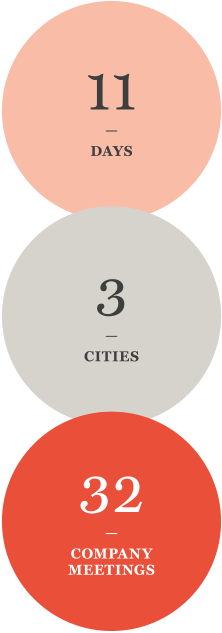

In September, investment managers Fraser Fox and Alistair Ceurvorst embarked on a two-week research trip to Japan that took in more than thirty company meetings across three cities. Viewed through a top-down lens, Japan’s well-documented challenges have long hindered its appeal as an investment destination. For bottom-up investors searching for genuinely high-quality companies, however, the country still offers compelling long-term opportunities.

Our trip to Japan came at an interesting time. As the era of cheap money recedes further in the rear-view mirror across much of the developed world, the Bank of Japan remains steadfast in its commitment to low interest rates and monetary largesse despite inflation running comfortably above its 2 per cent target.

The Bank’s reluctance to remove the monetary punchbowl is understandable. Having struggled to break the deflationary mindset that has bedevilled the Japanese economy since the implosion of an epic asset price bubble in the early 1990s, policymakers are keen to further encourage the emerging shift in price expectations seemingly taking root among consumers and companies. The hope will be that a durable uptick in inflation expectations can act as a spur to consumer spending, corporate investment, and productivity growth, helping the country to shake off its reputation for economic lethargy.

The Bank of Japan remains steadfast in its commitment to low interest rates and monetary largesse

Of course, slaying the deflationary dragon will not in itself prove a panacea for all Japan’s ills, but it might go some way to fostering a more positive investment narrative than one predicated almost entirely on long-term stagnation and decline. For some investors, that story has been reason enough to avoid Japan for many years. Our view has always been slightly different. As regular visitors to the country for nearly four decades, we’ve long been aware of Japan’s significant challenges, which shouldn’t be downplayed or dismissed. However, these can often obscure some very real strengths. The country remains a large and prosperous economy with low rates of unemployment, a highly educated workforce, excellent infrastructure, and high levels of R&D spending. It’s also home to many leading companies with enviable market positions, sound financial profiles and globally diverse revenue streams. For patient investors willing to look beyond the headline headwinds, it’s a market that will reward diligent research and close fundamental analysis.

No issue looms larger for modern-day Japan than its demographic profile. A low birth rate and very long lifespans have created a highly unfavourable dependency ratio – more elderly people and a declining working-age population is not a recipe for economic dynamism. And while not alone in suffering from this worrying trend (China and much of the West are on a similar trajectory) Japan is the most advanced expression of the problem.

Yet many Japanese businesses are turning this headwind to their advantage. Nowhere is this more evident than in automation, where the country is the acknowledged global leader. If people are in short supply, bring in the robots! Nobody encapsulates Japan’s talent for automation better than Fanuc, the world’s leading manufacturer of computerised numerical controls and industrial robotics, and a relentless innovator since its founding in the 1950s.

We’ve been visiting Fanuc for more than thirty years, always leaving impressed by its commitment to innovation. Nestled in the foothills of Mount Fuji, the company’s secluded demonstration centre is a fascinating place, where watching robots make robots leaves the visitor in little doubt about Fanuc’s technical prowess. However, trade wars, Covid-19 and supply chain disruption have made for a few challenging years, so this visit, only the second by an overseas investor since pandemic restrictions were relaxed, was an opportunity to dig a little deeper into how management is handling these headwinds. During a near four-hour meeting with senior representatives, including the president and CFO, we discussed parts shortages, lengthening delivery times and inflation, and the steps being taken to mitigate their impact. What’s clear is that while these remedial measures are helping to an extent, the operating environment for now remains tough.

