Key takeaways

- China’s efforts to strengthen its semiconductor industry are gathering pace, despite the

West’s export restrictions - Critical gaps in the country’s capabilities remain

- Many international incumbent companies are experiencing increased competition from

Chinese rivals

Not much is heard about Made in China 2025 (MIC25) these days. Unveiled to great fanfare in 2015, the industrial masterplan aimed to transform China into an advanced manufacturing powerhouse within a decade, reducing its reliance on imports in the process.

But as relations with the West soured, Beijing chose to downplay the plan. Anxious that proclamations of China’s grand strategic ambitions risked provoking a hostile response, policymakers deemed a more circumspect tone appropriate.

A plan unspoken did not mean a plan abandoned, however. China continued to diligently pursue its goals, pivoting away from the traditional growth engines of property and low-cost manufacturing towards high value-add industries. US-imposed restrictions on technology and equipment served only to intensify this effort.

From the vantage point of 2025, has MIC25 been a success? Overall, the answer must be an unambiguous yes. China is importing less, exporting more and boasts a much larger footprint in high-end technology and industries of strategic importance.

In some areas, progress has been remarkable. No longer the mere imitator, China has become an innovator and can credibly claim leadership in electric vehicles, batteries and renewable energy. In others, there is more work to do, although the country has made impressive strides. One area of qualified success is semiconductors.

THE BIG FUND BET

Nobody can accuse MIC25 of lacking ambition for China’s semiconductor industry. Under the auspices of the National Integrated Circuit Industry Investment Fund (also known as the ‘Big Fund’), the industry would grow threefold from 2015 to 2020 ($54bn to $140bn), before doubling again to $305bn by 2030.

To deliver on these lofty goals, China would have to become globally competitive at every stage of the value chain, from design and manufacturing to equipment and materials. Not an easy task in an industry famous for its complexity and capital intensity.

Ten years on, policymakers can point to significant progress in many areas. In the core competencies of design and manufacturing, there have been impressive strides towards self-sufficiency, at least in more mature technologies. However, there remain notable gaps in the country’s capabilities.

Our recent trip to China was an opportunity to explore further these successes and shortfalls. Importantly, it was also a chance to gauge the competitive threat to today’s supply chain incumbents from their increasingly advanced Chinese peers.

Over two weeks, we met with companies in five cities, including Shanghai, Beijing and Hangzhou. In a sector at the heart of today’s geopolitical sensitivities, the meetings were overwhelmingly open and candid.

DESIGNING FOR SPEED

One of the fastest-growing areas of China’s semiconductor industry is the fabless design sector. (Fabless design companies are so- called because they outsource the fabrication of their chips to manufacturing foundries). During our trip, we met with Omnivision, Bestechnic, and Gigadevice, which have emerged as competitive players in image sensors, audio chips, and memory components, respectively.

OmniVision competes with Sony and Samsung Electronics in the image sensor market. While it trails the big two in the smartphone camera space, it is building a formidable presence in autos, where the rapid adoption of advanced driver assistance systems (ADAS) is fuelling demand for image sensors. The number of sensors per car is also rising sharply as new on-board applications are introduced.

Nowhere is this more apparent than China. Thanks to the country’s auto manufacturers, onboard image-based technology has been democratised, no longer the preserve of higher-end models. BYD’s ‘God’s Eye’ ADAS technology, for example, is available in vehicles costing as little as $10,000. OmniVision expects overseas auto manufacturers to follow suit, using Chinese market-leading technology to do so.

What sets many of these fabless designers apart from their overseas counterparts is the ability to adapt to the innovation cycles of domestic customers like BYD. Local consumer electronics and auto companies refresh their product lines more frequently than Western peers, putting pressure on component suppliers. Fail to match the tempo, and suppliers risk losing business, as many Western firms have discovered to their cost. It is a ferociously competitive space in which to be operating, with one executive confessing to sleepless nights spent thinking about what the competition is up to.

