With concerns mounting over the global economy, and monetary tightening undermining equity valuations, information technology share prices have had a tough time in these turbulent markets following an extended period of strong performance. In this article, Investment Managers Tom Miedema and Alistair Ceurvorst, fresh from a trip to one of the sector’s major conferences, highlight some of the trends that are continuing to create great growth opportunities for many leading technology companies.

Global equity markets have continued to reflect the world’s darkening economic skies as surging inflation and ongoing supply chain disruptions, exacerbated by the Ukraine conflict and China’s draconian Covid-containment policies, chip away at the post-pandemic recovery. Compounding these growth fears, the old quip that the ‘Fed is your friend’ has lost its relevance as the central bank seeks to rein in inflation and bring an end to the monetary largesse of the post-GFC period.

Notwithstanding a slew of good earnings results, the information technology sector has seen considerable share price weakness given the concerns over economic growth and the shrinkage of valuations partly brought about by the demise of cheap money. There are fears that some of the demand trends established during the Covid pandemic are losing their lustre and that the derating the sector has experienced is predictive of potentially leaner times.

STICK TO THE FUNDAMENTALS

However, in this sector which comprises a myriad of different industries, not all technology companies are created equal. We look to invest in financially robust, market-leading businesses with a long and durable growth runway, enjoying strong and defensible market positions through products or services that are hard to develop and difficult to replicate. We would differentiate between such businesses and other tech counters with weak or untested business models, where low interest rates have led to ‘irrational exuberance’ and hope and hype have replaced fundamentals as an investment metric. The increasing cost of capital implied by the current environment, demands a focus on the delivery of earnings and cash flow. Markets will remain wary of the lofty valuations applied to companies with questionable profitability or distant prospects of idea monetisation.

The pandemic accelerated demand for many technological products and services, as in the case of hardware such as personal computers. In the face of slowing economic growth or stagflation, some near-term demand contraction or a moderation of the growth trajectory is likely. However, our long-term focus spans the ebbs and flows of cycles and crises. A common denominator of leading technology businesses is their ability to leverage and drive trends that will endure beyond the looming economic downdraught. Our belief in this derives from the rigorous application of our investment approach which examines, tests, and debates the investment merits of each stock irrespective of prevailing market or economic conditions. Talking to management teams and attending industry conferences to learn about the long-term trends that will drive businesses is part of that process.

Two members of the Research team recently attended the IMEC (Interuniversity Microelectronics Centre) Future Summits in Antwerp featuring CEO’s and industry experts across the technology spectrum. The conference highlighted that the technology industry, which arguably sits at the apex of human ingenuity, will be driven by a host of developments that will create opportunity and growth for years to come.

POWERFUL TRENDS ARE sTILL BENEFITING LEADING TECHNOLOGY COMPANIES

Our world is becoming increasingly digital and connected, and this shift remains a powerful driver of growth opportunities. More of our lives, our everyday activities as consumers of goods, services and entertainment, are moving online. Across the corporate spectrum from design to manufacturing to customer engagement, businesses depend on technological innovation, devices, and software to become more efficient and competitive.

From driver automation systems to the use of technology in healthcare where the ability to analyse huge amounts of data is reducing the time-to-market for drugs and costs, the demand for computing power is rising inexorably. At the conference, gene-sequencing company Illumina spoke of the ‘data explosion’, illustrated by the fact that in 2021, the company produced 280 petabytes of data, equivalent to around 900 years of continuous video recordings in high definition. That figure is doubling every year. The generation and management of data is vital for a company whose products provide a better and cost-effective understanding of critical diseases such as viral infections and cancer.

