The semiconductor chip sits at the centre of a technology war being waged between the US and China. Growing political and commercial tensions between the two superpowers continue to foster fears in the US, and elsewhere, over the supply of this vital component of economic activity. This, in tandem with the Covid-19 pandemic disruption, has prompted a global rethink about supply chains, and as China develops, the threats posed by this technology giant from a competitive and security angle. It was against this backdrop, that two members of Research team, Tom Miedema and Matthew Gerlach travelled to the US in February, to get an industry and government perspective on the changes that are occurring within the semiconductor landscape.

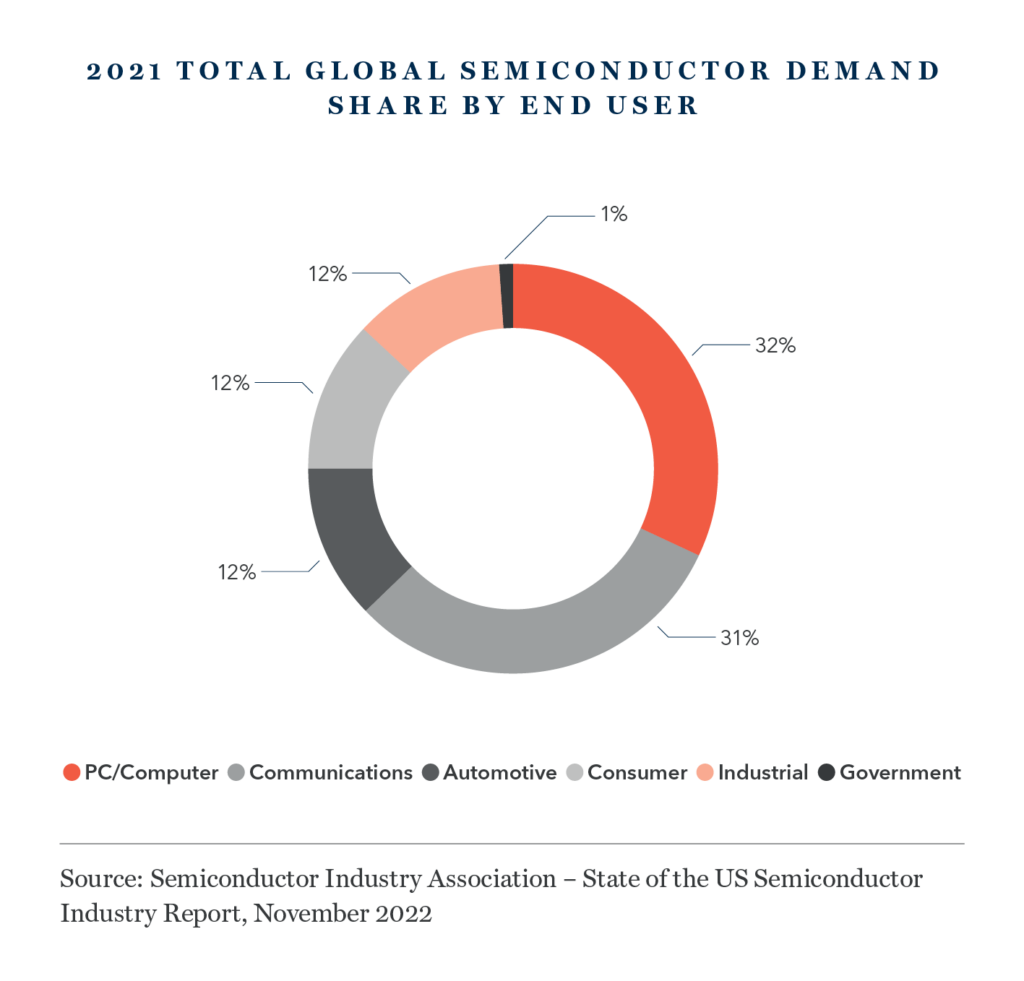

The importance of the silicon chip should not be underestimated. They are central to the functioning of the global economy. They are critical components of almost any manufactured product, from industrial robots to phones to cars and are the foundation of the technology infrastructure of businesses. Virtually all companies rely on software and hardware infrastructure, whether on-premise or in the cloud, to deliver value-added services or products. The development of new frontiers of technology, whether it be artificial intelligence, biotechnology, advanced simulation, or 6G, are underpinned by advanced semiconductors. As has been demonstrated in every major conflict since Vietnam, modern warfare is based on technology.