REACHING MATURITY

The growth of China’s fabless sector has been facilitated by a well-developed domestic ecosystem of manufacturers, both at the front end of the process (foundries) and the back end (assembly, packaging, and testing). Having invested significantly in capacity, these manufacturers are now better able to meet fabless demand, allowing for some reshoring of production.

For now, this is primarily focused on mature node manufacturing processes. (Semiconductors can be categorised as either mature node or leading-edge node based on the process node used in the manufacturing process.) Easier to produce, lower cost and more reliable, mature node chips are used in cost-sensitive, high-volume, and analogue-heavy applications, such as automotives and consumer electronics.

Mature node technology is where China poses the greatest threat to today’s supply chain incumbents. Two names that were frequently mentioned in our meetings were Texas Instruments (TI) and Infineon. Both Hangzhou Silan Microelectronics and China Resources Microelectronics outlined plans to take share from Germany’s Infineon in areas such as microcontroller units and power semiconductors.

Meanwhile, JCET, a back-end manufacturer based in Shanghai, told us it was benefiting from fabless companies copying TI’s analogue chips “pin for pin” but offering them at competitive prices. This chimes with what we have heard in meetings with TI: aggressive and increasingly capable local operators are making certain sections of the Chinese market hyper competitive.

To date, TI and Infineon have been losing share primarily in lower-end consumer-electronic applications. For now, both retain large technological and scale advantages in more profitable, higher-end markets. But while increased penetration in these areas should offset gradual market share losses elsewhere, China will prove a tough market in the years to come as domestic players move up the capability curve.

BRIDGING THE CAPABILITY GAP

The flipside to China’s burgeoning strength in mature node technology is a continued capability gap in leading-edge node technology. This is the critical weakness in the country’s semiconductor ecosystem. Despite some impressive progress, the country remains some years behind competitors in the chips crucial to driving forward technologies such as AI and high-performance computing.

SMIC, China’s leading pure-play foundry, is a microcosm of the country’s successes and struggles at the leading-edge of semiconductor technology. Reports emerged earlier this year that the company had established 5 nanometer (nm) chip production without recourse to EUV (extreme ultraviolet) lithography technology, using instead older DUV (deep ultraviolet) tools.

While the news was hailed as a victory for Chinese ingenuity (5nm production was thought, if not impossible, then at least very unlikely without EUV tools) a closer look at the detail highlighted how far it has still to travel. It appears that the yield of SMIC’s 5nm process is about one-third that of TSMC’s equivalent, with costs estimated to be 40-50% higher.

Put simply, there is some way to go before this 5nm process is commercially scalable, let alone before companies like SMIC can develop 3nm and 2nm processes, the most advanced iterations of chip technology.

UNINTENDED CONSEQUENCES

What explains this shortfall in China’s leading-edge capabilities? Most obviously a lack of access to some of the most advanced wafer fabrication equipment (WFE) used in front-end manufacturing, as well as a continued reliance on imports for others.

To some extent, this can be viewed as a victory for trade restrictions. The ban on shipping ASML’s EUV tools to China has clearly had a significant impact. In several meetings, WFE companies admitted that a shortage of EUV would continue to impede self-sufficiency efforts in the short term. (For more on ASML and lithography, visit

www.walterscott.com/asml-the-future-is-ai)