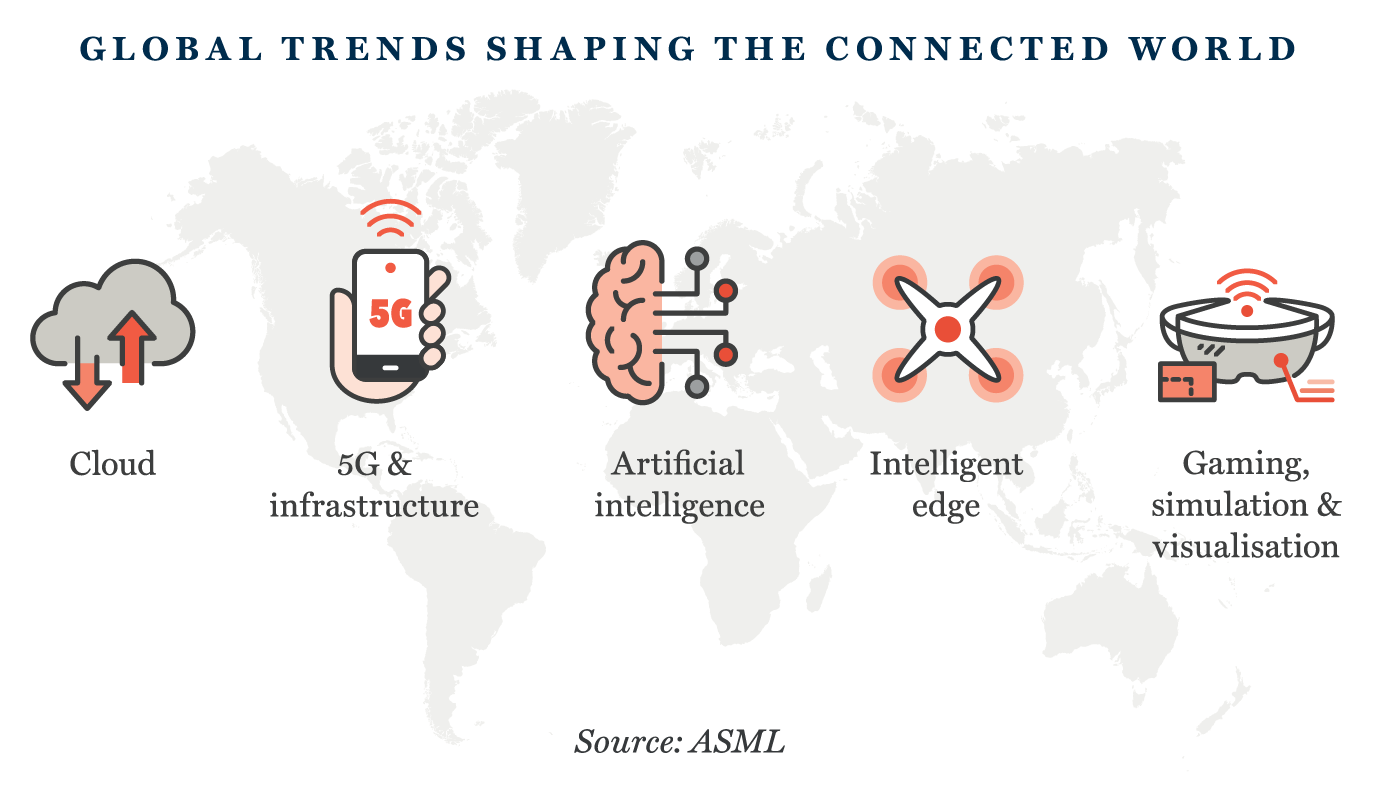

This voracious appetite for data and greater connectivity are powerful drivers for the semiconductor industry, where growth is being fuelled by the expansion of the ‘cloud’, 5G and its associated infrastructure, artificial intelligence, gaming, simulation and visualisation and the intelligent edge. The latter refers to edge devices that collect, communicate, generate, and analyse data in near real-time, for example, sensors, autonomous cars, GPS receivers and navigation systems. There are around 40 billion connected devices in use today, and that number is expected to grow to 350 billion in the next ten years according to semiconductor lithography company ASML.

“MOORE’S WHAT?”…BUT A KEY ELEMENT IN TECHNOLOGICAL ADVANCEMENT

The conference also reinforced the view that Moore’s Law is far from dead. Simply put, this ‘law’, which is effectively an observation, states that the number of transistors in an integrated circuit doubles every two years. This allows chips to become faster and consume less energy, so given their already small size, limits on shrinkage on a two-dimensional scale were seen as a barrier to technological progress. However, in similar fashion to a plot ratio on a building site, chips are being expanded up the way. This type of 3D design can perpetuate Moore’s Law-type results, thus continuing a trend that has propelled profound advances in technology.

TECHNOLOGICAL DOMINANCE AND STRONG DEMAND ARE POWERFUL DRIVERS OF PROFITS

Taiwan Semiconductor (TSMC) sits in a prime position to benefit from burgeoning demand created by these industry trends. The world’s leading semiconductor foundry recently reported an excellent start to 2022 accompanied by an upgrade in full-year guidance, expecting at least 30% revenue growth. Management expects that the impact of a cyclical downturn in consumer electronic gadgets or smartphones will be offset by structural growth in high-performance computing, driven by cloud service provider demand and automotive applications. The company does not foresee any impact from supply chain issues and has recently increased prices.

A key topic from the Antwerp conference was the geopolitical risk relating to the semiconductor industry. Over the years, markets have occasionally fretted over TSMC’s Taiwan domicile, given Chinese claims over the island. Recent events should caution anyone from embarking on geopolitical guesswork, but the nature of China’s interconnectedness with the global economy and the grinding folly of Russia’s invasion of Ukraine, suggests that a similar incursion by China into Taiwan remains but a tail risk. Nonetheless, TSMC is building a fabrication plant in the US, has ‘trailing-edge’ operations in China, has committed to an investment in Japan, and is currently in talks with (read being wooed by!) the EU about building a local plant in the region.

