Key takeaways

- America’s new energy strategy could have profound implications for the rest of the world

- Security, industrial competitiveness, and affordability are central to the new policy approach

- To transform rhetoric into reality, the new US administration will have to overcome

significant challenges

The new US administration is pursuing a different approach to the energy transition, with long-term implications for investors. What better place to find out more than CERAWeek, the world’s premier energy conference held each year in Houston, Texas.

With over 450 C-suite executives, 1,400 speakers, and 10,000 attendees from 89 countries, no other forum offers such a comprehensive overview of the energy world. This event has long been a recurring diary item for the Research team at Walter Scott and this year investment manager Des Armstrong travelled to Houston to understand how the new administration’s approach is impacting long-term thinking.

Long a forum for balancing the old and the new, fossil fuels and renewables, market forces and policy ambition, this year’s CERAWeek conference felt different. Gone was the cautious optimism about a clean energy transition. In its place, a clear sense of urgency about national security, economic competitiveness, and energy affordability.

For many of the attendees, it seems the old energy transition is over, both as an explicit goal and as a practical reality. What appears to come next is not a phasing out of hydrocarbons but rather a doubling down on them, whilst keeping the door open for nuclear, AI-driven efficiencies, and an industrial revival.

fortress america

The United States government is launching a shift in energy policy. Energy is a key lever of geopolitical strategy, now with the aim of securing the country’s industrial and technological future.

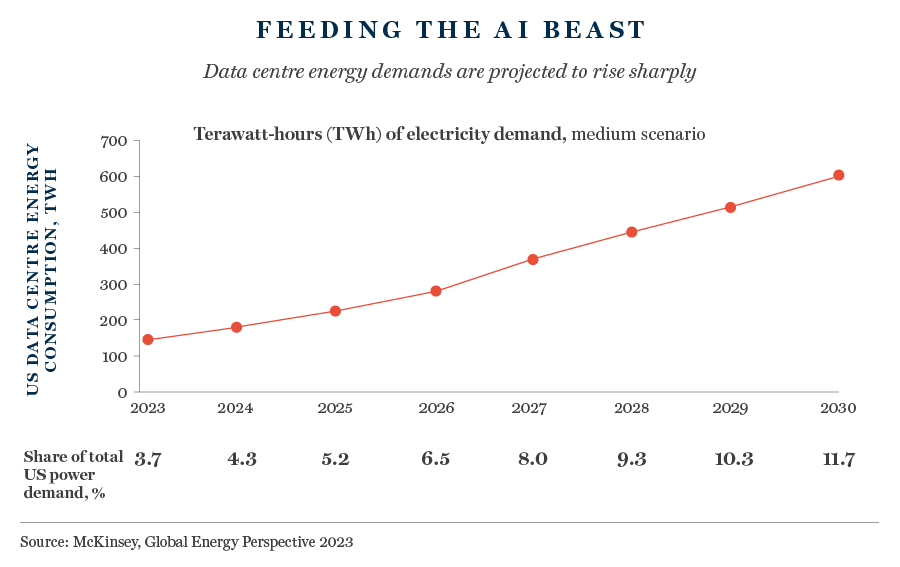

Previously, proponents of the energy transition assumed the US could afford to wind down fossil fuel production, with renewables representing a growing share of energy production. For many attendees, that assumption no longer holds. At the heart of the shift is AI – the great new industrial race. Washington sees AI as the defining technology of the century, requiring vast amounts of reliable energy. The race isn’t just about developing better chips; it’s about ensuring the US has the power to run them.

As one executive of a leading US gas producer stated bluntly: “AI doesn’t work without energy. And energy security doesn’t work without gas. That’s why we’re in the room now with people who wouldn’t return our calls three years ago”.

Other speakers included US Energy Secretary Chris Wright and Interior Secretary Doug Burgum, both key figures on the National Energy Dominance Council. Both delivered bullish speeches with a clear message: America must control its own energy future.

