The transition to electrification Tom Miedema, Investment Manager

Changing the energy mix is one of the most critical components in decarbonising the energy system. After more than a century of dependence on fossil fuels, there are now numerous alternatives – from wind and solar to geothermal and hydro power – that can not only provide the energy required to meet global demand but also reduce the world’s carbon emissions. As ever, there is no quick fix or one-size-fits all approach so how will we get there? And how do we identify the companies best placed to benefit from the transition?

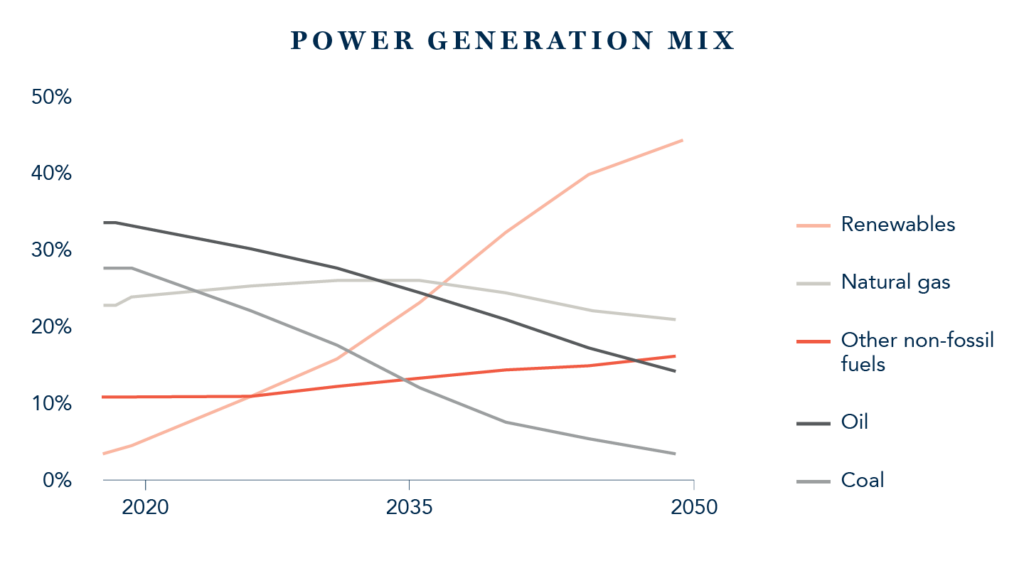

Within this vast subject of decarbonisation, and how the world can reduce greenhouse gas emissions, the spotlight typically falls on fossil fuels and how we cut back our dependence on these finite resources. Yes, burning fossil fuels makes up the greatest proportion of emissions, but in order to meet the ambitions of a net zero future we need to focus on the power generation mix and electrification. In other articles, other members of the Research team have tackled some closely related areas that will enable the transition to electrification from hydrogen, energy storage and carbon capture storage to electric vehicles and buildings. Here, I’d like to delve into the case for renewables, how these will fit with the power generation mix and the overall shift towards electrification.

Why is the world switching to renewable generation?

The move to renewables is no longer the whimsical fantasy of climate enthusiasts but a reality, acknowledged by many including most of the world’s major energy companies. Over the last decade, experts have consistently underestimated the speed of the growth in solar and wind power generation. These options were for many years reckoned to be too expensive, prohibitively so, and government subsidies historically made up the gap to create initial demand. Today, as volumes have increased, and companies have cut the cost of manufacturing and installation, there is less need for subsidies. Growth is instead driven by the economics of renewables.

Of course, the crucial point about renewables is that there is no universal solution for all. There are multiple factors to consider depending on your specific location around the world. These include accessible natural resources (whether it’s windy, sunny or there is an abundance of geothermal or hydro power activity), land availability, population distribution, demand patterns, existing infrastructure, grid connectivity and carbon pricing.

The case against renewables typically centres on four main challenges

1. The fear of mass blackouts

Technology can and will play a major role in solving the awkward issue of intermittency. Much of this problem comes down to grid infrastructure and a lack of diversification in energy sources. A country like the UK can largely guarantee the wind will be blowing somewhere at any time throughout the year, particularly offshore. Therefore, the key is to position wind farms at various locations spread around the country to capture the wind resource as and where it occurs.

Energy storage will allow for greater flexibility and improve the robustness of systems as a whole. Similarly, electricity imports and greater grid interconnection will ensure that, for example within the EU, one country could borrow power generated by nuclear plants in France or from the abundance of geothermal and hydro power in the Nordics.

It also makes sense to continue to make use of conventional operating reserves, particularly legacy gas plants for the years still to come. Electric vehicles themselves can be utilised as storage, contributing to a centralised storage facility. Smart grids will also be critical to provide the greatest understanding and control over of how much power is required when and where. Grid operators we have spoken to are confident that we can all be comfortable that they can build energy systems with enough resilience to negate intermittency issues and accommodate the rapid increase in the share of renewable power in the generation mix.

Dark doldrums solutions

- Distributed generation

- Energy storage

- Electricity imports

- Other renewables (hydro, geothermal, biomass, nuclear)

- Conventional operating reserve

- EV energy storage

- Smart grid solutions

- Technology breakthroughs

2. Are renewables as “green” as they’re made out to be?

Opponents often cite the low power density of renewables, and therefore the large areas of land that will be taken up by wind and solar developments as fundamental challenges. It is certainly true that land availability will be a challenge in certain areas, and that large swathes of land and sea will be required for renewable development. However, there is technical capacity to power the world many times over. The optimal solution will be determined by the specific natural resources available in each country or region.