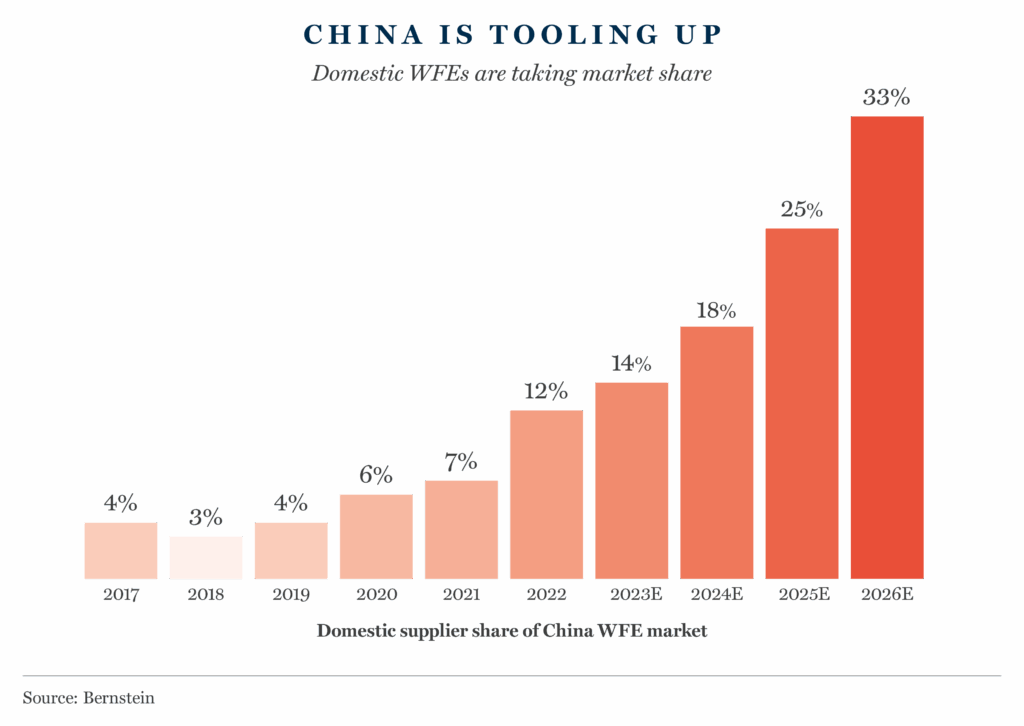

This doesn’t tell the whole story, however. There is ample evidence, confirmed by our conversations with WFE management teams, that sanctions have spurred collaboration between foundries and local suppliers, accelerating domestic substitution. The market share of domestic WFE companies is expected to rise to 25% in 2025, up from 20% last year.

In areas like deposition and etch, key steps in front-end manufacturing, WFE operators AMEC and Naura said that their ambitions to challenge Western incumbents had been boosted by rising demand from local foundries. While their tools can’t yet match the consistency of Western equivalents, quality is fast improving as foundries give critical feedback on operational performance.

CHINA CONCLUSIONS

While our trip to China yielded no great surprises, it did further refine our understanding of the strengths and limitations of the country’s semiconductor ecosystem. Under MIC25, the industry has made notable progress, particularly in mature node technologies and fabless design, where the rising technical competence of domestic challengers poses a credible threat to global incumbents.

Progress is uneven, however. Leading-edge capabilities – essential for AI and high-performance computing – remain a critical gap, hindered by restricted access to advanced equipment.

The breakthroughs and setbacks that DeepSeek, the poster child for China’s AI ambitions, has experienced in domestic semiconductor sourcing reflect the unpredictability of the country’s progress at the leading edge. The market dominance of technology leaders ASML and TSMC appears secure for now.

But while trade sanctions may have slowed progress in some areas, they have also galvanised domestic innovation and collaboration, reshaping supply chains in the process. This looks likely to continue, again with consequences for incumbents.

In the 10 years since China embarked on its journey to semiconductor self-sufficiency, geopolitical developments have served to strengthen its desire for strategic and economic autonomy. It is a mission that is central to the country’s vision of its future self. For investors, the long-term implications could be profound.

Important Information

This article is provided for general information only and should not be construed as investment advice or a recommendation. This information does not represent and must not be construed as an offer or a solicitation of an offer to buy or sell securities, commodities and/or any other financial instruments or products. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such an offer or solicitation is unlawful or not authorised.

Stock Examples

The information provided in this article relating to stock examples should not be considered a recommendation to buy or sell any particular security. Any examples discussed are given in the context of the theme being explored.