Worries over semiconductor supply security and technology transfer are not new, with US concerns about Japan’s growing pre-eminence in consumer technology products and memory chips very evident in the 1980s. However, in the main, over the past decades, the multi-national, border-spanning manufacture of technological products has worked on the mostly shared view of a mutual ‘buy-in’ into the benefits of the Ricardian principle of comparative advantage. Following China’s accession to the World Trade Organisation in 2001, the country was seen to offer the opportunity of a huge market and a cheap manufacturing base for many of the world’s goods, encouraged by a Beijing administration that was focused on economic reform in China. And indeed, for all the political schisms, China remains an important exporter of technology goods.

But the relationship between the West and China has been marked in recent years by trade disputes, tariffs and counter tariffs, with the US concerned about the trade balance with China, the risk of theft of intellectual property and the perceived competitive threat of an emerging Chinese tech industry.

Add to this a China that has become more assertive under the Xi administration, with the regime determined to follow a political agenda that does not accord with the West’s historic assumption about the country being driven into the fold of Pax Americana. Complicating matters has been the escalation of tensions regarding Taiwan, a key supplier of advanced chips, and home of the world’s largest semiconductor fabrication company, Taiwan Semiconductor (TSMC).

THE NEW ‘GREAT GAME’

Increasingly, we’ve seen the US put into place legislation aimed at inhibiting the development of the semiconductor industry in China, with restrictions on the ability of Western companies to export the critical equipment China requires to make advanced chips.

But the Covid-19-related disruption has also acted as a spur to policy making in the US. The pandemic represented a perfect storm for the global semiconductor supply chain, significantly affecting the vast array of businesses that rely on semiconductors. The disruptions, along with Sino-US tensions, brought about the enactment of the CHIPS and Science Act of 2022 (CHIPS Act), which provides critical semiconductor manufacturing incentives and research investments with the aim of promoting the development of the US semiconductor industry and countering potential security and supply chain threats.

This focus on security and supply chain resilience against the backdrop of concerns over China, was hammered home in the discussions we had with people working in and around Capitol Hill on our visit. The ubiquitous semiconductor chip has become a flashpoint in the ‘Great Game’ between the West and China, but at the same time, the challenge of creating selfcontained manufacturing capability is formidable. We believe that no single country can, or will be able to, produce a leading-edge semiconductor without the help of other countries.

