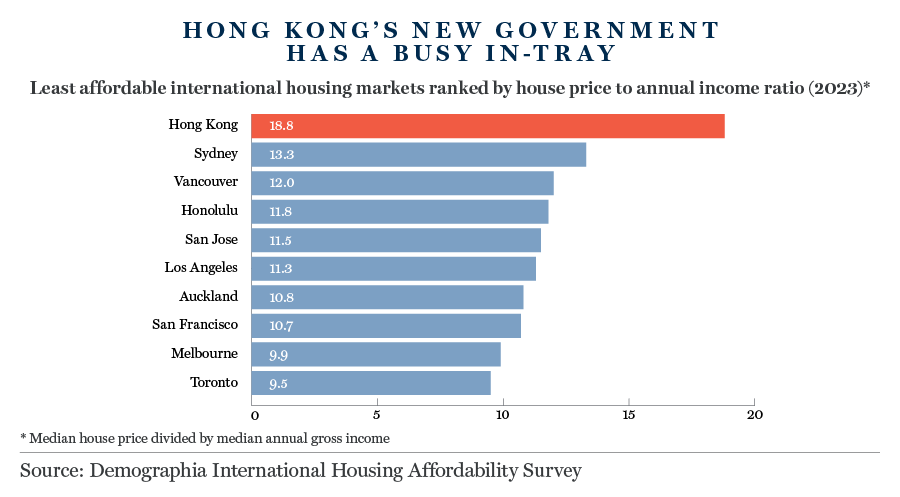

If anything, those we spoke with argued that greater Chinese involvement has been beneficial for those living and working in Hong Kong. After years of ineffectual local government, rising inequality and extreme issues with housing affordability had fostered considerable discontent. To avoid future social instability, Beijing understands the importance of effective, citizen-focused local government, and has acted accordingly. Today’s administration was roundly praised for its energy and the tangible policies it has put in place to tackle the city’s problems.

Although Hong Kong is becoming a more Chinese city, it is not becoming another Chinese city

Perhaps one of the most compelling pieces of evidence in support of the improving backdrop is the steady flow of people back to the city. Hong Kong shed a lot of talent due to onerous Covid restrictions and the British National Overseas visa scheme but some of that talent is now starting to return. Ex-pats who left for Singapore are being attracted back by the reopening of the city’s borders and a fall in rents that has reduced the cost of housing relative to Singapore.

Former residents are returning to a city that is not currently firing on all cylinders from an economic perspective, a fact acknowledged by everyone with whom we spoke. This has nothing to do with the national security law or Sinicization, however, and everything to do with China’s muted recovery from Covid-19, the ongoing issues in the country’s real estate sector and the volatile geopolitical backdrop. Activity in Hong Kong remains highly dependent on China and activity in the former won’t fully recover until the latter finds its feet again. For now, investor sentiment towards both remains depressed. From a fundamental perspective, however, the outlook for many companies is much brighter.

AIA Group is one such example and a meeting with the longstanding CFO and other senior representatives of the life insurance giant confirmed that its impressive post-pandemic recovery remains on track. Visitor numbers from mainland China – the biggest source of revenue for AIA’s Hong Kong business – are recovering and average case sizes are now nearly double pre-pandemic levels. The domestic Hong Kong market is also showing good momentum. Whilst insurance enjoys relatively high levels of penetration in Hong Kong, poor levels of state provision mean there are always opportunities to sell more to existing customers.

[AIA’s] impressive post-pandemic recovery remains on track

Business in mainland China is also progressing well, despite the economy’s well documented challenges. If anything, the group’s exclusively high-net-worth Chinese customer base is actually saving more, whilst new customers are finding their way to AIA, attracted by the highest-quality offering in the market. The launch of a new tax deductible pension product, the first of its kind in China, has been a great success, with good uptake from new and existing customers alike. Regulatory endorsement was reflected in a request to AIA’s peers to develop similar products.

The measured but positive tone of our meeting with AIA was replicated across numerous conversations we held during our time in Hong Kong. Despite China’s economic difficulties acting as a brake on the post-Covid recovery, the city and its residents are very much getting back to business. The long-term outlook is overwhelmingly optimistic.

The arguments we heard in defence of Hong Kong provided a valuable counterweight to the prevailing political and media narrative

A sceptic would naturally argue that it would be surprising if Hong Kong’s business community didn’t talk up the city’s prospects. Nor that they should be broadly uncritical of China’s growing influence. But if they were a little one sided, the same can be said of much Western press coverage. Cogent and convincing, the arguments we heard in defence of Hong Kong provided a valuable counterweight to the prevailing political and media narrative. Progressively greater integration with the mainland over the coming years is inevitable, but whether this is viewed as a good or a bad thing likely depends on the observer’s existing biases. Nobody we spoke to saw it as an existential challenge to Hong Kong’s unique position within Asia’s financial system.

There is no question that Hong Kong’s reputation has taken a knock in recent years, nor that it is facing some near-term economic challenges. Look beyond the next couple of years, however, and there is ample cause for optimism. The city sits at the nexus of a number of the Chinese government’s long-term projects. Renminbi internationalisation and the Greater Bay Area and Belt and Road initiatives represent huge multi-decade opportunities. With its characteristic vigour, we expect Hong Kong to harness these opportunities and continue its pivotal role in securing China and Asia’s long-term prosperity.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This article may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.