Other commonly referenced negatives relate to the full life-cycle environmental footprint of renewables. For example, the production of solar panels, usually in China, requires huge amounts of electricity, typically powered by coal; and that wind-turbine blades made of carbon fibre are largely not recycled once obsolete. These are real issues that the industry is attempting to address and which will need to be solved by technological innovation.

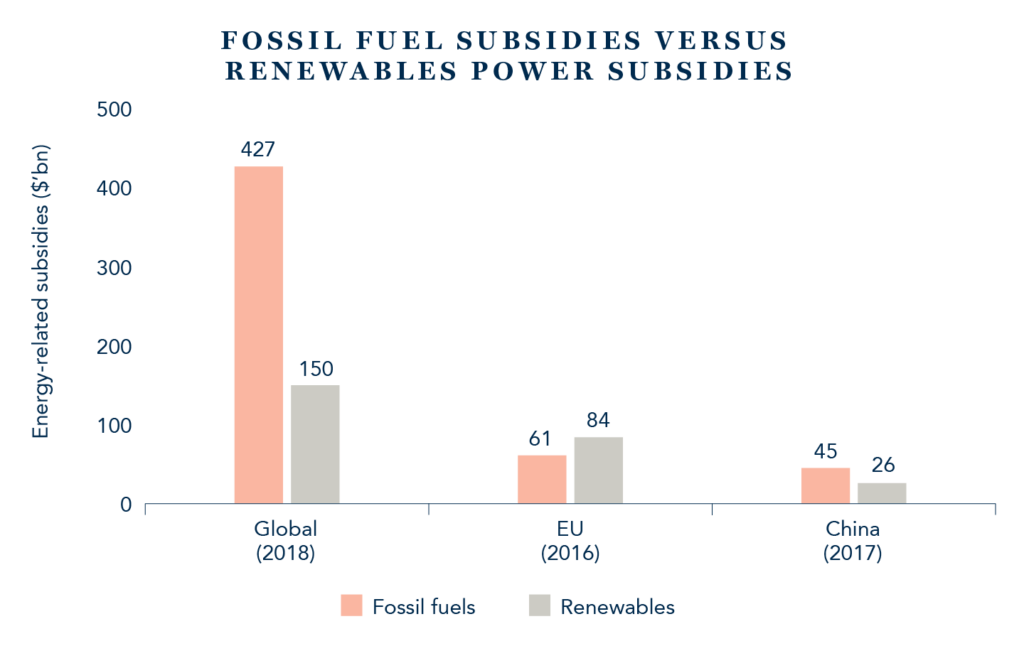

3. The industry is reliant on subsidies

As mentioned above, this argument no longer stacks up. As the chart below illustrates, today, it is fossil fuels which are the main beneficiaries of energy-related subsidies.

4. Political pushback

There is a typical refrain that governments can’t afford to invest in renewables and that the biggest offenders won’t participate in decarbonisation so why bother. In fact, the likes of China and India are both taking decarbonisation very seriously. China has already confirmed its ambition for CO2 emissions to peak within ten years and to be net zero by 2060.

For governments, the renewables industry creates employment, often in areas where traditional industries have been declining for decades, such as the Rust Belt in the US. Such investment could well be more beneficial to the economy than the current predilection for printing money. There is the additional benefit of energy security, making many countries less reliant on the likes of the Middle East or Russia for oil and gas supplies.

Where are the opportunities?

As ever, we consider each and every company on its own merits. Without any pressure to invest from a top-down perspective, we can identify companies that meet our stringent investment criteria irrespective of their industry or domicile. That said, this project has offered us the opportunity to explore broader topics and, from there, the companies within these areas of interest. With an approach that is genuinely long-term, we can take a more considered attitude than many. By gaining greater understanding of the renewable power industry, we believe we can seek out those companies capable of generating long-term sustainable growth. Within this area, we think there are four areas of particular interest.

1. Own the assets

The most obvious investment avenue is via the renewable operators themselves. Over the years, the number of utilities focused on providing sustainable energy has increased. On top of this, a number of the more traditional oil and gas players have demonstrated their commitment to producing low-carbon sources of energy as part of their transition.

The issue with many of the pure-play renewable energy businesses is that they are asset-intensive with returns reflective of the commoditised nature of the assets. There is however potential for quality players to differentiate themselves; through superior technology, scale or assets. In this case there may be interesting investment opportunities amongst such businesses.

2. Who sells the picks and shovels?

Beyond the utilities themselves, there are the equipment manufacturers that sell into the industry – whether it be those who make the wind turbines, solar panels or geothermal heat pumps themselves, or those that produce their components. As demand for such technology increases, these suppliers will benefit from a significant demand tailwind.

3. Invest in niche adjacencies

Innovative high-quality companies that provide enabling technologies, or are involved in adjacent areas, may offer interesting investment opportunities. Many technologies and solutions will need to come together to create a robust energy system. The relevant areas have been covered by my colleagues in their articles on hydrogen, carbon capture and storage, nuclear, buildings and electric vehicles.

Critical to transition

Looking ahead, it seems likely that forecasts continue to underestimate the ultimate level of renewable penetration in the energy mix, and the speed at which this will be reached. We believe that low carbon electricity will almost certainly become dominant within the energy mix. With greater renewable penetration, the value of enabling technologies such as smart grid solutions or storage to the system will only increase. From an investment perspective, it is an exciting sector and we are continuing to investigate appropriately valued investment opportunities.

Important Information

This article is provided for general information purposes only. The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored. The opinions expressed in this article accurately reflect the views of Walter Scott at this date, and whilst opinions stated are honestly held, no reliance should be placed on them when making investment decisions.