This extends far beyond oil and gas. China has spent a decade diversifying its energy mix and now dominates the supply chain for critical minerals, owning the keys to EV batteries, solar panels, and the raw materials for AI infrastructure. For Wright and Burgum, the US cannot afford such dependencies.

the new american energy order

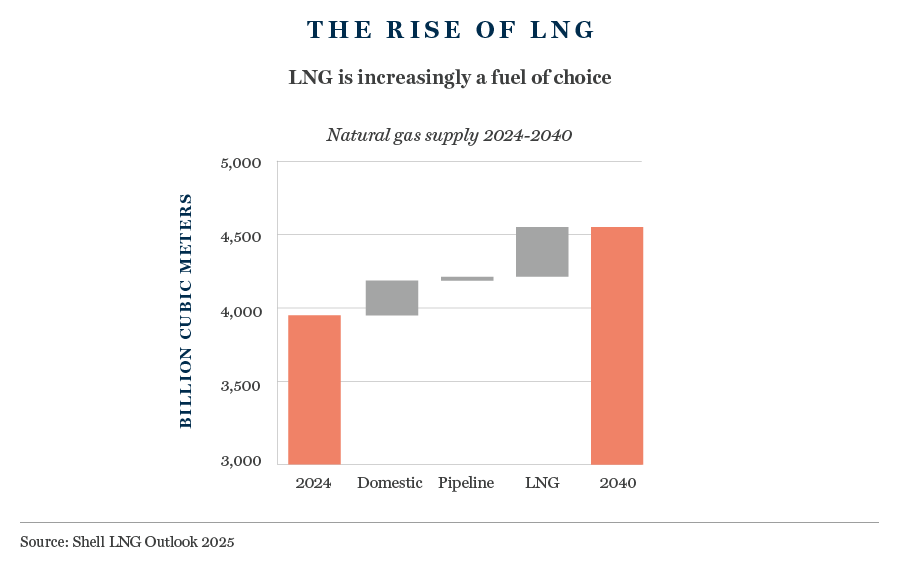

As the US government puts its new energy strategy into action, it is not picking policy-related favourites. Rather, it is backing whatever it thinks will deliver the energy required. And for now, fossil fuels are coming out on top. This is not purely a matter of a change in ideology, however. Market forces are already steering the energy world back toward fossil fuels, particularly natural gas. Liquefied natural gas (LNG) demand has surged, not as a temporary bridge but as a long-term structural solution to global energy needs.

As one CEO made clear: “We’re seeing utilities in Europe, South Korea, Japan, and Southeast Asia signing 20-year contracts, locking in US gas supply well into the 2040s. These aren’t short-term hedges—they’re strategic decisions”.

The reasons are simple. Renewables alone have not delivered the reliability needed at scale and the economics of energy security are reshaping government strategies. Asia is leading the charge, doubling down on LNG as the most practical way to reduce carbon emissions intensity while ensuring stability.

How is this new approach being reflected in the global energy complex?

- Oil and gas – the fastest way to ensure energy security is to ramp up domestic production. The White House is fast-tracking drilling permits, opening new leasing on federal lands and pushing for more pipeline capacity.

- LNG – the big winner. Once considered a ‘bridge’ fuel, LNG is now the growth fuel of choice. Countries are securing long-term contracts to guarantee supply.

- Nuclear – with AI-driven power demand growing, nuclear energy is back on the table, but meaningful new capacity is still years away.

The power industry is also getting a major reboot, with AI data centres, electrification and industrial reshoring requiring a major upgrade in base load power capacity. The challenge for America’s power infrastructure from AI alone is enormous.

will ai break the grid?

Data centres are devouring power at an unprecedented rate. By some estimates, data centres could account for 11-12% of total US power demand by 2030. The problem with this is that the US power grid has been stagnant for 25 years. It is simply not ready to cope with this level of demand.

Nor is it just a question of the amount of power – the grid’s ageing infrastructure is not designed for the rapid fluctuations in AI data-centre loads. Power reliability is emerging as a major issue.

But even when companies want to build new capacity, it can be hard to do so quickly enough due to delays with permits and transmission bottlenecks. This hard reality is driving a revival in nuclear power. For years, nuclear was dismissed as too slow, too expensive and too politically fraught. Not anymore.

However, even nuclear is not fast enough for the big hyperscalers, Alphabet, Amazon, Apple, Meta and Microsoft.