More positive are the long-term opportunities to which Fanuc remains exposed. This is a business entirely focused on helping companies do more with less and do it more efficiently. No surprise then that tight labour markets and rising inflation globally will likely lead more and more management teams to invest in automation. Robot demand is also getting a significant boost from the transition to electric vehicles. Whereas internal combustion engine manufacturing is largely a manual process, EV batteries make much greater use of robots of all sizes. Indeed, supply is unable to keep up with demand at present, given the scale of investment by the EV manufacturers. Enjoying long-standing relationships with the established automakers, Fanuc is in a very strong competitive position.

[Fanuc] is a business entirely focused on helping companies do more with less and do it more efficiently.

Electric vehicles are also helping drive growth at SMC Corporation, a leader in motion automation technology. First used in the automobile industry in the 1960s, today these pneumatic components play an essential role in supporting factory automation, featuring in production and conveyor lines, machine tools and industrial robots. We met with SMC’s CFO at the company’s Tokyo offices to get an update on the current operating environment, as well as internal developments since the appointment of a new CEO in 2021. According to the CFO, demand from China is holding up well thanks to Beijing’s bid to foster leadership and onshoring in semiconductors, EV supply chain products and battery technology. Nor does SMC expect competition from Chinese competitors to be a material issue given their relative lack of technical expertise.

SMC has undergone a shift in sales strategy since the arrival of the new CEO, Yoshiki Takada, in 2021. Hailing from a sales background, Mr Takada spent many years as the head of SMC’s US business, where he drove significant market share gains. He has now taken the strategy that worked so well there and rolled it out across other regions. Under this new approach, SMC’s 50 subsidiaries will retain their previous autonomy while being encouraged to share insights to improve product development. The CFO was adamant that scale is the most important factor for SMC, so leveraging design similarities is incredibly important. Any cost savings will be reinvested in reducing prices to help gain market share.

From Japan’s global automation giants to a meeting with one of its popular cultural institutions, and one building an increasingly global profile. Toei Animation is a pioneer of Japanese animation, having produced in 1958 the country’s first world-standard full-colour animated feature film. Today, the company can boast one of the largest libraries of titles and characters in Japan, with three of its titles making the top 20 biggest media franchises globally. While Japan is still Toei’s largest market, the growing popularity of anime, a distinctive Japanese style of film and television animation, presents a huge opportunity globally.

The growth of streaming platforms is helping to drive the internationalization of anime, enabling the genre to reach more eyeballs at lower cost. New fans are drawn to anime’s unique titles and characters, and the richness of storylines rooted in manga comic books. Many of Toei’s franchises, such as Dragonball, Slam Dunk and One Piece, are hugely popular. Coming with a high predictability of success, they are much in demand among the streaming platforms and give Toei a good degree of pricing power.

The growing popularity of anime globally… presents a huge opportunity [for Toei]

To capitalize on anime’s rising popularity, Toei has established three growth pillars. Firstly, the company’s long-standing export model, where content is produced in Japan and then exported globally. Second is the ‘Hollywood model’, where the content is created overseas and then distributed through Hollywood studios. Finally, a localization model where strict regulations or cultural barriers, such as in China and France, means that stories are ‘localized’ in partnership with local content creators. In time, management expects localization to match the export channel for profitability. Whatever the balance between the three, expect anime to continue its march into the entertainment mainstream.

Toei, Fanuc, and SMC are just three examples, but many of the meetings over the course of our trip were of a similar high quality. This alone is encouraging and bodes well for the future. In almost forty years of visiting Japan, quality engagement hasn’t always been a given, so to leave with a definite sense of improvement was welcome. Not every meeting lived up to our expectations, but most management teams were open, positive, and informative, furnishing us with deeper insights into our existing holdings and helping us to form a more comprehensive picture of potential investment candidates. Japan Inc., for all the country’s many challenges, still has much to offer the long-term investor.

Stock Examples

The information provided in this video relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.

Important Information

This video is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This video may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.