As the world’s leading CDMO, Lonza sits at the nexus of two of the most powerful long-term growth trends in modern health care: the growth of outsourced drug manufacturing and the rise of biologics.

In May 2020, during some of the darkest days of the Covid-19 pandemic, the global biotech firm Moderna entered a 10-year strategic collaboration with Lonza that would see the latter manufacture the former’s novel coronavirus vaccine. In just eight months and while grappling with workplace pandemic restrictions, Lonza had constructed manufacturing facilities and commenced production of Spikevax. The resilience, innovation and technical expertise that enabled Lonza to meet unprecedented delivery targets would surely have resonated with the company’s founding fathers, although the company itself would be entirely unrecognisable from the one they knew.

CDMOs offer outsourcing services to global pharmaceutical companies throughout the lifecycle of a drug

In the late 19th century, a group of German industrialists and Swiss financiers agreed to build hydroelectric generators where the river Lonza flows through the canton of Valais in the Swiss Alps. The generators would power electric furnaces used in the manufacturing process of calcium carbide. Elektrizitätswerk Lonza, as the company was known, endured a difficult infancy, hampered by explosions, floods, assorted technical challenges, and the transition from gas lamps, carbide’s largest end use, to electric lighting. Through perseverance and a series of astute pivots into other markets, however, the company survived and, in time, prospered.

Over the next 100 years, Lonza would morph from a straightforward electric utility into a diversified and complex industrial conglomerate. And it was in the 1980s and 90s that the company took its first tentative steps into a market that would define its future direction. Leveraging its existing chemistry expertise, Lonza entered the fast-growing biotechnology sector, providing manufacturing and ancillary services for the global pharmaceutical industry. Some four decades on, it is the world’s leading CDMO (contract development and manufacturing organisation).1

Carrying echoes of the semiconductor industry, where players such as Taiwan Semiconductor provide outsourced manufacturing services to chip designers, CDMOs offer outsourcing services to global pharmaceutical companies throughout the lifecycle of a drug, from development and small-scale production for clinical trials, to commercial scale manufacturing. Estimated to be worth US$184 billion in 2021, the industry is predicted to grow to US$290 billion by 2027, a compound annual growth rate of 7.3%.2

Driving this rapid growth is the heavy regulatory burden, rising technical complexity, and high capital intensity associated with drug development and manufacturing. Rather than deal with these challenges in house, pharmaceutical and biotech companies are increasingly outsourcing the responsibility to CDMOs, leaving themselves free to focus on their core discovery competencies.

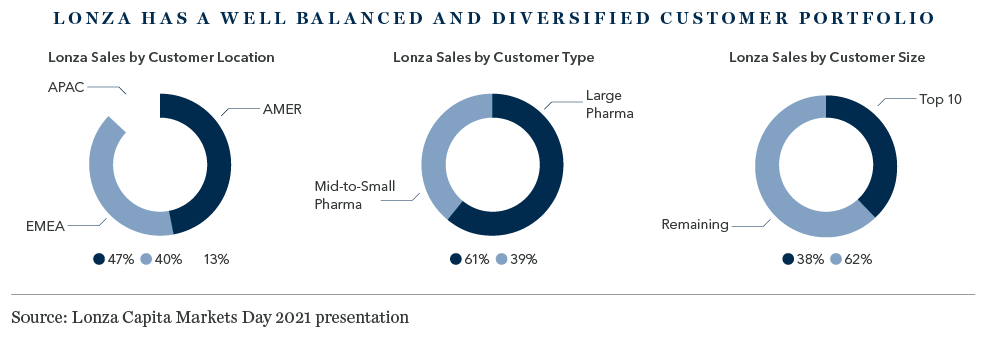

Mirroring the semiconductor foundry industry, the sector is increasingly consolidating around a handful of scale players, but none can match Lonza for geographical reach, breadth of service and technical capability. From its major manufacturing sites in the US, Switzerland, Singapore and China, Lonza serves the manufacturing needs of a global and diverse client base, from small biotech firms with limited in-house production capacity, more than half of whom use Lonza as a single-source supplier, to the large global pharmaceutical giants, who typically outsource a portion of their manufacturing.