This is why gas turbines are booming. They provide on-demand power when renewables are unable to deliver. Increasingly, companies are pairing them with potential carbon capture technology to keep them viable in a future decarbonising world.

As the big tech companies seek to win the AI race, they are embracing an ‘all of the above’ approach to energy and power. Nuclear, gas, renewables, batteries and grid-enhancing technology are all on the table. This American energy revolution will not just be about fossil fuels.

fuelling an industrial revival

The US administration’s energy pivot is designed to do more than just secure power, it is also meant to bring industry back home. The logic is simple: cheap, reliable energy should make US manufacturing more competitive again.

Energy alone will not spark an industrial revival, however. There are several roadblocks in the way to bringing industry back to American shores at scale.

- Infrastructure bottlenecks – transmission grid constraints mean energy abundance in Texas does not always translate into affordable power for manufacturers elsewhere.

- Supply chain dependence – the US remains heavily reliant on China for critical minerals, steel, and industrial components.

- Labour shortages – the skilled workforce required for advanced manufacturing and energy projects is not there at the scale necessary.

- Regulation and red tape – permit timelines in the US can be measured in decades. It is an extremely expensive process, with the regulatory cost sometimes multiples of the build cost.

- Execution risk – reshoring requires long-term policy stability for the private sector to commit.

Ultimately, whilst abundant and cheap energy is a key advantage, unless these challenges are addressed, America’s promised industrial revival will remain more rhetoric than reality. Reflecting this, one of the most fascinating whispers around CERAWeek was the potential for a US sovereign wealth fund to bankroll a modern-day Manhattan Project for critical minerals.

China’s grip on the mineral supply chain is viewed as one of America’s most significant strategic vulnerabilities. Speculation is growing that the administration is preparing direct state intervention to develop a domestic supply chain. Should the rumour turn into fact, it would mark one of the most assertive industrial policy developments seen in modern times.

In a further bid to clear what it sees as barriers to reindustrialisation the administration is promising sweeping deregulation. This is not just about drilling for more oil and gas, it is also about building more. More pipelines, more transmission lines, more LNG terminals, and more nuclear power plants. Even mining is back on the agenda.

The key messages we heard? The aim is to clear red tape, ease environmental restrictions and fast-track energy infrastructure projects. Little wonder the energy and power CEOs present were so optimistic. They view this as the most supportive policy backdrop for the industry in decades.

a new energy era

The US has embarked on a programme to ensure the country’s competitiveness and autonomy in an increasingly adversarial world. The big bet? That a pro-growth, energy-first strategy can drive industrial resurgence. If this policy holds, it could reshape both the US energy landscape and the country’s industrial outlook.

Nothing is certain of course, far from it. Political shifts, infrastructure constraints, market dynamics, and the physical impacts of climate change all pose challenges. But be in no doubt, there is real intent from the new administration to fundamentally transform America’s energy and industrial future, with major implications for the rest of the world.

There is already evidence that European governments are taking this ‘go it alone’ strategy seriously. A hard reset in European energy policy is difficult to imagine but the same might have been said about defence spending not that long ago. A radical push for greater energy self-sufficiency and industrial competitiveness may become an economic and national security necessity far beyond American shores.

lesson from a lifetime in energy

CERAWeek finished with Daniel Yergin’s observations on the lessons from The Prize: The Epic Quest for Money, Oil and Power, his Pulitzer-winning history of oil’s role in shaping the modern world. As the founder of CERA, Mr Yergin is an authority on the interplay of energy, politics and economics.

Despite having been published over 30 years ago, he believes the central themes of The Prize – geopolitics, energy security and the struggle for resources – remain as relevant as ever. We concur; today’s energy transition, far from being a smooth ride, is proving to be just as complex, just as political, and just as contested as the oil boom that preceded it.

His key lesson from energy’s history? In a word: diversification. Yergin referenced how Churchill grasped it over a century ago when he secured Britain’s oil supply, declaring: “Safety and certainty in oil lie in variety and variety alone.”

In Yergin’s view, critical minerals are the new oil, and China dominates the supply chain. Without diversified sources, nations risk strategic vulnerability. As the US takes that lesson to heart, the world stands on the cusp of a new energy era.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.