AN INTEGRATED SYSTEM, SPREAD ACROSS THE WORLD

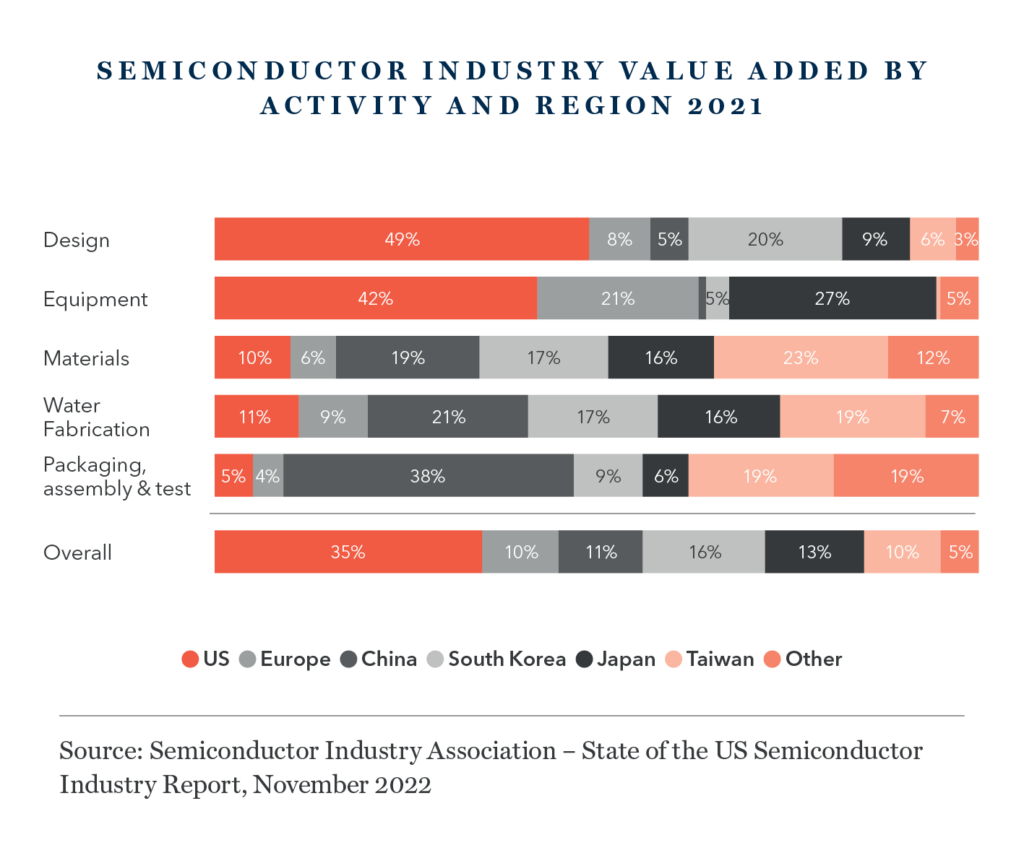

The history of the semiconductor industry has been one of geographical dispersion of various elements of the manufacturing process based on areas of specialisation. It is probably the most advanced manufacturing process in the world and is the orchestration of the effort of thousands of global companies. Many of these are so specialised that there is only one company in the world able to deliver a specific component or service. This has evolved over decades with many of these companies already operating without real competition for many years as the technological barriers continue to increase.

A case in point is ASML, to whom the US effectively ceded its capabilities in the production of semiconductor lithography with the disposal of Silicon Valley Group (no relation to the bank!) to the Dutch company in 2001. Having seen off Japanese competition, ASML is now the world’s only provider of leading-edge critical lithography tools for the semiconductor industry, and has over 80% global market share across all lithography tools.

The US semiconductor industry maintains leadership in the activities that are most R&D intensive such as design software, chip design and equipment. As the table below shows, looking across much of the rest of the industry value-add chain, Asia is dominant.

The supply chain is fragile with multiple potential single points of failure. Aside from ASML, there are many specialist companies; masters in a particular segment of the semiconductor manufacturing process. Germany’s Carl Zeiss is preeminent in the field of semiconductor optoelectronics (the original lens company was founded in 1846!). Hoya has a quasi-monopoly in EUV mask blanks, a key component of EUV photomasks that ASML’s customers use. VAT Group is the world’s dominant supplier of high-end vacuum sealing technologies which are critical to manufacturing processes requiring an ultra-clean process environment. These, and many other companies, sit interconnected in the semiconductor supply chain.

GOLDEN SCREWS

China and Taiwan remain integral to these global supply chains, which are extremely difficult to unravel. Companies might know who their direct suppliers are, but it becomes more difficult when looking at a supplier’s supplier, and nigh-on impossible once you go down three or four layers. The world has outsourced so much of the industry’s basic but critical components (referred to in the Covid supply chain crisis as ‘Golden Screws’) since the early 2000’s, that a reversal of the trend is exceedingly difficult.

It was clear on our trip that there remains a belief on the part of the US government that China will catch up in semiconductor technology, but we don’t see this happening anytime soon and it is a ‘concern’ which is being overplayed in certain political circles.

As we have highlighted, for one country to become a self-contained semiconductor giant is exceedingly difficult, given the need to replicate every speciality which is an expensive and near-impossible technological challenge. Our view is that this will take China decades, if it is even feasible. China is reliant on US, Dutch, German, Japanese, Korean technology just like every other country. We will hear more of China’s semiconductor strategy during a forthcoming trip to Taiwan and China.

Export controls are inhibiting the development of the industry in China, hobbling memory chip company YMTC, a perceived laggard in global terms, and HiSilicon, the chip design unit of Huawei. Just recently, China announced an investigation, on the grounds of national security, of US memory chip maker Micron Technology which has operations in the country. This was seen as a very modest retaliatory move, reflecting China’s ongoing need for chips made by UScompanies. Given America’s ability to knee-cap Chinese foundries with ease, Chinese research and development efforts are likely to accelerate in upstream technologies such as software, chip design, and tools.