However, this is not just for reasons of technological sovereignty, but because of TSMC’s bullish demand expectations. Once renowned for boom and bust cycles, the semiconductor industry has displayed much greater capital discipline in recent years. This is admirable, but it looks like long-term demand has been badly underestimated.

Testament to its dominance, TSMC’s growing capacity is not substitutable by the capacity being constructed by its competitors, either because the company is at the leading edge of the industry or has areas of specialty where it has proprietary technology. Consequently, management remains undaunted by the plans of competitor Intel (which is also currently a customer) to return to a totally inhouse manufacturing model in 2025, and has built this expectation into its capital expenditure plan.

“WE’RE GOING TO NEED A BIGGER BOAT”

These trends represent an excellent long-term growth tailwind for ASML, which occupies a dominant position as a key supplier of chip manufacturing tools. CEO Peter Wennink recently commented that semiconductor chip makers face two years of shortages of key equipment. The semiconductor industry must accelerate investment in new production to meet the global shortage, given the expectation that the chip market may double by 2030.

ASML’s recent first-quarter results were largely as expected, and reflected the low season for demand, but Mr Wennink, a speaker at the Antwerp event, stated that visibility continues to improve and that “we continue to see that the demand for our systems is higher than our current production capacity”. Management is consequently looking at building additional capacity based on demand forecasts following discussions with customers, and plans to upgrade long-term expectations at the next investor day later this year.

DIGITAL TECHNOLOGY AS AN ENGINE OF GLOBAL GROWTH

Many software businesses have been beneficiaries of the pandemic, and for Microsoft Corporation there remains a long-lasting opportunity set. Management estimate that the digital transformation market opportunity is around US$4.5tn. As with others in the technology chain, the key drivers are device proliferation, the growth of the ‘cloud’, the explosion in the amount of data that businesses process, and the movement away from a siloed, individual experience to a socially connected experience in gaming. The long-term outlook for capital spending by enterprises remains buoyant due to ageing IT infrastructure and the adoption of cloud technologies.

Microsoft’s recent third-quarter results saw all the company’s thirteen major businesses growing over the quarter once again, with operating profit rising 24% year on year. CEO Satya Nadella remains bullish, as evidenced by his comment that “going forward, digital technology will be the key input that powers the world’s economic output. Across the tech stack, we are expanding our opportunity and taking share as we help customers differentiate, build resilience, and do more with less.”

But with the digital revolution has come the increasing threat of external cyberattack. Fortinet is leading the fight against cybercrime with its innovative security solutions. The company operates in a fast-growing network security market driven by expanding digital attack surfaces (all attackable points in a system), the proliferation of sophisticated threats, increasing ecosystem complexity and growing compliance requirements. At its recent analyst day conference, the company stated that its total addressable market is expected to expand from $138 billion in 2022 to $199 billion in 2026 (10% CAGR) with broad-based growth across all market segments.

Examples of valuation of compression despite strong underlying operating performance can be found in a number of technology names. The shares of Japanese sensor maker Keyence have not been immune from the derating whirlwind despite a recent run of good results. In April, the company announced fiscal year 2022 earnings, which showed operating profit growing at 51% for the full twelve months and 30% for the fourth quarter. The breadth of growth across geographies (including China, where there was no evidence of a lockdown impact) and industries was encouraging. The sensor market remains in growth mode as Keyence’s manufacturing customers strive to become more efficient in their production processes and as these processes become increasingly complex. A bugbear for investors has been this conservative company’s dividend policy, as the dividend has been flat for the last three fiscal years, and is indeed guided flat for the coming year, despite a record-high cash balance of almost US$8bn on the balance sheet and expected continued earnings growth. However, in any climate, far better that than excess leverage and the absence of growth.

SHORT-TERM PAIN…BUT LONG-TERM OPPORTUNITY

Equity markets will remain turbulent as investors ponder the likelihood of a severe economic downturn. The consumer is being squeezed by rising costs, while companies across many sectors face a more uncertain demand environment. Yet the underlying currents for leading technology companies remain strongly favourable. From ever-smarter mobile communications to self-driving cars to facilitating advances in healthcare, technology is increasingly enmeshed in our existence, making our lives easier, safer, healthier, and, more enjoyable. Across the corporate spectrum, companies rely on technology to manage, develop and grow their businesses, and it allows them to be more resilient in times of economic stress. With our long-term orientation we can look through periods of turmoil and focus on innovative, financially strong, and well-managed companies that are at the forefront of trends that will drive their earnings for years to come. They may not be rendered immune from periods of earnings and share price volatility, but over time, returns should reflect the underlying earnings power of the world’s great technology companies.

Stock Examples

The information provided in this video relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.

Important Information

This video is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This video may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.