For pharmaceutical and biotech companies, selecting a CDMO is a significant strategic decision. Technical competence, operational flexibility, risk management capabilities, and a proven track record of delivery and compliance are key considerations. Once a trusted relationship has been established, however, they tend to last. Only rarely will a customer switch CDMO, providing the latter with a stable and recurring revenue stream. More than two-thirds of Lonza’s revenues are highly predictable, underpinned by long-term contracts.

Lonza is not, however, simply a play on the growth of the CDMO industry, compelling though that is. The company is exposed to another powerful long-term growth trend: biologics. Currently estimated to be worth ~US$370 billion3, biologics is the fastest-growing class of therapeutic compounds, having revolutionised the treatment of myriad diseases and previously untreatable conditions due to their reduced side effects and ability to better target medical disorders than chemically synthesized drugs.

Despite their greater effectiveness, however, biologics are more complicated and expensive to develop and manufacture than their simpler chemically synthesized forebears. Made using living organisms, such as bacteria, yeast, or mammalian tissue and cells, they contain many thousand times more atoms than a drug such as aspirin. Even very small changes to the manufacturing process can significantly alter the finished drug and how it functions in the human body. Reflecting this, whereas a typical manufacturing process for a chemical drug might involve 40 to 50 quality-control tests, a biologic can be subject to more than 250.4

For pharmaceutical and biotech companies, selecting a CDMO is a significant strategic decision

Given this elevated level of complexity, it’s little wonder that pharmaceutical companies are keen to outsource to trusted partners. This is particularly true of the small biotech players who dominate innovation in the sector. Lacking manufacturing capacity of their own, these firms rely almost entirely on CDMOs. Lonza, the only CDMO with a presence across all major biologic technologies, commands a market share of 30-35%, a figure that rises further for certain niche areas where it has specific expertise.

Biologics are expected to eclipse chemically synthesized drugs as the primary driver of pharmaceutical sales in the coming years. CDMOs will play a growing role in this trend. Lonza expects the biologics CDMO market to experience a compound annual growth rate of 11-13% up to 20255 and the company has invested heavily in recent years to reflect that.

The most high-profile manifestation of this investment is the recently opened Ibex Solutions facility, a campus of five state-of-the-art manufacturing plants nestling in the Swiss Alps not far from where Elektrizitätswerk Lonza built its first hydroelectric generators. Providing customers with agility and flexibility across the entire product lifecycle, the complex supports multiple biologic technologies and was integral to the rapid development of Moderna’s Spikevax. In an industry where speed-to-market matters – the first and second drugs released onto the market will typically dominate sales – Ibex symbolises Lonza’s commitment to maintaining its place in the vanguard of the biologics revolution.

Sources:

1 https://pharmaboardroom.com/articles/top-5-global-cdmos/

2 https://www.mordorintelligence.com/industry-reports/pharmaceutical-contract-development-and-manufacturing-organization-cdmo-market

3 https://www.globenewswire.com/en/news-release/2022/04/20/2425668/0/en/Biologics-Market-Size-to-Worth-Around-US-719-84-Bn-by-2030.html

4 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3564302/

5 https://www.lonza.com/-/media/Lonza/Lonzacom/investor-relations/Financial%20Presentations/CMD_2021_presentation_121021.pdf

Further Listening

From cancer therapy to pineapple leather alternatives, synthetic biology is evolving at an extraordinary pace. In this podcast, investment manager Tom Miedema previews findings from his upcoming white paper on the topic.

An Introduction to Synthetic Biology

Further Reading

To read more on CDMO’s Tom Miedema and Sasha Thomson were interviewed on this subject and the broader potential of synthetic biology in the most recent edition of Walter Scott’s Research Journal.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.