During our trip, we met with Intel, whose sales to China are still material. The company’s message to the US government was to do everything possible to prevent IP leakage to China, but that it was also important to continue to sell to and do business with China. This is essential for a company that has much work to do if it is to catch up with TSMC on process technology and AMD on silicon design, and also deliver US$8-10bn in savings over the next few years.

MUTUALLY ASSURED ECONOMIC DESTRUCTION

One area that appears to have unanimous agreement is the complete economic disaster that would arise from a military conflict across the Taiwan Strait. Exports from Taiwan, and probably China, would be severely curtailed, bringing about mutually assured economic destruction. This would have dire consequences for the Chinese, US, and indeed the global economy. The supply chain troubles experienced during Covid would pale into insignificance. Manufacture of products where semiconductors are used – cars, planes, industrial equipment, smartphone, medical equipment, and servers – would be decimated. It would be extremely challenging to rebuild the capacity needed to produce chips as the required semiconductor tools also need large volumes and a large variety of different chips. Apple, Nvidia, AMD, Intel, Tesla and many more companies would be selling close to zero products.

China’s aggressive stance towards Taiwan makes for uncomfortable watching. Beijing is infuriated by America’s closer ties with Taiwan, despite the fact the White House still supports the ‘One China’ doctrine, in that the US formally recognises China diplomatically, while not recognising Taiwan. However, the economic and political fallout of a Chinese invasion likely mitigates against any Chinese military action. While the risk is that politics trumps economics, China will prove sensitive to any events that might induce a prolonged severe downturn, and it is thought likely that despite the country’s tilt towards statism, economic pragmatism will win out.

SHIFTING SANDS

But in view of ongoing geopolitical tensions and governments seeking to secure supply of semiconductors, the ground is shifting, albeit gradually. The road map for the future will see moves towards a supply chain with at least one alternative source for each link in the chain, ideally in an alternative country. The US, Europe, and Japan will likely see a degree of reshoring of trailing edge (older, larger nodes, but still much in demand) and some leading edge manufacturing. Taiwan Semiconductor is building a new plant in the US, expanding in Japan and is in discussions in Europe. By 2027, 20% of its production is expected to be overseas. South East Asia, India and Mexico represent alternatives to China in the supply chain… eventually. Where technological monopolies exist, companies need to work with suppliers to build resilience.

But all these incremental changes seeking to bolster supply chain resilience will take a long time and will come at a cost, representing a partial undoing of years of globalisation, economies of scale, and specialisation. The world has become used to a steady decline in chip prices, and it has been hugely beneficial to innovation and economic growth. An unwinding of the current chains would likely lead to a lower pace of price decline.

The beneficiaries of such changes are companies that can help deliver ‘technological sovereignty’ or ‘geopolitically stable supply’. ASML will benefit from the investment in additional capacity to build a more robust supply chain, it is also currently a monopoly so it can pass through any additional cost to its customers.

We met with analogue chip leader, Texas Instruments (TI), in Dallas. The company seems exceptionally well positioned for an expected acceleration in analogue demand due to adoption of EVs and multiple ‘Internet of Things’ megatrends. Due to a number of technology changes, the trailing edge is under-supplied and TI is ahead of the curve, in our view, with multiple new fabrication plants under construction to support 10% revenue growth for the next decade. The expected returns on these fabs, particularly with the CHIPS Act, look impressive. Just as important, this new capacity is entirely in the US and caters to customers increasingly wanting geopolitically dependable supply.

Our trip highlighted the risks and frustrations with the current industry inter-dependence and supply chain fragility. It will likely take many years of concerted effort to see any meaningful changes but moves to address these concerns have now been set in motion. In the meantime, the status quo is beneficial to all, and it needs to work from an industry, economic, and political perspective. The underlying demand for the ubiquitous semiconductor chip, a vital component in our daily lives, will remain a strong driver of long-term growth for key companies in the sector. There are still massive opportunities in this industry, especially amongst those benefitting most from its shifting dynamics.

Stock Examples

The information provided in this video relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.

Important Information

This video is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This video may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.